I just got my first Capital One card over the weekend – and not for lack of previous trying. I’ve applied several times over the past few years but have always gotten a big fat denial. The official reason has always been “too many card accounts” or some other vague message, and I missed out on some really great offers.

I’ve tried to get the Capital One Venture card, the Capital One Spark Miles for Business card, and most recently, the fantastic Capital One Venture X card when it launched in November.

The Capital One Venture X card is THE card to have right now.

The Capital One Venture X card is the best premium card to come along in years. Using this photo until I can take one with my new card

It checks all the boxes: huge welcome bonus, great earning potential, ongoing benefits that justify the annual fee, and an overall simple yet powerful card. For most people looking for a premium rewards credit card, this is the one – and I don’t say that lightly. I really really wanted this card.

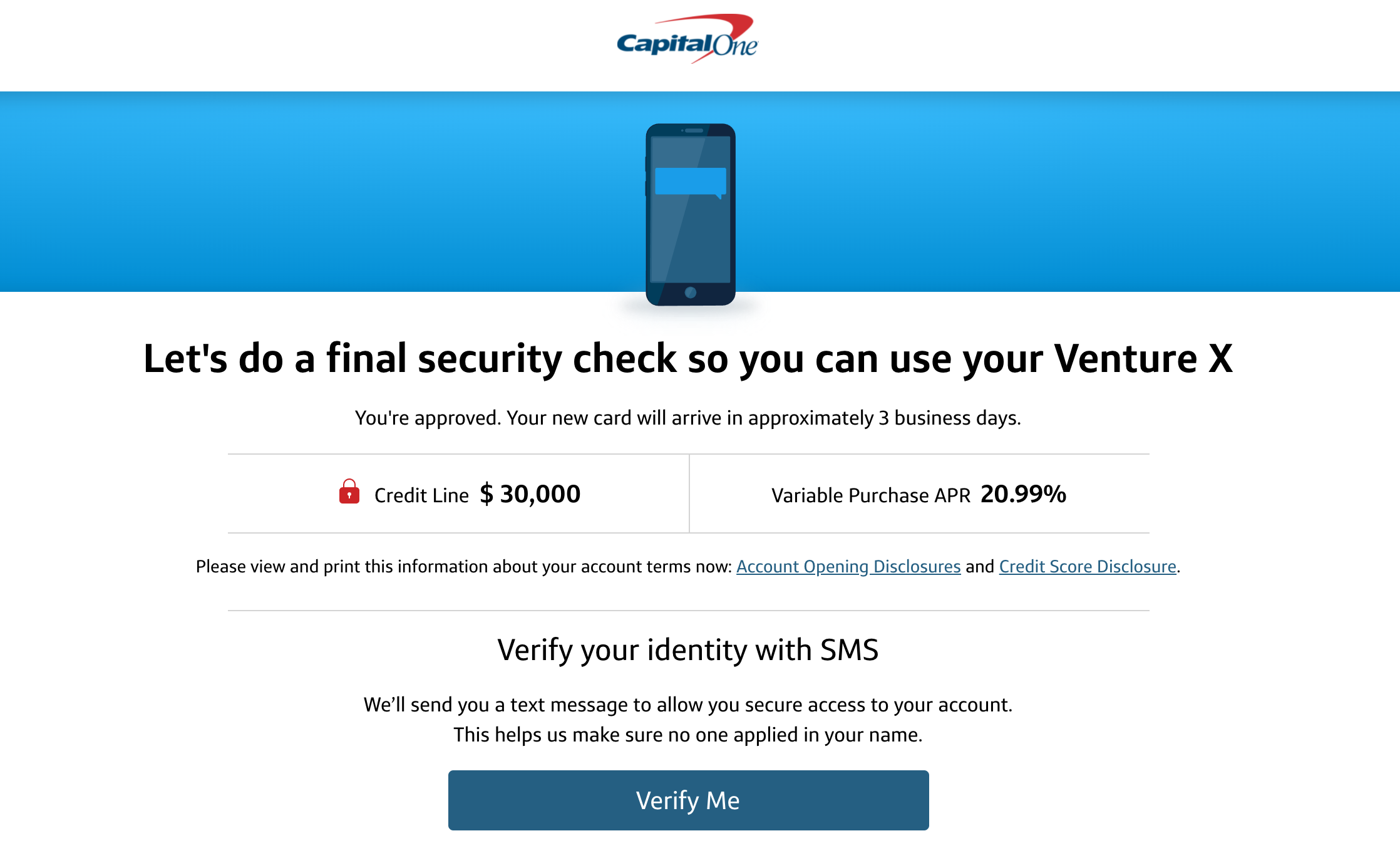

Here’s what convinced me to apply again. This time, I was instantly approved online with a $30,000 credit line.

Capital One Venture X approval

- Link: Capital One Venture X Rewards card

Capital One didn’t like me for the longest time. I watched offers come and go, and even threw my hat into the ring a few times. With each application, I filled out the information, Capital One pulled my credit from all three bureaus, and then… denied. I even had an auto loan with Capital One that had perfect payment history. Surely that would give me a boost?

I was getting seriously bummed over this, because Capital One has a great card lineup – and has made strides with transfer partners and most recently, brand new airport lounges.

With each denial, I turned around and got a different card with another issuer, usually with instant online approvals. When I applied for the Capital One Venture X card in November and got turned down, I was just about ready to give up on Capital One altogether.

Capital One preapproved cards made me change my mind about applying again

I’ve been checking my Capital One preapproved offers every so often, just to see what comes up (there’s no impact to your credit). Despite having ultra-premium cards from other issuers, a 100% on-time payment history, and 20 years of revolving accounts under my belt, Capital One did NOT like me.

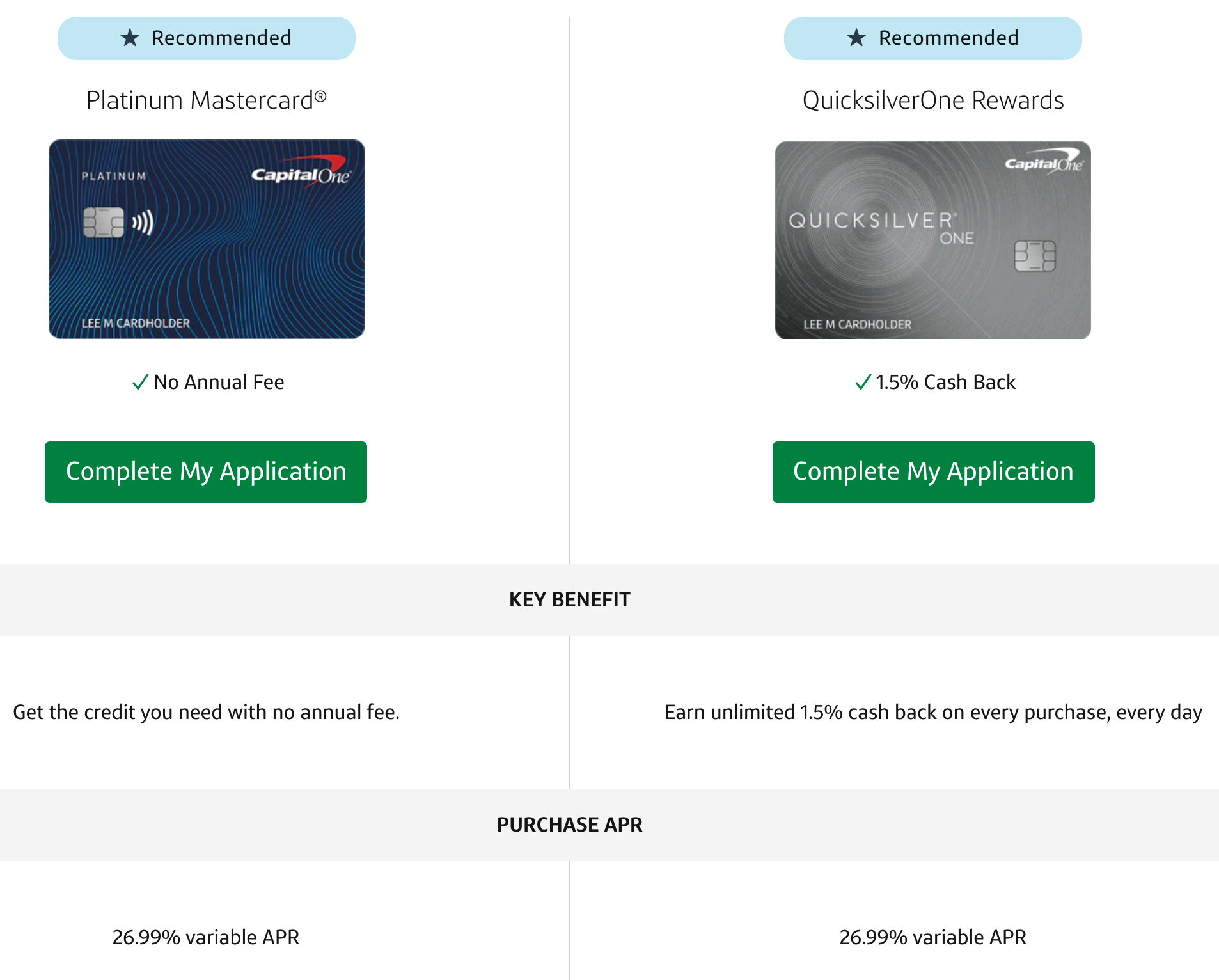

My preapproved offers were for secured credit cards. Clearly they didn’t like what they were seeing. Did I have too many card accounts?

Seems promising

Then it changed.

When I checked over the weekend, I was preapproved for two actual credit cards. That was new.

But here’s what made me apply: the fixed interest rate.

The cards had a 26.99% interest rate, which is ridiculous of course but I never carry a balance and don’t pay a dime of interest, so it was moot.

What struck me was that it was a fixed rate instead of a range. That made me think that Capital One had reassessed me, enough to show me one interest rate and two preapproved card offers. Could I parlay this to the Venture X card? I decided to apply again.

Instant approval

I was halfway expecting to get another denial. But, there are few cards I’m eligible to get any more and I closed on my house so I thought, “YOLO” and spun the wheel again.

There’s no high like hitting the “Submit” button on a credit card application

I literally gasped when I was instantly approved with a $30,000 credit line. I verified my information and set up my online account.

Finally, after all these years, I got my first Capital One card – and I’m really excited about it!

Capital One Venture X details

Though there’s a $395 annual fee, the card benefits more than make up for it. The Capital One Venture X card comes with:

| Capital One Venture X | 75,000 Venture miles (Worth $750 toward travel) |

|---|---|

| • Earn unlimited 2x miles on every purchase • Transfer your miles to 15+ travel loyalty programs • Enjoy free access to Capital One lounges for you and two guests • Get 10,000 miles very anniversary year (worth $100) • Get an annual $300 credit for bookings through Capital One Travel (flights, hotels, and more) |

| • $395 annual fee | • $4,000 on purchases within 3 months from account opening |

| It doesn't get much simpler to earn and redeem points than this | • Learn more here |

The annual $300 statement credits plus the 10,000 anniversary bonus miles (worth $100 toward travel) easily cover the annual fee. Then there’s lounge access to Capital One and Priority Pass lounges, 10x miles on hotels and rental cars booked through Capital One, 5x miles on flights booked through Capital One, and 2x miles on all other purchases.

That doesn’t even include the huge 100,000-mile welcome offer, which is worth $1,000 toward travel on its own.

You can transfer Capital One miles to a variety of transfer partners for even more value per point, which is likely what I’ll end up doing.

And while those transfer partners are still a bit limited, I can see myself using the Venture X card for regular purchases just to get the 2x miles. If anything, it pays for itself and can be an “everywhere else” card. It’s definitely the one I’ll use at Costco from now on, because it’s a Visa card. (Actually, this might the new best card to use at Costco… I’ll have to think about that.)

Capital One Venture X approval bottom line

I’m pleased as punch that I got an approval for the new Capital One Venture X card! Maybe this will help others who’ve struggled with Capital One approvals in the past.

The switch for me was getting preapproved offers for credit cards with a fixed interest rate. Based on that, I decided to apply for this card, and it worked. On the flip side, if you check your preapprovals and don’t get anything – or only get secured cards – you might not get approved for this (or other) Capital One credit cards.

While I don’t think the Capital One Venture X card completely kills other ultra-premium rewards cards, it does have an annual fee that’s lower than most, and the built-in rewards easily cover the cost of the annual fee. For most people (even casual travelers) this is the best all-around travel rewards card on the market right now.

I’m excited to get it and put the benefits to use. It is my highest recommendation now. The welcome offer, the simplicity and versatility of the card, the benefits – all superb. This card is a game-changer.

Have you had a hard time getting approved for Capital One cards in the past? Are you interested in the new Venture X card?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

@Harlan Who are Cap One’s travel partners, & at what rate do they transfer?

Aeromexico, Air Canada, Air France/KLM Flying Blue, Accor, Avianca, British Airways, Cathay Pacific, Choice hotels, Emirates, Etihad, EVA Air, Finnair, Qantas, Singapore Airlines, TAP Portugal, Turkish Airlines, and Wyndham Rewards. All are 1:1 except Accor is 2:1 and EVA Air is 2:1.5.

You can do some good stuff with Air Canada, Flying Blue, Avianca, Qantas, and Singapore. There are a few other sweet spots. I’m encouraged that they’ll add more (and more domestic) partners based on their previous progress. I’ll have to do another post about this in the future – thank you for the idea and asking this question!

Did you apply through a referral?

No, just through the link that’s here on the site: https://outandout.boardingarea.com/VentureX

Then clicked through to apply and it worked! I have a referral link now though if you’re interested: https://capital.one/3qOnFpL

No luck here. I’m in the identical boat you just got out of. Never get Capital1 approvals. Only pre approved secured cards. Great credit score never helps.

But good advice as to what to look for before next application. Thanks.

I hope you can get out of it! I think they’re being a little more open with Venture X approvals. Keep checking back to see if you have any preapproved offers. I think that was the turning point for me. Good luck and thank you for reading and commenting!

I got the VentureX and thus far I’ve had a “meh” experience, primarily because of the Capital One Travel portal. They are lacking a number of airlines and car rental agencies that are bookable through other third-party sites like Expedia, Priceline, and other travel portals (including Chase). I called specifically about a JetBlue flight that I want to take and was explicitly told that JetBlue was not bookable through Capital One. I was bummed. Beyond that, the way the site groups fare classes is not intuitive: Basic, Standard, Enhanced, Premium, Luxury.

All in all, it seems like the 100k offer is to try and entice people to beta test a product that is really not ready for prime time.

Thank you for the perspective, Adam! Good to know about the missing airlines and car rental agencies. I’ll keep that in mind when I poke around the portal. Here’s hoping I can find an easy way to use the $300 annual credit. Thanks again for reading and commenting!

Thank you for writing. I was rejected today for this card- first time ever rejected for a card. Will try your method with the pre approval tool- as you predicted just variable rates when I checked today. Would also be curious whether all the fuss is worth it once approved. Like the others, high income, never missed a payment, multiple other cards (but no capital one) excellent credit score, and rejected. Was cautious on applying because of prior rejection accounts. Of course immediately got multiple emails about the hard pull and my credit score dropping 10 points. But will check the pre approval tool as you recommended for the future.

Hi Steve – glad this was useful for you. I’d recommend to keep checking. My offers changed within a few weeks and I went from getting denied to instantly approved. Hope it works for you. Thank you for reading and commenting!

i was denied the X Card, however i do have capital one venture no fee card and i get offers to upgrade to X with no bonus. i personally think thats a bad move if i do it. is there anyway to call capital one and tell them about the offer i get on my account and they can reconsider?

Based on my previous experience and what I’ve heard from others, I don’t think that would work. You can certainly give them a call and try, but the phone agents don’t seem motivated to offer approvals or offers. Would be curious how it goes for you. Hoping for the best for you!

Thanks for the post! I finally got an approval today after several rejections on the card. I checked my reapproved offers first just as you did, and then was approved!

Woot woot – that’s incredible! I’m really looking forward to the experience of redeeming the credits and booking travel to see how quickly things post and what it’s like. Also curious about their airport lounges. Congrats on your approval! <3

I had read you have to wait six months after being rejected before applying again. Is that not necessary?

Oh wow, I never knew that. Based on my experience I don’t think I waited even two full months. It seems like a six-month wait isn’t necessary between applications.

This is great news! As I just got declined and dreaded having to wait until August. Unfortunately I just came across your pre-approval tip now. Think going for one of the secure cards would make a difference? *establish* a relationship with Capital 1.

If you’re seeing a fixed rate, I’d say go for the card you really want. They were showing me secured cards with a range, but once I saw a fixed rate I decided to go for the Venture X and it worked. If you’re still feeling uncertain, sure, a secured card might be a good move but then you’d be locked out of any other cards for a while. What a dilemma! Let me know what you decide and how it turns out!

thanks for the tip – rejected in Dec, but followed your method and approved today 🙂

That’s awesome! Glad it worked for you – congrats! And thank you for sharing the good news!

PS – 6month wait is between C1 approvals only

Hi I did your method & also get a fixed interest rate 🙂 Do you think it is ok to freeze 1 credit report to get less hits from Cap1 or leave all 3 open? Thanks!

Hmmm I’d say it’s probably OK to freeze one of them. I left all mine open. Let me know how it turns out for you!

Nope, I was also pre-approved for 2 credit cards (Platinum Mastercard and QuicksilverOne Rewards) and both have fixed interest rates, still got declined:

800+

$220k Income

$3500 rent

7 years of credit history

$6000 monthly spend

Sometimes carry a balance,

util 0%

Credit Karma says approval odds is Excellent

This is such a joke

Finally worked – third time lucky! Last time I tried the preapproval I got 0 offers, not even secured (and I also have an auto loan with Cap1, perfect payment history). Anyway, tried again today and got 4 offers (not including venture x) but with variable interest rates. Gave it a shot anyway and woohoo!

I’m actually really excited.

So no 6 month rule apparently.

On another note, I used your blog link. I didn’t see the referral link until after. Hope that still works for you. Great tip!

Yayyyy! Did you get the Venture X? I gotta say, I am really really liking the card. It’s been at the top of my wallet since I got it for min spend purposes, but also just really enjoying the simplicity of it. I love that I can use it for Costco shopping – we shop there often and getting 2X is a little better than the CFU 1.5X rate. Because of the transfer partners, I also think it beats out the US Bank Altitude Reserve for Costco.

I’ve already used some of the travel credits and am really looking forward to visiting their airport lounges. And their Priority Pass allows you to use the restaurant credits (unlike Amex cards).

So glad you got an approval! Yayayay! Thank you for sharing!

Hey Harlan, I was looking at DP and just been reading about Cap1, too me it seems very overwhelming with the way its structured on approval, like its very unfortunate that they don’t have a team for recon. Where as Chase or Amex, if they don’t instantly approve you, you could at least call to talk to someone and have it reconsidered. But, in this case whatever the computer tells you that’s final. They also deny you from all types of weird ways, I heard this person on reddit got denied due to closing a credit card with a $0 balance like wtf?! Or even getting denied for having “too much revolving credit” even if its just a few cards. I have 20+ cards so i know it’s going to be hard for me… But, the thing that I’m trying to get at is, I did the tool thing and I got rebuilding/secured cards. As I stated I have 20+ cards, 760+. clean CR, on time payment, etc I don’t understand why I’m getting those cards, even when I did cardmatch I was getting those type of offers as well. I remember a very long time ago, I haven’t applied for cards for about a year or so, and never got those offers but I think because I recently applied for a few these past months. Like my recent card was back in May and then another card in Nov of last year. So, my thing is what should I do now? Just wait and pay off some balance on my cards?

Congrats on your approval btw and thank you for sharing your experience!

I’ll keep the card for at least a year but unless they offer a great retention offer besides the 300 portal credit and 10k annual bonus I will have to look on a year by year basis. If the lounge network improves and doesn’t get crowded like amex I might stay but it would be nice to be able to purchase sameday airfares and have hertz President circle on reservation and not have to go to the counter . Would be great to use the credit without the portal and have better insurance coverages like amex plat .

Just leaving a follow up note, potential DP. So I actually got an email from CapOne today, unsolicited, inviting me to see what I was pre-approved for via their pre-approval tool. If you see my 1/3/22 email, had got rejected then (first rejection ever). As with most others, 800+ 175k never missed a payment, but 20+ cards overall given the hobby. My rejection letter mentioned a low credit score(really?), and too many cards. My results today appear to show pre-approval for a Platinum Mastercard, a Quicksilver One Rewards, and a Quicksilver Secured Rewards. For all 3 there is listed 26.99% variable apr. Is this the criteria you were looking for? Unfortunately, I didn’t save my results from January, so I don’t know if this is a different result from then. Even if it is, I’m still a bit hesitant to apply as I have no cards with them and they seem VERY quirky. Also, when rejected, the credit score they referenced seemed to be 30 points less than all my other actual other scores. Finally, if I recall, their application questions were different than any other card and I wasn’t sure what they were looking for regarding expected spend, paying off balances (I always pay on time in full, but they seemed to be looking for a different answer from their phrasing) and other questions. I know their current offer is running out next week. So I am curious what the community thinks.

Thanks for your opinions,

Steve

If you see a set APR, that means they’re considering you. I put that I pay off my balances every month. I didn’t add an AU. I had a similar pattern as you (rejected despite great credit history, and then the set APR that led to an approval). I’d try again! See how it goes.

Consider using my link as I’ll get affiliate credit for it – thanks if you do! Let us know how it goes if you decide to apply again!

Thanks for your quick response. When they state 26.99% variable apr for purchase and transfer, I was a bit confused by the term “variable apr,” but is that still what you meant by a “set” APR?

Thanks,

Steve

Ah, yes, I’m referring to them interchangeably. Seeing one number instead of a range is a good sign!

Got approved! I think it was for a 30k limit. Did use your link! I guess you figured it out (although they also emailed me directly). I really thought it was going to be a “Lucy pulling the football” moment but it worked. Thanks!

YAY!!! Congrats! I am here for all Lucy references! :p

It takes a while for the data to upload (sometimes weeks or months), but it should come around eventually. THANK YOU, Steve!