Update: One or more card offers below are NO LONGER AVAILABLE. Please check here for the latest deals!

OMG, cringe. Did I just write that headline? Me, Mr. “I Don’t Care About Starpoints?”

I did. A lot has changed since that proclamation nearly 3 years ago. Devaluations, tougher approval rules, and a vastly different landscape for points and miles.

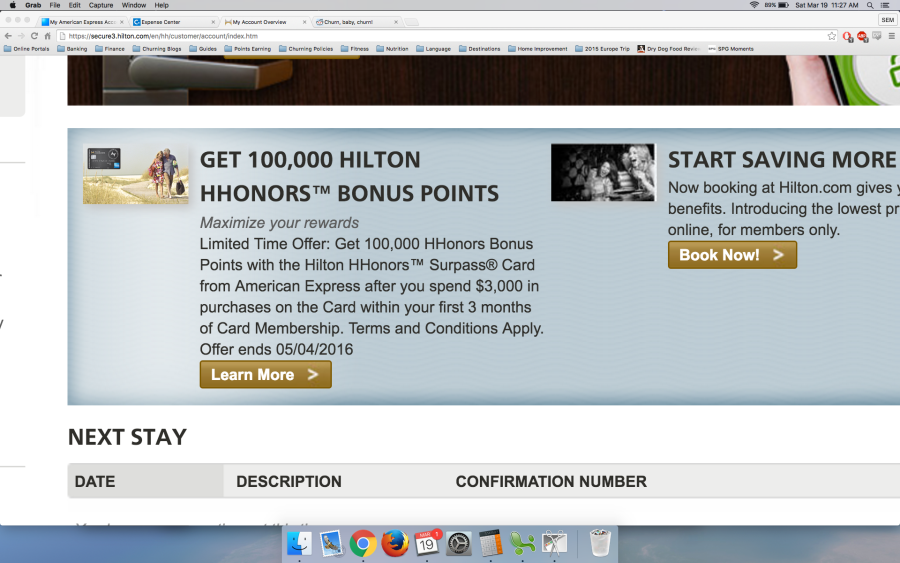

In particular, you can only get an AMEX sign-up bonus once per lifetime on all their cards.

This is the highest bonus there’s ever been – and likely will ever be – on the AMEX SPG cards. I took the bait.