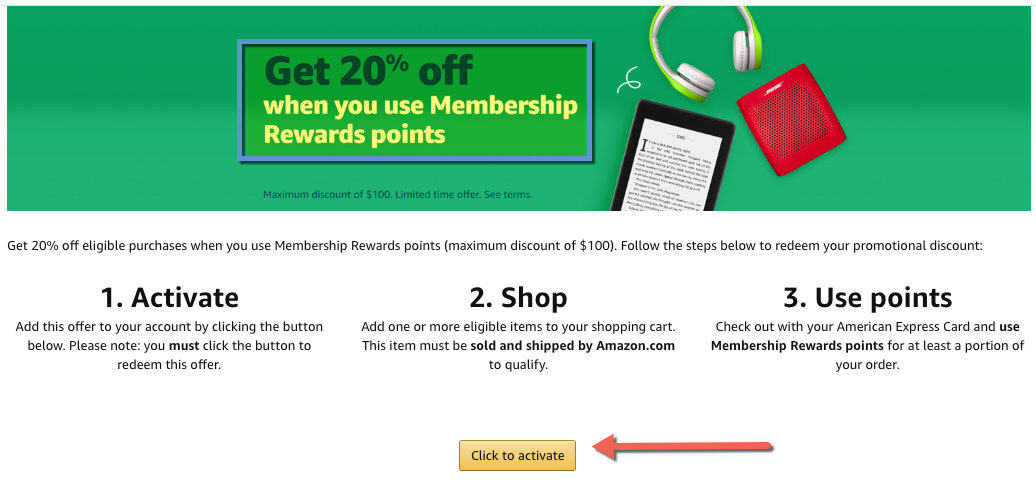

I’ve been using bank points of all kinds to save on Amazon purchases recently and wanted to share. This next week is the last dash to purchase gifts before the holidays, and in many cases you save big bucks by adding these promotions to your account and redeeming a single bank point.

These deals come and go frequently. Sometimes I’m targeted, other times not. Still, I always check to see if I’m targeted and add the promotions to my account.

I didn’t need anything the last time I got an offer, so I stocked up on dog food and called it a day. In that way, it’s great to save on basics or things you absolutely know you’ll need in the future. And of course, gifts! 🎁

Save money on Amazon by clicking a link and activating a promotion – as easy as it gets

Y’all know I’m all about the quick, easy wins. And well, this is about as quick and easy as it gets.