I’m creating my own nail-biter over here. This is the third month in a row of a new net worth high. That feels dang good on its own: At nearly $350K, I’m 70% of the way toward my $500K goal.

But the goal is to hit $500K by August 2024. That’s in 7 months! Being $150K short means I’ll have to increase my net worth by over $21,000 each month on average until then to achieve it.

That’s… a lot. Is it realistic?

Sleep < Haircut

I mean, probably not.

Is it also incredible? Heck yeah! I continue to be amazed at how compound interest truly has a life of its own.

I’ve had plenty of months with gains and losses of that size. But to have 7 winning months in a row? I’m my own underdog. It’s unlikely but it would be soooo cool if it happened.

Even if it doesn’t, I think I’ll get pretty close. Either way, 2024 is already shaping up to be an incredible year.

February 2024 Freedom update

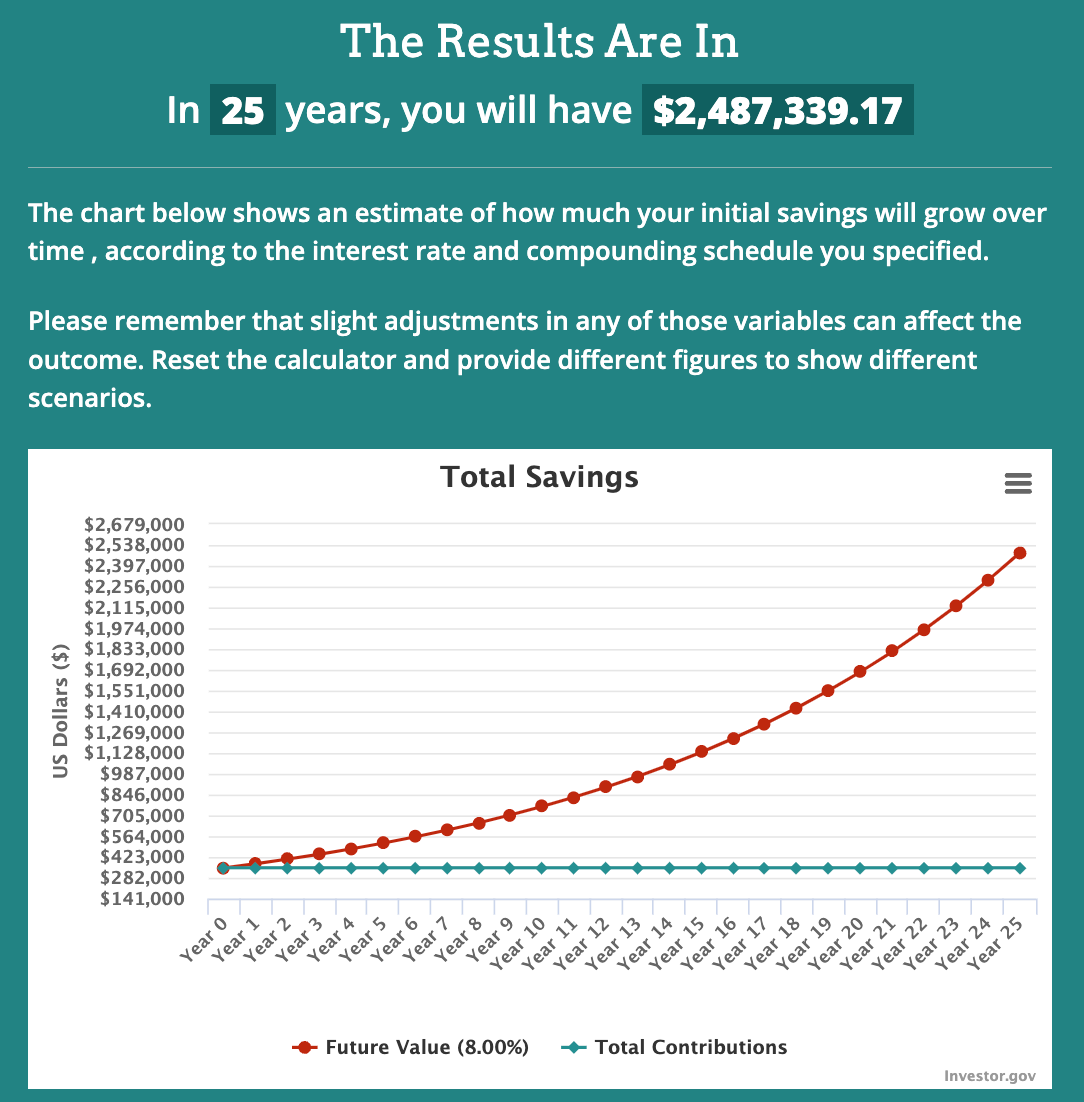

I also have to keep the big picture perspective. According to this compound interest calculator, even if I never invest another cent, I’ll still end up with $2.5 million at age 65 with an 8% return.

That’s still really awesome

But I’ll continue to add around $1,500ish per month through my 401k, HSA, Roth IRA, and regular brokerage account and land closer to $4 million.

It was a snowy month, and we were homebound for most of it

All that to say, hitting the $500K isn’t absolutely imperative this year, especially considering we just welcomed our third child last month, but it’s on the horizon. And being 70% of the way there is really starting to feel like I’m closing in on it!

This month’s progress

Pretty much all of the gains this month were from stocks. The real estate market is holding steadily soft, and though I continue to pay the mortgage, the gains aren’t there. If there’s a rate reduction later this year, that may snap back… but not holding my breath on that.

I feel horrible that I have no savings right now. Our new baby had to be in the NICU, and I’m paying a lot for housing and [insert reasons]… I’ve dipped into savings and now it’s depleted. I have two 0% APR cards where I can charge stuff if needed, but that’s just kicking the can down the road.

We already met our out-of-pocket max on insurance, so it’s supposed to pay for all new charges, but the providers are sending bills generated before we hit the max, and they’re having to go back and adjust. The hospital bills continue to roll in and I don’t know what I’m supposed to pay any more.

There’s also life stuff going on. Long way of explaining the savings situation, but getting that part of my financial picture is becoming foremost in my mind. I’m sure others are in the same boat. I’m doing my best and until I come up with a better plan, that’ll have to do. Tbh, I’m just focused on sleeping more than anything right now.

To recap this month, I:

- Am dealing with a lot of medical bills and hoping it’ll all come out in the wash

- Slowly repaying balances on a couple of cards I used to get us by last month

- Depleted the rest of my savings

- Started building my HSA account again (and thank gods for it, really!)

- Lost some value on my primary residence because of a soft market

- Still got more gains from a strong stock market to reach another new net worth high

Warren at the children’s museum

By the numbers

So now that you have the lay of the land, here’s the raw data. Remember: Numbers never lie.

| Current | Last Month | Change | 2024 Goal | ||

|---|---|---|---|---|---|

| ASSETS | |||||

| Overall investments | $263,526 | $255,263 | +$8,263 | As much as possible | |

| Roth IRA 2023 | $63,213 | $61,109 | +$2,104 | $6,500 (in new contributions) | $4,000 so far! |

| Roth IRA 2024 | $0 | $0 | xx | $7,000 (in new contributions) | Starting May 2024 |

| Taxable brokerage + UTMAs | $3,495 | $3,366 | $129 | $25,000 (total invested) | |

| Savings | $472 | $670 | -$198 | $30,000 | |

| Primary home equity + appreciation | $53,005 | $55,788 | -$2,783 | $70,000 | |

| Raw land | $40,400 | $40,400 | xx | No goal, just including for completeness 🙂 | |

| LIABILITY | |||||

| TDB | ? | ? | ? | ||

| Net worth in Empower Personal Dashboard | $349,887 | $342,551 | +$7,336 | $500,000 (overall goal) | Track your net worth with Personal Capital |

Kapow, cowboy

Long-term goals include:

- Put more money into Beck’s UTMA

- Contribute to new baby’s UTMA (we already got her SSN and I started one for her a few days ago!)

- Finish maxing out my Roth IRA for 2023

- Build my savings account again (will I ever? )

- Start on 2024’s Roth IRA

- Work up to 15% in 401k contributions this year

Happy Valentine’s Day/Month

February 2024 Freedom update bottom line

- Link: Track your net worth with Empower Personal Dashboard and get a $20 Amazon gift card (this is where I pull all my numbers from each month)

- Link: Join Yotta (a lottery-enhanced savings account) and get FREE lottery tickets! Do it do it do it!!!!

I’m getting inspired by my own journey—because with nearly $264,000 in pure stocks, I routinely gain or lose a few thousand per day when the market has a big movement. But each month, despite my other financial activities, the upward trend continues because of compounding interest.

It’s separate from me now and has a life of its own. Will it be enough to get me over the $500K mark? Yes, definitely! But… by August 2024? I can’t even guess what the odds are right now. 50/50? 30/70? I’m gonna keep my head down, keep working, and let this thing go where it’s gonna go. If I could get into the $400s, I’d consider that a huge win, even.

I hope this journey, with all its stumbles and randomness and momentum inspires someone out there. I feel good about knowing my financial future is secure and that I’ll have enough to leave to my kids. I’m also the kind of person that just really enjoys setting big goals and working hard to reach them—if only to challenge myself. That’s my “why” for this aggressive goal.

As always, thank you for reading and following my journey. Hope everyone is doing well!

Stay safe and scrappy out there! ✨

-H.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

First off, thanks for writing this. Maybe it’s my inner geek or maybe it’s because my retirement is closing in but I find this stuff interesting.

You obviously do pretty well on saving and investing. One thing I’m curious about though is why. Why $500,000? Why 4 million, which, even with inflation is a vast amount of money?

Everyone has different goals and aspirations. I simply wonder if there’s something that you need that much money to obtain or attain.

I’ve been following Harlan’s blog for awhile and enjoy his monthly reports. I hazard a guess that a round number ($500k, $2.5m, $4m etc) carries psychological significance, much like when the S&P hits 5000 or falls to say 4000 which could act as psychological sell/buy points.

$4m really isn’t a lot of money in 25 years. If you assume a 3% rate of inflation, in 25 years $4m is going to be the new $2m. Going by the 4% rule, that would yield a safe withdrawal rate of $80,000 per year (using today’s dollars). That’s fairly average.

Hey Glenn! You absolutely hit the nail on the head here. Thank you for reading and commenting. I’m so glad you enjoy the monthly reports!

Thanks Harlan. Absolutely love your reports and am stoked for your journey to FI. I am deeply interested in this topic as well. Wishing you and your family the best. One little thought I’d like to share is not to get too caught up in the minutiae to enjoy life. I think you’ve done a great job zooming out and it looks like whether you hit that $500k goal by August or not, over the longer term you will do just fine.

Hey Christian! Thank you for reading and commenting! This is SUCH a great question and I’ve been thinking about since last night. It really took me back.

Back to November 2019, when I started blogging about this audacious 5-year goal: https://outandout.boardingarea.com/november-2019-freedom-update/

At the time, I’d been following A Purple Life and had a $95K net work after owning my place in Dallas for a few years. She offered up the $500K number (https://apurplelife.com/why-im-comfortable-retiring-with-500000/) and because I was in a similar boat, it seemed like a SMART goal: Specific, Measurable, Achievable, Relevant, and Time-Bound.

Of course, that was before COVID, before the housing market skyrocketed, before interest rates sank and rose again. Essentially, it was a lifetime ago, and we now live in a different world. I remember when stocks started falling and the goal started to seem not only less SMART, but impossible. Then it roared back. And my life changed, too. I couldn’t have known I’d have three kids or move away from Dallas or anything else that’s happened. Through it all, the $500K number became more challenging and more aggressive with each new development. What at first seemed like a “stretch goal” started to border on impossibility—which is where I am now.

But the number continued to work. It’s certainly given me a goal to strive toward. $4 million is simply a consequence of the $500K number—but $80K per year sounds right per Glenn’s comment, and also seems safe and realistic (like $500K used to).

At this point, I’ve blogged monthly for over 4 years and have written about the highs and lows. Now that I’m in the home stretch, I genuinely wonder if it’ll happen. I write about it now with wonder.

TLDR; It seemed like a SMART goal 5 years ago. A lot has changed, but I’m sticking to it. $500K would set me up well for retirement and I want that for myself and my kids—and at the time, it was a nice, round number.

No liquid savings?!?! With a hospitalized baby?!?!

And how much are you giving to church, charity and/or those in need?

I used my HSA to pay for most of the hospital costs, but yeah, I had to dip into my savings – that’s what it was there for. We are all doing fine now. But yes, I need to re-build my savings now.

I donate when I can—and would love to more in the future. That would be the ultimate end goal.

Also! I had a separate HSA that I used to cover the hospital expenses. It was never included in my net worth calculations, and it was always the plan to use that money for the birth. So the cash was there, but yeah, my cash flow is temporarily lower.

I think everyone should rub in how much money they have online! I do not know you and sir personally I could care less about your personal financial goals

Then don’t read it? Good luck out there.

So you begrudge someone moderate success? Why not go after Elon instead? He actually has the money to make a difference but unlike Harlan, he’s busy whining about something all the time.

And btw, congratulations on your new baby Harlan! Don’t get overwhelmed by the medical bills. As long as you pay something – even $10/month – they have to accept it and not send it to collections. *At least* that’s what a billing person told us in a recent medical situation. It’s designed to be confusing, so just take it step by step, like everything else you’re doing, and you’ll get there. I hope she is doing well!