Happy New Year! I can’t believe it’s 2019! I’m working on travel plans and my credit card strategy – and soon I’ll have gigantic news to share.

If you spent too much over the holiday season, and carrying a balance is inevitable, consider transferring your balance to a new card with a 0% APR period. They vary from 12 months to a staggering 21 months! This will hugely minimize the interest you’ll pay.

Depending which card you get, you won’t have to pay it off until January 2020 at the shorter end – or October 2020 at the longer end. That’s awesome!

Or if you have a big purchase coming up, opening a card with a 0% APR period gives you time to pay it back.

I’ve used both strategies successfully. But beware – pay close attention to the dates (which are listed on every statement you’ll get), or you’ll be right back where you started.

Still, it’s a LOT better than carrying a balance and paying huge interest rates. NEVER carry a balance if you can help it!

Paying interest negates any rewards you earn. Your balance will grow and you’ll get stuck on a debt treadmill – don’t do it!

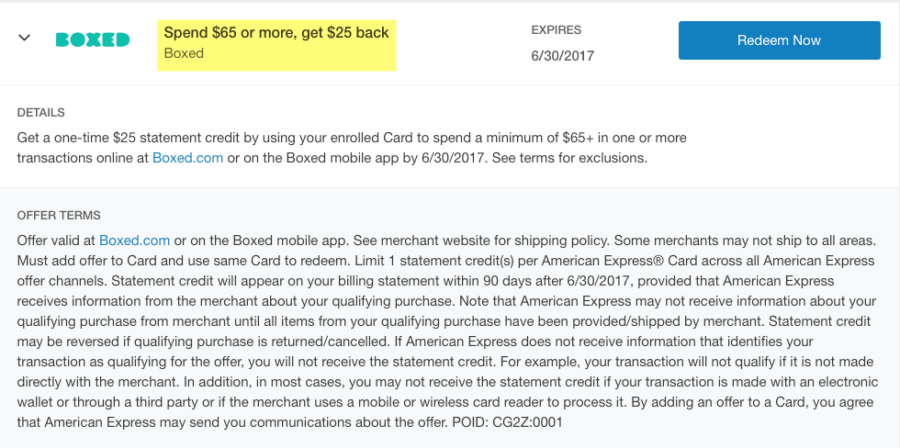

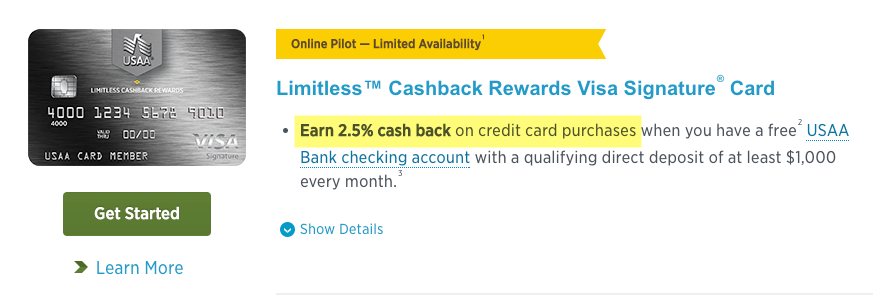

Here are card options for balance transfers and big-ticket purchases. Because yes, life happens. Just try to control the damage as best you can.