It’s been over 4 years since I first professed my love for the Fidelity Cash Management account – one of the best no fee checking accounts. And about the same amount of time since I wrote about the Aspiration Summit account.

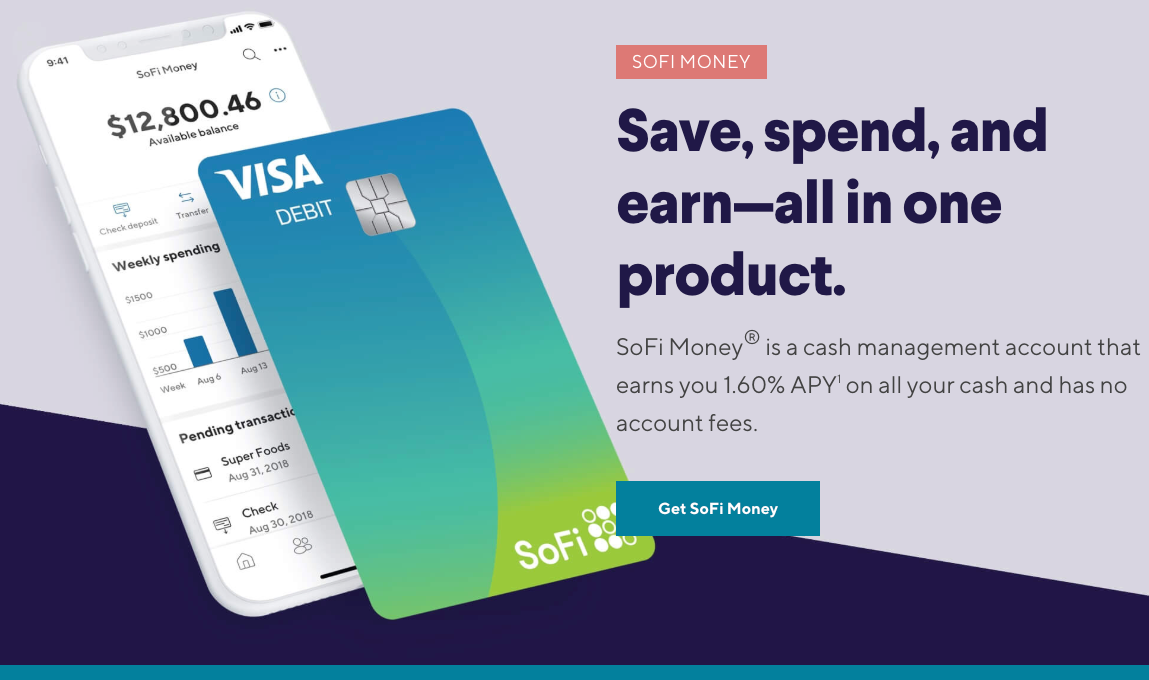

But that was before SoFi Money came on the scene. That account has no fees – but also free unlimited ATM withdrawals worldwide AND 1.6% APY on any balance you carry. It’s now the one I recommend most if you’re looking to dump your brick-and-mortar bank (and you probably should).

There’s a new sheriff in town, and it’s SoFI Money

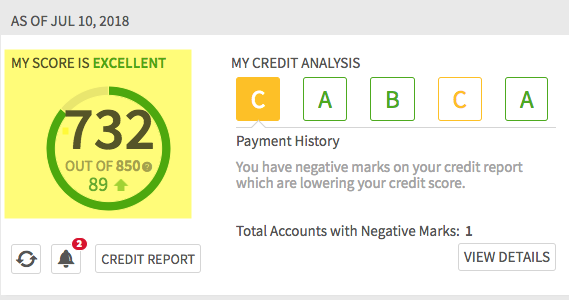

All are fantastic checking account options because there are no fees, no minimum balances, and no direct deposit requirements. Essentially they’re free to open and keep forever, even if you never use them. Even better, these accounts reimburse ATM fees from ANY ATM in the world. And there are no hard credit pulls to open.

There are a couple of key differences. But, bottom line, you should have at least one of these accounts!