Also see:

- My Last Chase Card: Just Applied for Chase Freedom Unlimited

- Loving Citi More Than Ever – Time to Cancel Other Cards?

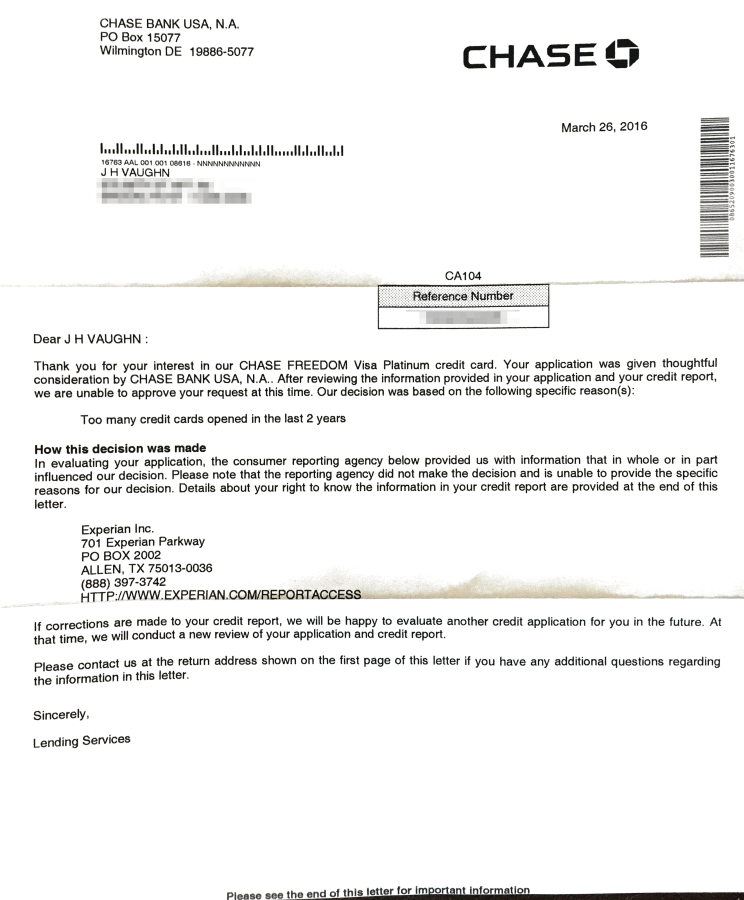

Well, I got the letter today that I was straight-up denied for the new Chase Freedom Unlimited card (which is now open for online applications).

It was to be my last Chase card.

I kept trying to call the automated line for info (888-338-2586), but even now it still says to look for a letter in the mail. I presume this one:

The reason?

“Too many credit cards opened in the last 2 years.”

Wowwww. It’s interesting that’s listed as the only reason.

It seems this rule will now cover ALL Chase cards, including small business and co-branded cards.

DIAF – Die in a fire

Definition: To be in a fire, and die within it.

Usage: I hate you, DIAF.

Why I applied for Chase Freedom Unlimited

- Link: Apply for Card Offers

I heard that other peeps had luck getting this card even with the 5/24 rule considered.

So, I threw my hat in, hoping for the best.

I thought I had a decent shot because:

- I’ve been banking with Chase for the past 10 years

- I’ve had a Chase credit card for 14 years

- I’ve never missed a payment

- My credit score is well over 700

- The Chase Freedom cards usually have more lenient approvals

But, no dice.

I’ll have to run the numbers, but I can probably product change to the Chase Freedom Unlimited if I really wanted to. I thought the card would be useful for ongoing benefits because it earns a flat 1.5 Chase Ultimate Rewards points per $1 spent, with no cap – or crap.

But I’ll have to see if I get more “mileage” from the Chase Freedom, or if I’d be better off with the “Unlimited” version.

Bottom line

I haven’t been flat-out denied for a credit card in years. Gotta say, I’m pretty disappointed.

Who knows when, or if, I’ll get another Chase card again.

Wonder what their co-brand partners will say about all this.

Oh well, at least there are other good offers out there from AMEX and Citi… for now.

Earning points and miles is getting more difficult by the day!

A nice send-off from Chase though, with this “FU” card. You too, Chase!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I was denied a Southwest business card recently. Same day that I reviewed the letter I called the reconsideration line. I had to close a card but they ultimately approved it. 40 minutes with a rep but it was worth it in the end. I won’t be applying for another chase card for a long, long time. Don’t want to push my luck.

Good news at least! Yes, I’ll call tomorrow and give it ONE more try. I’m done for a while, too. Too bad.

so did you ever call? any luck?

I did call. They straight up told me no. I’m torn between trying and again and just letting it go – because I know they’ll notate my account if I call more than once or twice. I explained my reasoning – good customer, long history, etc. Nothing.

I think I’ll wait for a pre-approved offer. I must say, I’m disappointed in Chase with these changes.

I feel your pain as I was recently denied the Chase Ink card despite opening a high balance business checking account in-branch in mid-February and applying for the Chase Ink card in the branch manager’s office during the same bank branch visit. Denial Reason: Too many inquiries – despite the fact that my last four credit cards were from Chase! Upon receiving my 5/24 letter I presented it to the branch manager who confidently promised me that he could reverse the decision and then – over the phone – a Chase Lending Rep told him absolutely no way. I quickly closed my newly-opened business checking account and told the bank manager to look for a new job since his own bank was working against him to meet his new business quota. 825 Credit score BTW.

I also called to apply for this card but I’m guessing I’ll be denied as well, based on your experience. I’ll try calling to have them reconsider but at the very least, I;m hoping to be able to convert my Chase Amazon card to the Freedom Unlimited while keeping the account history in tact.

Any luck with converting the Amazon card to the Unlimited?

Heyo I just found your blog (i’m from NY) and you’re moving!? 🙁

Yessir, but not until May! We can hang out before then if you’re around!

I got an email targeted offer for United Mileage Explorer, 50,000 points but am scared to try it because I’m over 5/24. Some of the other banks are starting to look more interesting.

I’ve heard targeted offers are safe – for now. You could try to apply in-branch. Ask if you are pre-approved for any offers. If they mention the United Explorer card, you have a good chance of getting it.

But I agree, the risk vs reward margin is quickly decreasing with Chase. And other banks are more than happy to welcome you as a new customer.