Also see:

- My Last Chase Card: Just Applied for Chase Freedom Unlimited

- 4 Things Holding Back Citi ThankYou From Being the Best Points Program

There were rumors on Reddit that Chase is putting together a new premium credit card with a high annual fee a la AMEX Platinum and Citi Prestige.

Moreover, on that same link, there’s another rumor that Chase is planning an overhaul to its Ultimate Rewards program to make it less lucrative.

While I don’t believe Chase would mess with Ultimate Rewards any time soon (because they need to compete with AMEX and Citi’s transferable points programs), I do think Chase is ripe for a new ultra-premium credit card offering.

I thought it’d be fun to imagine what that card might look like. And what features it would need to have for Chase to remain a viable competitor in the premium credit card space.

A new Chase card?

I’d love to see Chase put together a card with premium perks and benefits.

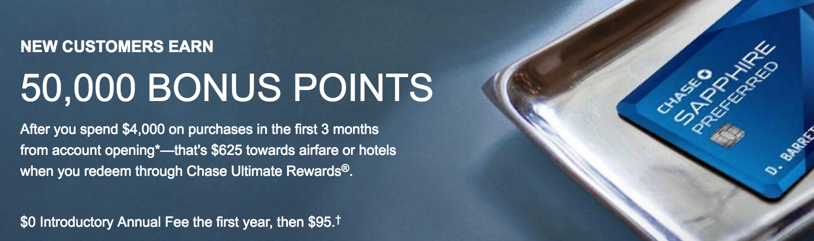

They pioneered transferable points programs with the Sapphire Preferred card and Ultimate Rewards. Because they were first to offer bonus points on travel and dining, they were able to set the benchmark.

But with regard to a premium card – they are tardy to the party. And to beat the competition, a card like that would have to be seriously amazing.

It would need:

- A $450 annual fee

That’s the fee on AMEX Platinum and Citi Prestige. They could probably get away with $500 if the card is seriously kick-ass.

- United Club lounge access

AMEX has Delta, Citi has American. Chase has United, but has yet to add United Club access to a card not directly affiliated with United.

Now that there are only 3 legacy airlines left, it makes sense.

- $200 or $250 airline fee credits

And not just for United. Even Citi, who’s loyal to American, gives you $250 per year to use on any airline as you wish. And not just for incidentals – you can buy a ticket and get it reimbursed.

- 3X, 4X, or 5X bonus categories

Citi Prestige offers 3X on airfare and hotel stays. AMEX Platinum has annoyingly never offered more than 1 AMEX Membership Rewards point per $1 spent.

Chase has to top Sapphire Preferred, otherwise what’s the point? 3X makes the most sense – for travel purchases at the very least.

- At least 1 seriously amazing perk

Preferably 2. Citi Prestige gives you the 4th night free on ANY paid hotel stay booked through Citi Travel. You can use this perk an unlimited amount of times.

I’ve used this perk several times and expect to get well over $2,000 in credits from this feature alone!

I don’t think that’s sustainable for the long-haul. But AMEX Fine Hotels & Resorts has dependably given $100 spa/dining/property credit on hotel stays for a while now.

- Primary car rental insurance world-wide

Sapphire Preferred has it. The new card should have it, too.

- Several ancillary bennies

3 free rounds of golf per year, anyone? Citi Prestige has a few fun perks to enjoy. I’m not a golfer, but if you are, this is a fantastic benefit.

Citi also has Citi Price Rewind and AMEX has high purchase protection limits. A new Chase card should have several built-in features like this to encourage all types of spending – especially big-ticket items.

- Airline and/or hotel elite status

AMEX Platinum gets you SPG Gold and Hilton Gold elite status.

Hilton Gold status gets you free breakfast. So does Marriott Gold status. And Hyatt Diamond status. (IHG is hopeless.)

Chase might get Starwood hotels soon. Having a mid-tier – or even top-tier – hotel status perk for free breakfast would be amazing.

Chase also has United and Southwest. Maybe mid-tier status on United? That may be reaching too far, but they’d need to sweeten the deal – and that would help a lot.

- Premium Ultimate Rewards points

Make them worth more toward booking travel through Chase. Instead of 1.25 cents each, how about 1.5? Like Chase Freedom Unlimited.

- A great sign-up bonus

I’m thinking 60,000 Ultimate Rewards points – at least.

- Priority Pass, Global Entry, No forex fees, great phone service

Simply because AMEX Platinum and Citi Prestige have all of these. Gotta have these standard perks!

Bottom line

These are just rumors for now, but I believe there’s a kernel of truth in there. It makes sense and it’s logical – an ultra-premium credit card is missing from the Chase lineup of cards.

So these are my wishes for such a card. As long as it has a $200 – $300 annual fee fee after credits, I’d seriously have to consider it. But with the 5/24 rule, it’s anyone’s guess who would even qualify for the card. Maybe we’ll get lucky and get an early crack at it like the Chase Freedom Unlimited card.

Your turn! What would you want to see on a Chase premium card with a $450 annual fee? What would be the dealmaker (or breaker)?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Ummm, this card already exists, it’s called the JP Morgan Palladium Card. Obama has one. $595 per year but fees can be rebated by your Chase Private banker. The only things it really lacks from your list are a signup bonus, category spend bonus and airline credits. But it does include UC and PP lounge memberships.

It was discontinued in 2014.

Are you sure?

I have one and unless I’m paying a bill to no one am still actively using it.

The FlyerTalk group about the card also seems relatively active.

That’s great! But the title of the post is, “Imagining a New Premium Chase Card.” Emphasis on NEW lol.

Incorrect. The Palladium is still offered, however, you can now only apply for it via a Chase Private Client (CPC) banker.

Great news if you qualify for that service.

I found the FlyerTalk thread discussing it:

http://www.flyertalk.com/forum/chase-ultimate-rewards/1089511-jp-morgan-palladium-card.html

There is a premium card, the Ritz Carlton card, however, it earns Marriott points rather than Ultimate Rewards. Comes with Marriott gold, airline credits, variety of category bonuses, and more or less all of the bennies you mentioned sans UC club access.