I opened 3 new checking accounts last week. And will earn a total bonus of $900 after making the required number of transactions and/or direct deposits.

That’s a super easy way to make $900. And I didn’t even have a credit pull.

I have around 30 credit cards. And currently can’t get most Chase, Citi, or Amex cards because:

- Chase has 5/24

- Citi limits to “family of brands” every 24 months when you open OR close an account

- Amex has the once per lifetime (AKA every ~7 years) rule

I’m not interested in any Barclaycards. Or US Bank cards. And I can’t get more Discover cards (limit 2).

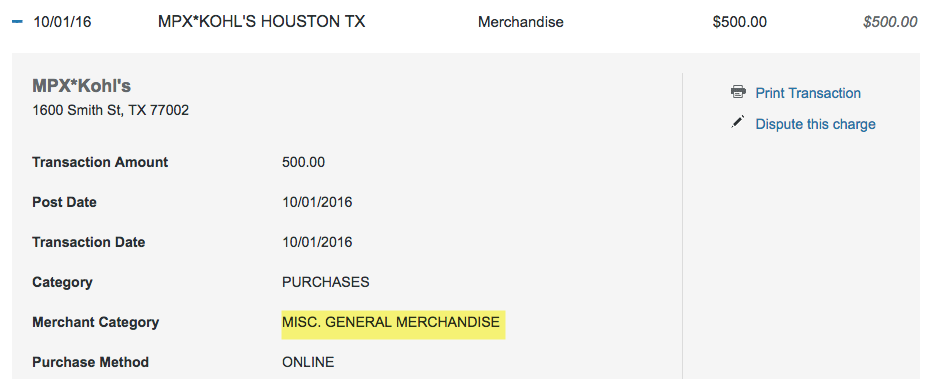

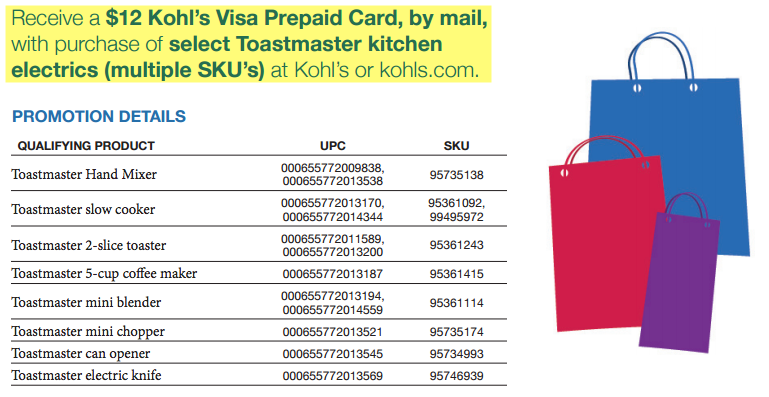

I’m really only dealing with Bank of America these days for Alaska miles from credit card sign-up bonuses. Except for when there’s an odd offer here or there.

So, scraping the bottom of the barrel. But it’s not so bad down here! I’ve been following more checking account bonuses recently – a new world indeed.