Also see:

- My Last Chase Card: Just Applied for Chase Freedom Unlimited

- Loving Citi More Than Ever – Time to Cancel Other Cards?

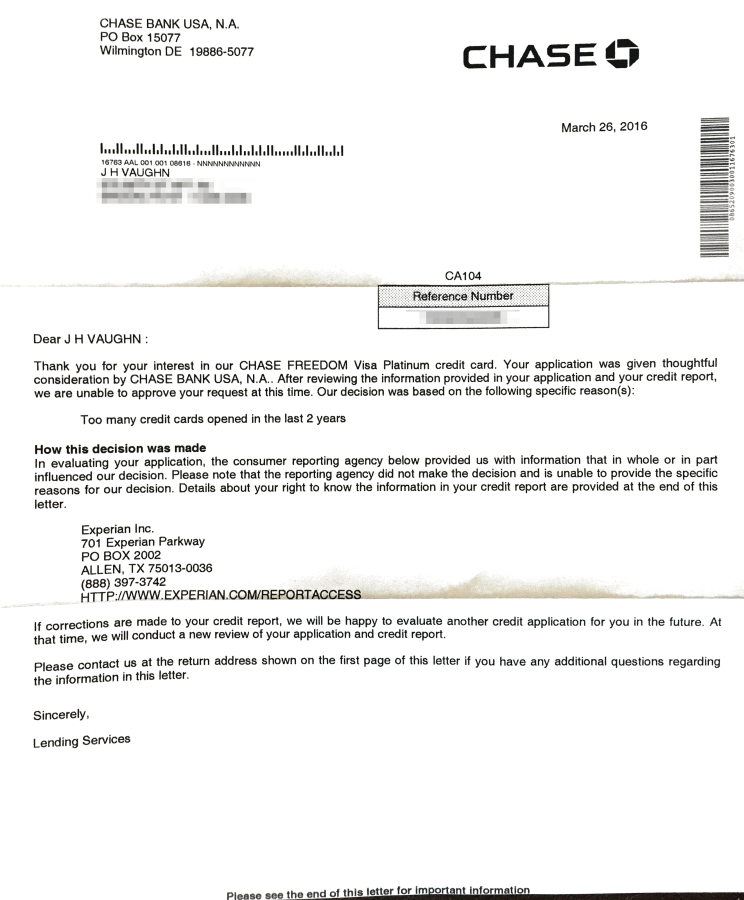

Well, I got the letter today that I was straight-up denied for the new Chase Freedom Unlimited card (which is now open for online applications).

It was to be my last Chase card.

I kept trying to call the automated line for info (888-338-2586), but even now it still says to look for a letter in the mail. I presume this one:

The reason?

“Too many credit cards opened in the last 2 years.”

Wowwww. It’s interesting that’s listed as the only reason.

It seems this rule will now cover ALL Chase cards, including small business and co-branded cards.

DIAF – Die in a fire

Definition: To be in a fire, and die within it.

Usage: I hate you, DIAF.