For those who are going to comment, “What’s this have to do with BoardingArea?”, the answer is nothing, so don’t bother. Close the tab and leave.

If you’re still here, know that I’m so excited to travel and can’t wait to post more travel stories. This article has a story behind it.

It was originally published on August 25, 2022, on NextAdvisor in partnership with TIME on the Time.com domain. That site folded in early 2023 and the story disappeared into internet ether. I thought it was a good one, so I want to republish it now—on my own blog—for posterity so it isn’t lost forever.

I’ll admit: It’s definitely on the personal finance side of things. It relates to my own personal finance journey that I’ve chronicled here since 2019 (a literal different world ago). It’s a great complement and explains more of my thinking and personal finance philosophy.

And so, I hope having one more personal finance post is OK. This one’s mostly for me, and I hope you enjoy it too.

I Grew Up Poor and Learned Financial Literacy Late. Now, I’m Investing for My Children and Teaching Them to Become Millionaires

Me and Warren in 2022

I’m going to teach my children how to be millionaires.

My oldest son, Warren, already has a brokerage account – and doesn’t even know it yet. Soon, he’ll have a little brother (and we’ll have another son). I plan to set up an account for him, too.

My efforts alone won’t make them millionaires. But I’m going to give them a big head start and show them the power of consistent, long-term investing with low-cost, broad-market index funds.

It’s something I wish I’d learned sooner. Teaching my children will be a big step toward building generational wealth in my family.

I grew up poor, and my family is mostly poor. They don’t own assets or leave anything behind to their children. If anything, they pass on debts to other poor family members to clean up when they’re gone. It took a long time for me to start saving. Even now, I often feel like I’m “behind” or should’ve started earlier.

Since having kids, I decided they’re going to grow up differently than I did.

Here’s what I’ve done so far, how much they’ll potentially have when they become adults, and how teaching my sons about money is healing my own money traumas.

My Brief History With Money

There’s a proverb that goes, “Shirtsleeves to shirtsleeves in three generations.” Variations include “From stables to stars to stables” and “The father buys, the son builds, the grandchild sells, and his son begs.”

They all address the notion that first-generation wealth is rarely sustained. Most often, it’s due to a lack of education and not understanding what money is or how it works.

My sons will know about their investment accounts, and money won’t be a taboo topic in our household. The concepts of long-term saving, compound interest, and living below their means will be introduced early and discussed often.

Contrast that with my upbringing, where I didn’t know what a brokerage account was until my mid-20s, money was described in terms of lack or frustration, and saving? There was nothing to save when life was paycheck-to-paycheck.

I’m now to the point that I’ll be a millionaire in my lifetime – perhaps several times over if my investments perform well. And even if not, I have enough to retire comfortably without ever adding another cent to my retirement fund.

Investing for Kids With a UTMA

Right now, I’m investing for my three-year-old son Warren in a UTMA brokerage account. The acronym UTMA is short for the Uniform Transfers to Minors Act, which allows a minor to receive monetary gifts with minimal tax implications.

I’m the custodian of Warren’s account, which means I choose the investments on his behalf until he reaches the age of majority and the account transfers to him.

That age is either 18 or 21, depending on the state you live in. Some states have UGMA (short for Uniform Gift to Minors Act) accounts instead. They’re basically the same, except a UTMA account allows gifting of additional assets, including equities like stocks.

You can give up to $15,000 per year to a UTMA account for a child, and your contributions are never taxed. The first $1,100 in earnings (like dividends, interest income, and capital gains) are not taxed. The next $1,100 are taxed at the kiddie tax rate, also known as the child’s marginal tax rate, which is much smaller than an adult would pay. Any earnings over $2,200 are taxed at the parent’s marginal tax rate.

Warren’s Investments: A Peek Under the Hood

Here’s what I chose for Warren’s investments. I chose to invest in VTI, Vanguard’s total stock market ETF index fund. It’s extremely low-cost and captures activity throughout the entire stock market. The S&P 500 features heavily, but there are some small cap and alternative investments in there for good measure.

A fund like this provides instant diversification, so if one company or sector severely underperforms, the entire portfolio won’t go down in flames. This protects his investment portfolio from any downturn in the market.

Based on the stock market’s historical returns, they should see somewhere around a 10% return on average, which accounts for the market’s dips, crashes, and incredible bull runs.

And whatever happens, they’ll have their Dad to remind them to stay the course and keep investing. After all, it’s the best thing you can do to have a successful portfolio.

How Much Will Warren Have in His UTMA Account?

Right now, there’s $1,100 in Warren’s UTMA account. I try to put in at least $100 per month (and more if I can swing it).

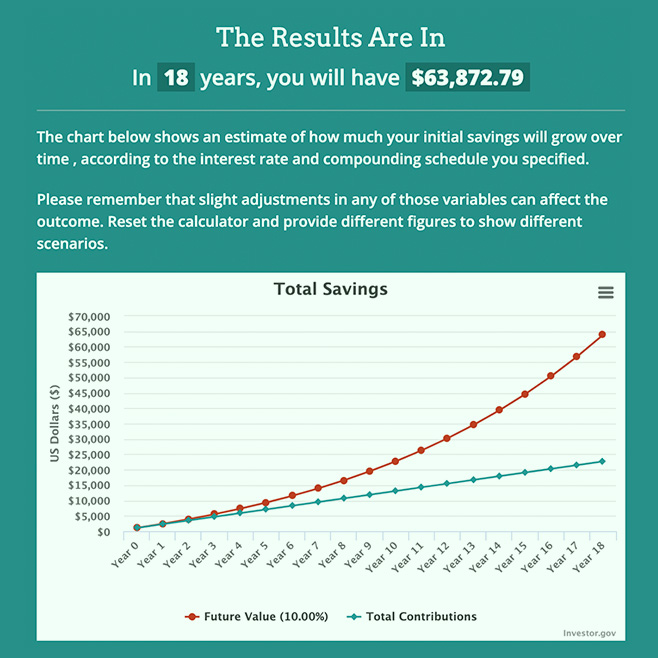

According to the compound interest calculator on Investor.gov, Warren can expect to have $63,872.79 when he turns 21 in 18 years, assuming a 10% return and $100 added monthly.

While that’s a nice chunk of change for a young person, the results are even more dramatic if it sits until he’s 60. In 57 years, he’d have $3.4 million if he keeps up a $100 per month contribution. And he’d cross the line into millionaire at age 48.

For $100 per month, he can retire as a multi-millionaire on his 60th birthday. That’s the power of compound interest. Should he choose to keep the money and increase the investments, the sky is truly the limit. And knowing he only has to minimally maintain his investments and have that kind of nest egg waiting for him should be plenty motivating.

Why Not Go With a 529?

A 529 account is used solely for a child’s educational expenses. Some states even give a tax deduction or credit for contributing to a 529 plan. But there’s a 10% penalty if the funds aren’t used for educational expenses.

The biggest difference is that the funds inside a 529 plan are considered the parent’s assets, and therefore have a smaller effect on the child’s need-based financial aid calculations when it’s time to apply to colleges.

With a UTMA/UGMA account, the assets are considered the child’s assets and can be used as income, which could significantly lower financial aid qualifications, depending on how much is in the account.

And I’m fine with that.

I don’t want my children to feel like they have to go to college to enjoy their gifts. Already, the traditional trajectory of college after high school is being challenged.

What if Warren decides trade school is better for his career goals? What if he wants to attend community college and can’t spend all the cash in his account? What if he receives scholarships on his own merit and doesn’t need a 529 after all? What if he simply doesn’t want to go to college?

Further, if he decides to attend college, the funds in a UTMA account can be used for anything – including educational expenses. If that’s how he wants to spend his money, then that’s his decision. I don’t want to lock him into anything while he’s only three.

If he starts talking about college when he’s in high school, maybe I’ll switch gears. But for now, a UTMA account seems like a better choice because of its additional flexibility. For example, he could also just keep it and keep investing. The choice will be his.

I’m Doing This for My Next Son, Too

Our newest child will make his grand entrance in just a couple of weeks. I already have a checklist of things I want to do for him, like set up an email account where I can send him letters through the years, give him a membership to my preferred financial institution, USAA, and open a UTMA account.

I’ll make my sons beneficiaries on my other investment accounts, but I also want them to have their own, separate accounts that we can watch and monitor together as they grow up.

My hope is that they’ll be one another’s accountability partner for ongoing financial stewardship when they’re adults.

Ongoing education is the make-or-break with making successful transfers of generational wealth. Instilling a sense of ownership and putting an account in their names will, I hope, give them encouragement – and power.

A Roth IRA Could Be a Good Play in the Future

I love Roth IRAs. They’re an amazing way to supercharge your retirement with flexibility, tax-free growth and withdrawals, and serve as a hedge against increasing tax rates.

The hitch is that you can only contribute as much as you earn in a year, or up to $6,000 a year in 2022, or $6,500 in 2023 (whichever is less). I can’t open a Roth IRA for Warren or his new sibling just yet, since they don’t have their own earned income. When they start working, I will.

I mention this to illustrate that there are many account types that would work well for what I intend to do: raise financially literate children. And will the strategy change over time? I sure hope so.

How You Can Set Your Kids up for Success

There are lots of ways to invest, and many account types – even for kids. It doesn’t matter where you start, because getting started is all you need to do.

The sooner you can invest for your children, the better, because compound interest will have an incredible impact over the years while they’re growing up. The earlier you can save for them, the more time their money will have to multiply.

And don’t get too caught up on the strategy. You can always learn more and change it later if you want. Even if you start with a little bit of money, it can give your kids a huge head start.

Because one day, you’ll blink and they’ll be all grown up – and so will their money.

Bottom Line

I’ve broken through a lot of ideas about money that kept me down. After dealing with my own trauma and claiming back my power, I’ll teach my children to feel empowered about money, how to save, and why thinking long-term and multi-generationally is important to build and preserve wealth.

Warren just turned three, but already loves playing with coins. I tell him their values. He watches as we pay for gas and groceries with our credit cards. And I’ve occasionally remarked that we need to buy things before we can open them in the store.

He’s completely a sponge right now, so even if he doesn’t seem to “get it” yet, I know that introducing the concepts and language now is already setting him up in a way I wasn’t. He’s also observing our attitudes and energies about money.

He’d be absorbing all of this anyway. The shift here is molding the narrative for him while he’s young. And it’s healing for me to be able to give my children something I never had. As a father, that makes me feel proud of how far I’ve come.

As the boys mature, they’ll start working or talk about college and figure out their plans on the way to adulthood. There’s no way of knowing how these accounts will change over time, too. There could be new legislation, new rules could emerge, or there could even be a new type of investment account when they’re older. We just don’t know what will happen.

That’s why I’m always open to pivoting based on their financial goals and what changes over the next decade or so.

For now, all the future millionaires have to do is be kids, play, and grow. Their Dad’s got a plan to educate them as soon as they’re ready.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Harlan,

I’ve been reading your blog maybe for over a decade and it is so nice to read your updates. I am starting to focus on financial freedom and I feel everyone has a different journey. I am an immigrant and also a solo parent in NYC. I am saving money for my son’s future and last year I was able to get a nice 2 bdrm rent stabilized apartment in the East Village. My son attends a nice school and now I can focus on my retirement savings. Sometimes I feel I am late in the game but I know this is MY journey so I have embrace it. Congrats on your boys!!!

MS and personal finance/investments overlap once you get advance enough where your priority shifts from points to travel to cash money 😉

Also, recent 529 change where unused funds can now be converted into a Roth IRA. So you may want to check back with the details to see if that now appeals to you. Benefits of 529 tax advantages and fall back Roth IRA option vs lifetime taxable brokerage. That added benefit swung me to decide to open a 529.