I have three real estate projects going on simultaneously:

- Building a cabin in the woods of Arkansas

- Rehab for an 105-year-old house in Memphis

- New home purchase pending for an August closing

I expressed to my real estate group that I might be taking on too much at once, but they chuckled and said something to the effect of: Do as much as you can.

My new kingdom lol

And it DOES sound like a lot, but between the three projects, there’s quite a lot of waiting. Waiting for permits to get approved, contractors to be ready, the loan to close. So I do everything in pieces, a little here and a little there. So far, it kinda works?

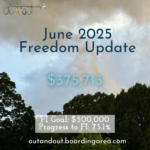

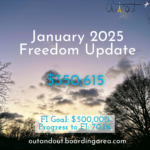

I’m spending a lot of cash lately. The cash outlay for these projects is big. Even so, the equity, appreciation, and monthly income will ultimately be even greater — and I don’t think I’ll lose money on any of it. But I am leaving “save” mode and well into “spend” mode. Sometimes you gotta put it all out there so it can come back later.

Plus, these projects are what’s going to take me to the next level.

I’ve been busy building my team, making connections, and getting everything in motion.

This month, I’ll talk about where I stand in the current moment. Next month will be my final Freedom update, and I’ll include my projections for these projects and where I plan to be within the next year or so, say.