Also see:

- Seriously tempted by the 75,000 point Citi Hilton Visa offer

- Yay! Just got Discover It and Citi Hilton 75K cards!

- My Top 5 Hilton Category 2 Hotels for Award Stays

If you want to boost your Hilton points balance, you can earn 75,000 Hilton points when you get the Citi Hilton Visa. The minimum spend is $2,000 on purchases within the 1st 3 months of account opening.

If I didn’t already have this card, I’d sign up for it. I caved after being seriously tempted the last time this offer popped up because:

- 75,000 Hilton points is nearly enough for 2 five-night award stays at Hilton Category 2 properties

- The card comes with automatic Hilton Silver elite status

- You’ll get the 5th night free on all award stays

- The card has no annual fee

- It helps to build a positive relationship with Citi, who you’ll note is NOT AMEX or Chase

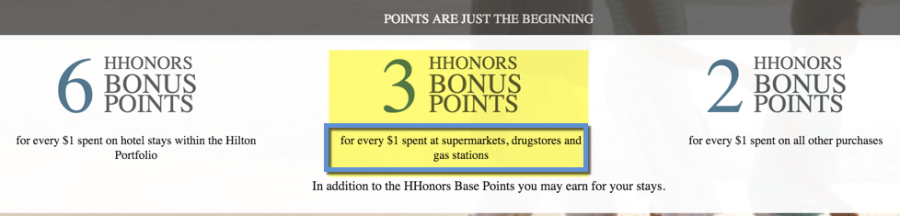

You’ll earn 6X points on your Hilton stays, which is awesome. (Just don’t use it outside the US, because there’s a foreign transaction fee!)

But this is one of the few cards that still earns bonus points at drugstores.

You’ll earn 3X points at supermarkets, drugstores, and gas stations. And 2X points everywhere else.

Is a Hilton card better than a 2% cash back card at drugstores?

If you spend $1,000 in that category, you’d earn:

- $20 cash back

- -OR-

- 3,000 Hilton points

Scale it up.

If you spent $4,000, you’d earn:

- $80 cash back

- 12,000 Hilton points

Back to the Hilton Category 2 example. Those hotels are all $100+ a night and go for 10,000 Hilton points.

So depending on your Hilton status level, travel goals, etc., yeah, you might actually come out ahead with the Citi Hilton Visa at drugstores.

Also, if you like Hilton hotels. Or want to save up for a particular award stay. Or just want to get a good sign-up offer.

Bottom line

Something to consider. I personally value having a no annual fee credit card to age my overall account and help bring up my credit score. And Citi has a bevy of excellent cards, so building a relationship with them is a good thing.

This is also one of the few cards left that rewards spending at drugstores.

Thank you for applying with my links if you decide to pick up this card. (Yes, the 75K offer on the Citi Hilton Visa is there. Just select “Card Type” and “Citi” and you’ll see it).

Will this offer for 75,000 Hilton points tempt you like I was? What’s the main draw for you – the points, not having an annual fee, the drugstore category – or something else?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Announcing Points Hub—points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Do you think Michael could qualify for this card?

Hey Mom!

You know, he probably could. But he shouldn’t apply for just any card. He wouldn’t have much use for Hilton points. I’d recommend a Chase card like the Chase Freedom. Or he could wait until April and get the new Chase Freedom Unlimited.

This card is geared toward peeps that travel a lot. Michael might prefer cash back. Even a 2% cash back card would be a better option for him.

Call me before he applies for anything though! Love you!