Also see:

My Citi Prestige card’s $450 annual fee recently posted. I will happily keep it for another year (if only to have Admirals Club access through the end of July 2017).

I’ve dutifully tracked the value I’ve gotten on the Citi Prestige by the Numbers page. But I want to dig into the numbers a little more.

Sorry for the selfie, but I needed a pic for this post

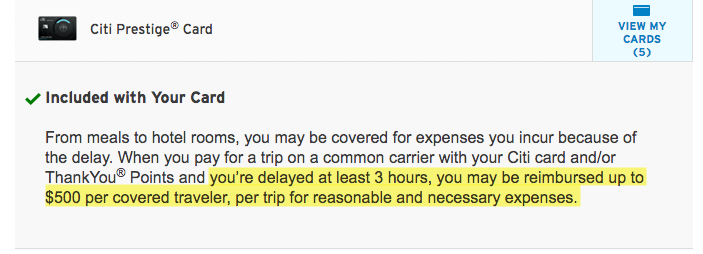

I also got an retention offer to earn 7X Citi ThankYou points on $8,750 in spending on airfare, hotels, and travel agencies – which is fine because I book ALL my airfare on this card to take advantage of its industry-leading trip delay and cancelation insurance that kicks in after only THREE hours (better than Chase Sapphire Reserve and any personal Amex card).

Year One by the numbers

- Link: Apply for Card Offers

Here’s a breakdown of the savings I got last year with Citi Prestige (November 2015 to November 2016):

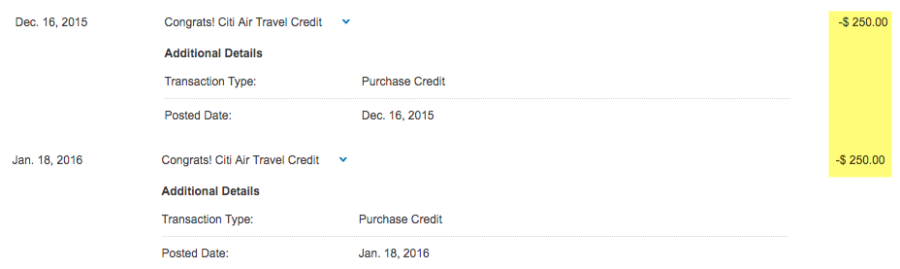

- November 15 – $250 airline credit for flights on Norwegian to Martinique

- November 18 – $244 saved with 4th night free benefit on a hotel in Martinique

- December 10 – $116 saved with 4th night free benefit at the Alexandra DoubleTree in Barcy

- December 16 – $450 annual fee charged (amount subtracted from total)

- December 17 – $250 airline credit for flights to Dallas

- December 18 – $800 from 50,000 Citi ThankYou points (worth 1.6 cents each on American Airlines) for meeting minimum spending requirement and earning sign-up bonus

- January 18 – $100 on admission for 2 to Sala VIP Miro lounge @ BCN

- January 20- $160 from 10,000 Citi ThankYou points for finding an error on ThankYou.com

- February 6 – $70 on admission for 2 to Air France Lounge @ JFK (day passes are $35)

- March 6 – $100 on admission to Admirals Club 2X at LGA and DFW (day passes are $50)

- May 2 – $490 saved with 4th night free benefit at the Hilton Tokyo

- August 7 – $50 on admission to Admirals Club at DCA (day passes are $50)

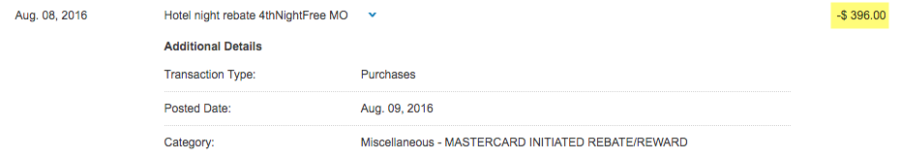

- August 10 – $396 saved with 4th night free benefit at the New York Hilton Midtown

- October 12 – $156 saved with 4th night free benefit at Homewood Suites by Hilton Austin-Arboretum/NW

- November 9 – $269 saved with 4th night free benefit at Hilton Hawaiian Village in Honolulu

- November 9 – $288 saved with 4th night free benefit at Hilton Capital, Washington, DC

Total: $3,289

Let’s analyze

I subtracted the annual fee.

I’m conservative in my estimates.

IMO, all the lounge access shouldn’t be added if I “only” popped in to have a drink. To account for that give and take, I did NOT include every time I accessed a lounge with the card. I included every 3rd or 4th visit, say.

I did stop in to Admirals Club locations during connections, right after landing to grab a drink, or grab a coffee. I figure they all add up.

I used some of the 50,000 point sign-up bonus to book award tickets (like my brother’s trip to Hawaii with Flying Blue and Singapore miles and a Business Class award ticket on Brussels Airlines). I used the base of 1.6 cents per point but definitely got waaay more than that.

And I got $500 in free airfare last year. Between that, the lounge access, and the sign-up bonus, I came out ahead of the $450 annual fee.

Got nearly the whole annual fee rebated from one 4th night free credit

But the biggest value by far was the 4th night free benefit. Wow.

I used it 7 times last year (which also seems conservative). If you only use this perk once or twice a year, the card more than pays for itself, even with the upcoming changes (more on that in a sec).

In fact, I’m about to get another $250 travel credit, which drops my next annual fee to $200.

Note: If you’ve opened or closed another ThankYou card in the past 24 months, you can’t earn a sign-up bonus for this card.

My retention offer

Getting over $3,000 in value (and actually much more) in a year made keeping Citi Prestige for a second year a no-brainer.

But, I called to check on retention offers. You can find the entire list of data points here.

I got:

- 4 additional ThankYou points for travel (hotel, air, car rental, travel agency) up to a max of 35,000 over the next 6 months

35,000/4 = 7X Citi ThankYou points on $8,750 in those categories (as they are already 3X categories).

Prolly my fave Citi Prestige bennie

I have a spate of airfare purchases coming up in 2017, so getting 7X and the card’s fantastic trip insurance seemed like a good deal – not that I was going to cancel it, anyway.

I consider this gravy.

Is Citi Prestige worth keeping another year?

Hell yeah. As mentioned, paying $200 for this card ($450 less the $250 travel credit) is an excellent deal. You can easily recoup that with one pointed use of the 4th night free benefit.

Here’s what’s changing on July 23, 2017:

- 4th night free will turn into a 25% discount (without taxes or fees)

- No more free rounds of golf

- Points will be worth 1.25 cents each toward travel

- NO MORE American Airlines Admirals Club lounge access (this is already gone for new cardmembers)

I’m still going to put on my airfare on this card, and will surely have a 4+-night hotel stay to get more money back. And I’ll use it for Admirals Club access through July.

All of those things are worth $200 to me. At least for another year.

And as for a third year? We’ll have to see how the second goes. But assuming no other major changes or cuts, I don’t see any reason why this card wouldn’t remain a keeper.

Bottom line

It’s pretty incredible that I saved $3,000 with one credit card last year. That being Citi Prestige.

Keep in mind the planned changes won’t kick in until July 23, 2017. So if you pick up the card now, you can get a solid 7 months of the current perks (just not Admirals Club access).

Any way you slice it, you profit the first year with both $250 travel credits

You also get the $250 travel credit twice in the first year (the cycle resets after the close of your December statement). So the first year, you actually profit from the get-go. Not including the 40,000 point sign-up bonus and all the other bennies.

At the moment, I don’t have any paid hotel stays planned (because I am drowning in hotel points and need to burn them). But if/when I do, the charges will go onto this card. And of course, all my upcoming airfare thanks to my retention offer.

Others have gotten even more value from this card their first year. If you have this card, do you think it’s worth keeping despite the upcoming changes? What’s a ballpark range for your savings?

Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I value my club acces at $15 per entry. I would never pay $50 to enter a club. I got about $150 in club access value at my personal valuation. plus about $1000 in fourth night free savings and the $250 travel credits. The card is a no brainer

It’s all about the value you assign to it, absolutely agreed! Sounds like you did well and came out ahead, too – congrats on that!

This was my favorite card for a long time. It’s still near the top. Definitely a no-brainer and hope Citi doesn’t mess with the rewards or benefits for a while.

Thank you for sharing!

How come you didn’t mention the Priority Pass benefit from the Prestige? That would’ve allowed you and a guest free access to the Air France lounge at JFK.

Only because I have like 3 Priority Passes lol.

I did use Priority Pass at the Air France lounge. It’s a great benefit at some domestic airports – but it really shines if you travel internationally a lot. Definitely a good perk to have (especially if you don’t get it through another card you might already have)!

LOL…gotcha…I agree. It definitely made our time at HKG, MNL, and TPE much better, getting a quick bite and not dealing with the masses.

Absolutely. I used it a lot in South America and a few times in Europe (and at JFK, obviously). Especially good to unwind if you’re flying coach. Makes it all a little more tolerable.

The vast majority of my hotel stays are (1) Paid by my company, and they have a strict policy against using personal cards for Corporate travel or (2) I find ways to cover with points (SPG, CSR, etc). Generally the only way I would ever pay a cash rate would be the occasional mattress-run scenario to qualify for a promotion or something.

So saving $400 on a 4th night (that tells me the total cost was $400 x 3 = $1200 for 4 nights) is so far outside even an aspirational reality for me I can’t even wrap my mind around it. I actually don’t think I’ve paid a nightly cash rate over $150 (pre-tax)…ever?

I don’t say that to poo-poo your post. Rather, I’m acknowledging that there is so much enthusiasm for this card in the travel hacking community I feel like I’m missing something. Is there a deeper value here or leveraging of this 4th night free that I’m missing? I feel like this is one of those cards that is going to go away in 3 or 4 years and I’ll be kicking myself for never biting on it, but I keep getting tripped up on how I would actually leverage some of these amazing benefits. Is there something I’m missing, or do I just not have the right travel profile to really leverage it the way many others are able to?

Thank you for the thoughtful reply.

The thought of paying $1,200 for 4 nights wasn’t palatable for me, either. I found an award on AA First Class DFW-NRT right before they devalued their award chart. And no hotels were available on points (this was during the height of cherry blossom season). Even Airbnb was expensive. But I really really wanted to go.

I split the cost, so it ended up being $150 per person per night. Still a lot, but it was my only expense other than food and train tickets – taxes on AA were very low. And I got free nights at an IHG in Osaka. So that’s how I thought of it.

It doesn’t happen a lot. But over the course of a year…

Even at $150 a night (as opposed to $400 a night), you can do well if you use the 4th night free even once or twice. The card, as it currently stands, is most useful for peeps with any type of paid hotel stays.

If you’re focusing on points or can’t use the card to pay, all you’re really missing is the travel insurance, which isn’t a big deal.

The other value from this card comes when you can find a 3rd night free promotion. Because then you end up with the 3rd AND 4th night free when it’s all said and done.

It sounds like you’ve considered your travel goals, which is important. With a net $200 annual fee ($450 minus the $250 travel credit), if you’ll use the 4th night free once or twice to cover it, you come out ahead. The rest (points, insurance, Priority Pass, Price Rewind) is all gravy.

But if you won’t use it, best to skip. The biggest reason I keep it is for those opportunities that pop up during a years’ time. And by tracking it, I realized I was using it a lot more than anticipated.

(FWIW, my employer lets me book hotels with a personal card, and that did contribute to some of the credits. But they were mostly from my own personal use.)

Hope that gives you some guidance. Thanks again for adding your thoughts!

Thanks so much for your perspective – that really helps a lot. I’ve read about the third night free promos and that almost made me bite, but I’m still holding off for now. 🙂

I am moving to the American Express Platinum card since they have access to the Delta lounges, priority clubs, and the Centurion Clubs.

I am very happy that the Prestige card did not lower their annual fee and took a majority of the benefits away, especially the American Airlines lounges. If anything, they could of at least provided 4 complimentary visits to the lounges yearly. Citibank told me to apply for the American Airlines executive card instead. This card is not worth $450.00 per year.

It no longer pays to keep any of these premium cards any longer as their is no loyalty. The best thing to do is yearly apply for a new card, get a bonus offer, keep the card a year, and find another one the year after.

I am moving to the American Express Platinum card since they have access to the Delta lounges, priority clubs, and the Centurion Clubs.

I am not happy that the Prestige card did not lower their annual fee and took a majority of the benefits away, especially the American Airlines lounges. If anything, they could of at least provided 4 complimentary visits to the lounges yearly. Citibank told me to apply for the American Airlines executive card instead. This card is not worth $450.00 per year.

It no longer pays to keep any of these premium cards any longer as their is no loyalty. The best thing to do is yearly apply for a new card, get a bonus offer, keep the card a year, and find another one the year after.

Reply

I hear ya. I’m only keeping the card because of the 4th night free benefit right now. If that ceases to be meaningful, I will probably let the card go too.

I don’t visit Delta lounges often but I do go to the Centurion lounges whenever I get a chance.

Oh another note, I do think Citi REALLY ought to rethink the changes they’re planning for the Prestige card in July. I suspect lots of peeps will cancel after they go into effect. I certainly am keeping that option open.

Thank you for sharing your ideas and strategy!