File this under #hypothesis and #gumshoe. But I wouldn’t be surprised if this happened soon.

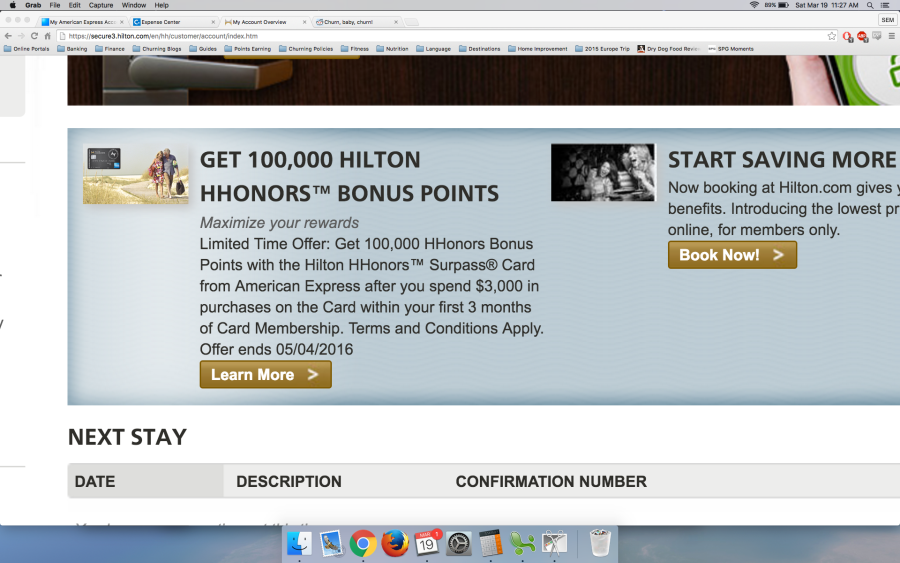

Redditors are claiming they’ve seen offers to earn 100,000 Hilton points on the AMEX Hilton Surpass card.

If the offer is indeed real, if will run through May 4th, 2016. And you’ll earn 100,000 Hilton points after spending $3,000 within the first 3 months of account opening. Like previous offers, the $75 annual fee probably won’t be waived. And you’ll get Hilton Gold status just for having the card.

If you have a few breakfasts at Hilton in a year, that covers the annual fee.

This week?

Because this offer expires in early May, I’d assume they’d leave the door open on this offer for at least a month, which means we could expect to see it live… well, any day now.

If that happens, it’ll match highest-ever targeted offers from 2010 and 2015. I don’t know if the new offered will be targeted or not. My guess is probably not, though.

Also, if that happens, you won’t be able to get this offer if you’ve ever had this card before. And, AMEX will only allow you have 4 credit cards in total.

I’m currently at 2, with the AMEX EveryDay Preferred and newly opened AMEX SPG biz card.

So I’d be hot to trot on this offer.

I just hope I hear back about my Chase Freedom Unlimited decision before (when/if) this offer pops up.

Best use of Hilton points

Yes, Hilton points are notoriously “devalued” but you can still do well at lower category hotels if you like to stretch out your points.

You get the 5th night free on award stays with elite status (which you’ll have with this card), and Hilton Category 2 hotels are still only 10,000 Hilton points per night.

So you could get 12 free nights at my favorite Hilton Category 2 hotels (10 nights x 10K points = 100,000, add 2 more nights because of 5th night free).

With Points & Money rates, you can stretch the points even farther.

I pegged the value of 75,000 Hilton points as high as $1,000. 100,00 Hilton points is even better – there’s no reason why you couldn’t do even better. Because each of your redemptions only needs to cover ~$83 for each of 12 nights to hit that target ($83 X 12 = $1,000).

Or ~$167 for 6 nights at Category 4 hotels (5 nights x 20K points = 100,000, add 1 night because of 5th night free) – which is also doable.

Bottom line

I’ve said it before and I’ll say it again: when banks compete, you win.

I think this is a response from AMEX about the recent 75,000 Hilton points offer on the no annual fee Citi Hilton Visa, which is still kicking until April 1st, 2016.

You can apply for that offer here:

In fact, I wouldn’t be surprised if this new AMEX offer popped up a day or 2 before the Citi offer ended.

Considering its expiration date, it seems likely.

Will I apply? Hell yeah. You can only get highest-ever offers on AMEX cards once per lifetime now, so why not?

I’ll probably cancel it soon after, get the AMEX no annual fee version of the card later and hope to be targeted to upgrade to the AMEX Hilton Surpass card again in the future. Because I would’ve already gotten this bonus, it’ll be a moot point if that happens, and I might even wring some more Hilton points out of the whole deal.

Hilton is vilified within the points/miles community, but I’ve found Hilton points are incredibly easy to earn. And they’ve been quiet generous to me so far this year.

In fact, I’ll hope to score another “suite” upgrade in Tokyo in a couple of weeks – and hopefully 100,000 Hilton points richer.

Have I finally flown the coop? Will you pull the trigger on the AMEX Hilton Surpass offer if it’s publicly available at 100,000 Hilton points?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Leave a Reply