Also see:

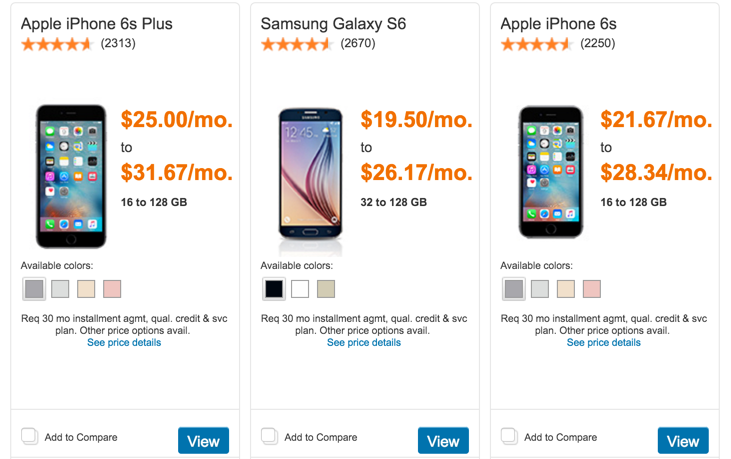

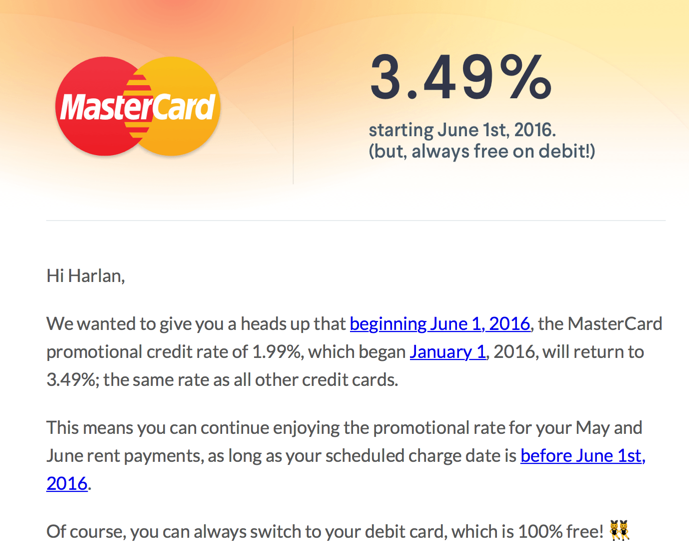

- Earn Points for Rent and Mortgage Payments With Plastiq (2% Fee With MasterCards)

- Bye to RadPad, Hello to Plastiq for 2% Bill Payment Fees With MasterCard (Including Mortgages and Utilities)

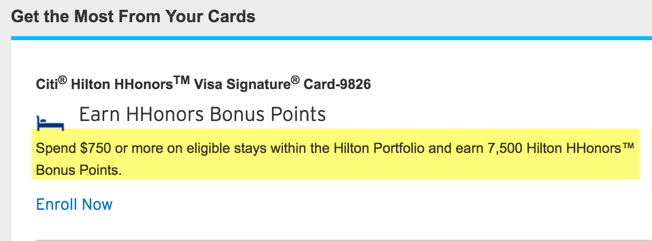

I made a test payment to my student loan company through Plastiq and earned 3X Citi ThankYou points with the Citi AT&T Access More card.

I’ve written how easy it is to boost your ThankYou points balance by paying rent and mortgages via Plastiq with that card.

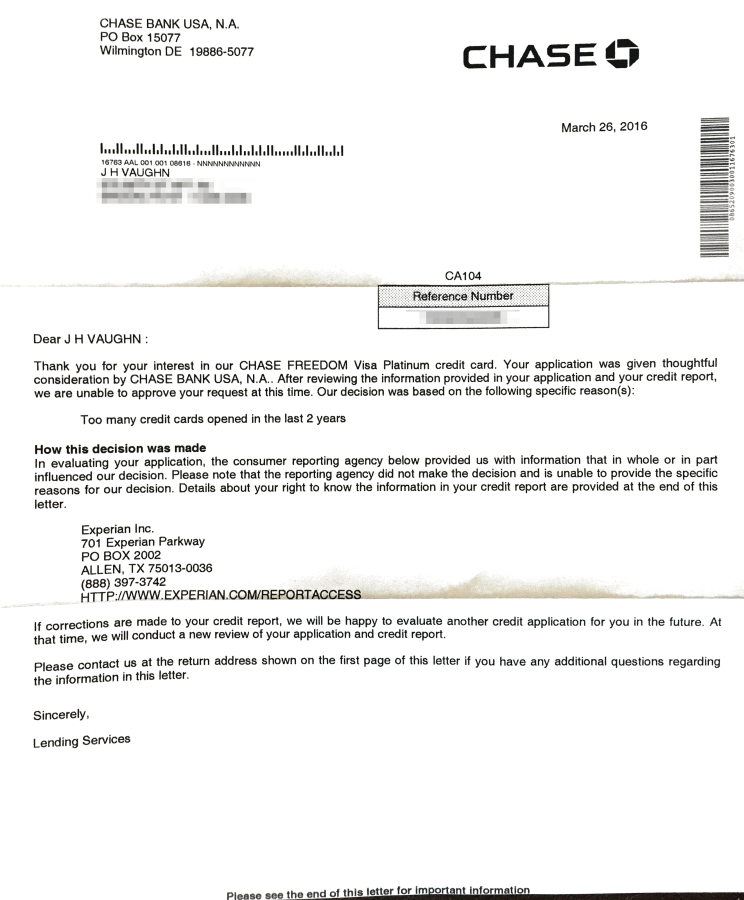

Literally the devil

And now, there’s another way to earn Citi ThankYou points if you need to make student loan payments.