Also see:

- My Top 5 Hilton Category 2 Hotels for Award Stays

- No Annual Fee Cards + Personal Finance: Why You Need (At Least) One

- Get an Easy $600 with the Discover It Card

- DTMFA: Barclaycard Arrival Plus. Still a good card?

- I’m dumping the Chase British Airways Visa – and you should, too

I sense an app-o-rama coming on after pondering the benefits of the Discover It card. And now the Citi Hilton Visa has its highest-ever 75,000 point bonus. I heard this offer was ending on August 31, 2015.

Some cards simply aren’t worth keeping any longer, like the POS that is the Barclaycard Arrival Plus and the completely, utterly, insanely useless Chase British Airways Visa (RIP to both. I’ll bury you next to Club Carlson).

But, out with the old, in with the new.

What’s so dang special about the Citi Hilton Visa?

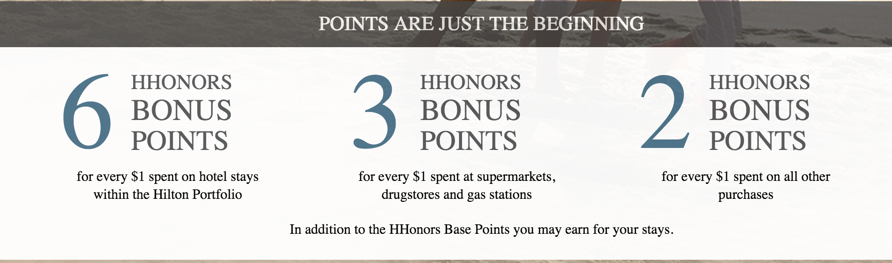

For one, its earning structure:

Are they crazy? 3X at drugstores is asking for it, no?

If I max out the $4,000 limit on PayPal My Cash cards, that’s 144,000 Hilton points per year ($4,000 x 3 points per dollar x 12).

Not bad!

Maximizing Hilton points

If I’m strategic, each month I’d earn 2 nights at a Category 1 property or 1 night at a Category 2 property… and there are a lot of Hilton Category 2 hotels all over the US and Europe.

If I’m doubly strategic, I can save up some points and get the 5th night free on a 5-night award stay.

5 nights at a Category 2 hotel costs 40,000 points. So the sign-up bonus alone would be good for 10 nights at Category 2 hotels.

And 20 nights at Category 1 hotels! Useful if you want to go off the beaten path.

I already have Hilton Gold status through FoundersCard, but this card does offer Hilton Silver status automatically, which unlocks the 5th night free benefit.

I wish it offered an ongoing annual benefit for renewal, but since it’s a Citi card, you can’t rule that out. Citi is known to have generous, aggressive retention offers.

Because it’s a no annual fee card, you can get the points and throw it in a drawer if you hate it. And let it age your credit accounts.

A good deal considering it doesn’t have an annual fee – but not as good as the Amex no annual fee Hilton card.

Still, for 75,000 points… I’m thinking of pulling the trigger on this one.

Bottom line

So interesting to see the sign-up bonuses on various cards come and go, benefits get added and taken away, devaluations, and new perks… and how they all tie in together.

If you can live with Hilton’s categories, maximize the Category 1 and 2 properties, and take advantage of the earning structure, this card might be a good one to add to the arsenal.

If you hate it after the initial sign-up bonus, who cares? Throw it in a drawer and let it age your other credit accounts. And Citi is known for retention bonuses, so you might get an annual injection of Hilton points by calling and asking.

I’m thinking of doing it… 5 nights for the price of 4 at a Category 2 hotel costs 40,000 points, so the sign-up bonus on this card right now would be good for 2 such jaunts.

Is anyone else thinking of getting in on this offer?

Thank you for using my links! (And yes, the 75K offer is available there!)

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

HHonors points are worth 0.5 cent each. Airlines miles are worth 2 cents each. So this is the equivalent of 18750 miles bonus. Not worth it!!!

Great analysis! I don’t compare hotel points to airline points as it’s a bit like apples and oranges. I do agree that you should always strive to get at least 2 cents of value per point for airline miles… but I don’t see much comparison in Hilton points to AAdvantage miles, for example. Both points have their pros and cons.

harlan, just curious why do you think the equivalent AMEX no-AF Hilton CC is better? that only comes with a sign up bonus of 40-50k.

Only because the AMEX Hilton card has 7X points at Hilton (instead of 6X) and 3X on all other purchases (instead of 2X). It also earns 5X at supermarkets, gas stations, and restaurants. But the Citi Hilton Visa has a 3X drugstore category…

I’d rather earn more points, but I can really maximize drugstores as a category, so in that regard they’re about equal.

The AMEX card is also eligible for Small Business Saturday and AMEX offers.

They’re not worlds apart or anything, and I guess in the end, they’re about equal (Visa Signature has its own set of benefits that AMEX doesn’t have and is accepted more places).

I guess it comes down to personal preference. But I got the Citi Hilton Visa because of the 75K sign-up bonus – nearly double the bonus on the AMEX Hilton card. That makes up for any extra points in bonus categories, especially the 1st year.