Also see:

- Come in Houston, er, Dallas: Buying a House and a Move Toward FIRE

- In Closing: My Experience Buying a House

I’m targeting late April/early May to be out of NYC and in Dallas full-time.

For as long as I can remember, I’ve wanted a silver Subaru Forester. Buying a house and moving to Dallas meant I’d need to buy a car sooner or later.

The budget I had in mind was $6,000 for everything. Tax, title, registration, base price of the vehicle, everything.

I knew car prices tend to rise as it gets warmer, so when I found a great deal on the car I wanted in late February, I went ahead and snagged it.

Oh! And I wanted to pay for it in full. No financing.

Just an in-shape, reliable used car whose only expenses were maintenance, insurance, and gas. Boom.

Buying a car with credit cards

The purchase price was $4,500.

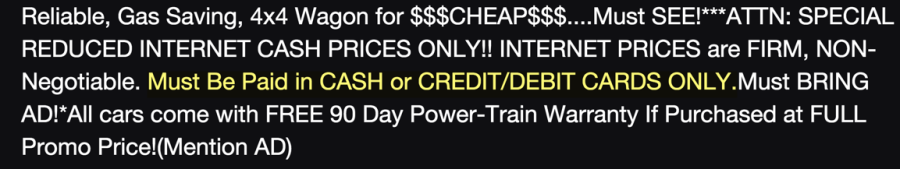

While scanning the ad, I noticed a small but important detail.

So I called to verify and they said yup, but only Visas or MasterCards. So that meant no meeting the minimum spending requirements on a new SPG small biz AMEX.

But here’s what I came up with.

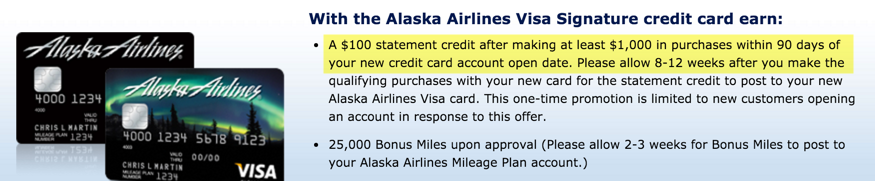

I just got a new Bank of America Alaska Airlines Visa with a $100 statement credit for spending $1,000 within the 1st 90 days.

So I’d put $1,000 on it to give myself a $100 discount on a new car.

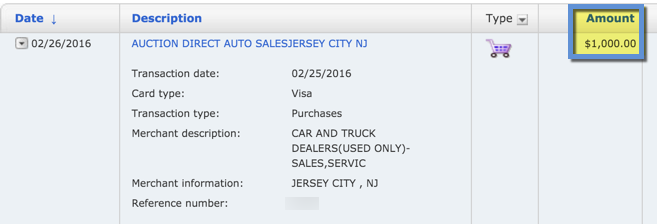

That left $3,500 to go. I contemplated opening a new card to earn some extra miles. But then I thought of an opportunity to downgrade a card.

Remember how I said to DTMFA with regard to the Barclaycard Arrival Plus card?

Well, my $89 is due in May and I’m going to downgrade the hell out of that useless card!

I had 2,206 Arrival miles. But need 10,000 Arrival miles to offset a $100+ travel purchase.

So I needed 7,794 Arrival miles. And charging $3,500 would net me 7,000. That was perfect. And didn’t account for inevitable documentation fees.

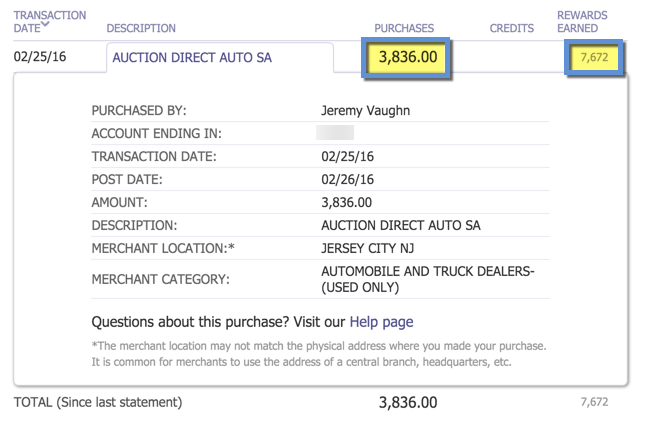

I went with that one. In the end, I earned 7,672 Arrival miles for an out-the-door price of $4,836. And now I can get $100 toward a flight, subway pass, train ticket…

In all, this would give me a $200 discount. Plus, I had them knock another $100 off the purchase price when I got to the dealership.

It was already priced well below its full retail value. And thanks to credit cards + negotiation, I got a 6% discount on the total price.

Not a bad deal at all.

Other benefits of purchasing a car this way

The more I thought about it, the more benefits I saw to charging the car instead of using debit, or withdrawing cash.

No, there wouldn’t be a warranty or purchase protection (vehicles are restricted from those coverages), but there would be other fringe benefits, like:

- Floating the cost for a few weeks until I could pay the cards off in full

- Showing the banks I’m responsible with my cards, and pay them off in time

- The bonus Alaska Airlines miles

They also helped in the negotiation. Because they put me in the position to offer full payment up-front. Which led to a lower purchase price.

Extra picture to break up the layout and give your eyes a break from scanning the page. But whoa, isn’t that a good-looking car?

Not to mention the thousands of dollars saved by not financing the vehicle!

Other reasons you might want to use a credit card for a vehicle purchase, or any other large purchase like this:

- Meet a spending threshold for elite status, bonus miles, EQMs/MQMs, stay credits, companion ticket, etc. etc.

- Meet minimum spending requirements on 1 or more cards

- Ease cash flow

- Build a positive relationship with the bank

- More accurate proof of payment than cash for your records, just in case

And again, the bargaining proposition gets a lot better when you can offer a larger amount up front.

Bottom line

This is obvi very niche, but I feel this story expresses some of my other tenets very well:

- Never, ever buy a new car. Always buy used. Pay in full. And take care of it until the wheels fall off.

- Negotiate everything. They said their prices were firm. But I’m firm, too. Ask for the best deal.

- Credit cards do have an important place in personal finance. This is an example of when they take center stage. It’s not always all about points and miles, although I did earn a nice chunk of both.

- Set goals. My god, set goals. Goal-setting is so powerful.

I wanted to spend $6,000 or less for a silver Subaru Forester, including tax, title, base vehicle cost, and registration.

With everything added up, I came to within ~$40 of that amount. The best way to set a goal is to make it as specific as possible. Mine was specific in every detail, including color, make, model, and total price. And it materialized in the exact way I envisioned.

Envisioning is a powerful way to draw your goals to you faster.

And of course, maximize every purchase. :p

So now that it’s all laid out, how’d I do? What would you have done differently?

Would you considering purchasing an automobile with credit cards?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Seems like this worked well for you, but my understanding is that having a traditional car loan could raise one’s credit score. We don’t owe anything on our cars and our credit reports always mention not having any installment loan as a negative for our score.

That’s an interesting and important thing to note. Thanks for adding that!

I actually already had a car with a note that’s been completely paid off. Plus, I have the ol’ mortgage now, which is helping my credit score.

I considered financing it, and then paying it off in full with no pre-payment penalty, but then figured I’d just go ahead and buy it outright. Doing it that way, if you’ve never had one, is a quick and easy way to get an installment loan on your credit report.

Interesting dream car choice!

LOL, I’m a weirdo. :p

X2

Reminds me of the Bay Area all over again!

LOL they’re very “Northeast.” I love ’em because they usually last for 250K+ miles and they’re built like little tanks. And very safe.

Hopefully this is the last auto purchase for a looooong time!

I’m in the market for a used car and I’m VERY interested in paying with a credit card. I don’t need financing anyway and might as well earn some points. 🙂 I was under the impression that dealers don’t like to take credit cards. Was it hard to find a dealer that accept cc payments?

No, not at all. I searched on cars.com and I found that 80% accepted credit cards. They said so in the description.

They have various fees though. Bigger places will eat it, smaller places will pass the fee to you.

Depending on how much it is, it might be worth it to meet a minimum spending requirement or 2!

Good luck searching!

You’re paying the interchange fee one way or another. You probably could have negotiated a discount for all cash.

Perhaps. But I negotiated the price before I revealed I wanted to pay with a credit card. Either way, I feel like I got a solid deal.