Also see:

- I rented an Apartment to Airbnb in NYC

- Airbnb First Month By the Numbers

- How I Made an Extra $60K from Airbnb in 2015

Back in 2014, when I rented my first Airbnb apartment, I felt like I was doing something crazy. Then, in 2015, I made an extra $60,000 from Airbnb rentals – after taxes and expenses.

I love my new Dallas Airbnbs!

Mike from Upgrd playfully calls me a slumlord. My Airbnb posts tend to get a LOT of polarity in the comments; I’ve addressed my moral and ethical position in this post.

I get a lot of questions about why I do it and how it’s going. So here goes.

Why I still love Airbnb

THE PERNTS! DUH!

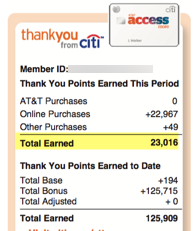

I dutifully pay my rents each month via Plastiq with my Citi AT&T Access More card (no longer available AFAIK).

I also pay my mortgage, my student loans, and any other bill that pops up.

Pernts, pernts, pernts!

Quite simply, I run ~$10,000 per month through Plastiq – and get to write off both the rents and the fees – thanks to my side hustle.

In fact, I think opening a small business or side hustle is one of the best ways to accrue extra points & miles.

As it stand, that $10K earns me an extra 30,000 Citi ThankYou points per month AKA 360,000 points per year. That’s how I’m able to fly my family to Hawaii for a vacation next month. And book cool trips to Europe.

Is my motivation purely the points? Well, no. The money is nice, too. Let’s get to that.

The situation

I must admit, things have slowed down a lot for me and Airbnb in 2016. Why?

I axed one apartment, and have another on the chopping block next month. Both of those were/are in New York.

I will keep one apartment in New York until early 2017. And now I have 2 (soon to be 3) in Dallas. So, a lot of juggling.

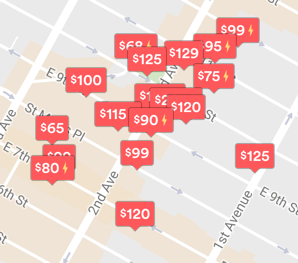

This is a 5-block stretch in Manhattan. Oversaturation has driven down margins big time

In New York, the margins shrank. Rents were raised and competition increased, though occupancy stayed the same.

In Dallas, the numbers are smaller, but I have good margins: the rents are cheap, and I can charge enough to more than cover the cost. So the issue then becomes scalability – which I’m still exploring.

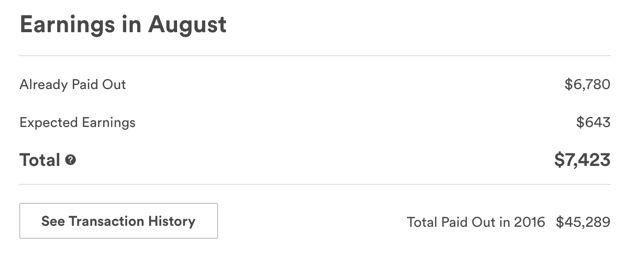

So far in 2016, I’ve only made a little over $11,000 up to this point in August.

This time last year, I was well over $30,000. Just to show you how much it’s slowed down.

And yes, that’s after taxes – I put 20% aside for quarterly tax payments.

Why the slowdown?

My rent in New York on my main unit increased from $2,300 per month to $2,875 a month. That’s almost an extra $7,000 a year!

On another unit (a 2BR), it went from $3,200 to $3,500. I split that one with a business partner, so my share went up $1,800 a year.

Yup, these numbers are low

Also, the 2 Dallas locations are brand new, so they’re still in a growth phase where I’m building up reviews.

The rent increases along bring my $60,000 down to $50,00 right off the bat.

Also, I’ll miss some of Q3 and all of Q4 at the one I’m losing next month – that was an extremely lucrative time last year.

Finally, the year isn’t over. I still have 4 months coming up in Dallas – which is the high season here. So I am hoping for a big finish.

I think I can get to $25,000 this year. And maybe even $30,000.

But it’s no 2015. The margins have, it seems, halved.

Is it worth it?

Absolutely. I am mostly hands-off at this point.

I have a crew in New York looking after the places. And now I have a service here in Dallas set up. Plus, I’m around if anything happens.

I’m sunsetting my NYC locations by early 2017

All I do is accept the requests, send check-in info, and arrange the cleanings once per month. It is extremely low-pressure.

Say I get to that $30,000 mark. That’s $30,000 of low-stress side money after taxes in exchange for doing not that much work.

Plus, as mentioned, I get to sit back and collect 360,000 Citi ThankYou points a year for my efforts. That’s worth $5,760 in American Airlines flights (through July 23, 2017, with my Citi Prestige card).

I’m conservative

Just want to quickly note that in my 2015 post, I was extremely conservative in my projections. I estimated ~$31K but netted $60K.

And, I noted at the end I did not expect that level to continue.

So I guess we still have a few more months to see what shakes out. (OMG, I said I’d quickly note something and actually noted it quickly!)

Bottom line

I’m not optimistic about the future of Airbnb in New York – financially or otherwise. So much so that I am pulling out completely by early 2017.

I am optimistic for them in Dallas, though. I’m going to try to open one more and see how it goes with my new hands-off stance.

I’ve only been in the market here for 2 months, and I started in the heat of the summer (the slow season), so I don’t have a basis for future numbers at this point.

As it stands, my pure profit from Airbnb seems to’ve decreased this year. But there’s so much skewing the numbers right now I can’t say for sure how 2015 stacks up to 2016.

(But, this is the bottom line, right, so I should bottom line it.)

I’m much, much more hands-off this year than I was in 2015. And I had more units in 2015. But, an extra $30,000 for 2016 is nothing to sniff at. For the amount of work I do, which is little, I’ll take it.

Plus, I have hope for a big upswing in Dallas the next few months. There seems to be interest, so I’ll be sure to post a full 2016 update with more in-depth numbers once the dust settles. 🙂

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Thanks for this post – we’re airbnb hosts too, however for a not-so-touristy city (Jacksonville, FL) so we’re not racking in as much income, but it helps pay for our mortgage (but not all of it though) – We love AirBnB and it’s a great way to earn a bit of side hustle income!

Absolutely! And if it helps with the mortgage, even better! Free extra payments! 🙂

Thanks for the update, I was curious to see if you started doing this in Dallas as well.

I started looking into this for Denver lately, but recently they passes an ordinance that bans AirBnB type sub-rentals, and it only allows them for units that are the primary residence. So I could only put my own unit that I live in up for AirBnB. There goes that idea…

It’s going great so far in Dallas. And I think it’ll continue to improve.

Too bad about Denver – that’s how New York is leaning these days too. Good thing there are other side hustles out in the world! 😉

Denver is becoming more and more business unfriendly. My wife has family in TX and I’ve even considered a move to the Dallas/Ft Worth area, but we’re spoiled for weather here and I don’t know if I’ll be able to leave this behind. I grew up in Florida and suffered for 20+ years before I got out.

are you leasing apartments and then renting out through AirBnB? Or you buy them and then rent them out?

Leasing

Harlan, I’ve enjoyed the posts about your Airbnb experiences. I’m wondering… how did you get into the Airbnb realm in the first place, and what did you read or take courses on that helped you understand what marks a good vs. bad investment property? Finally, what would you say is your average length of stay?

I worked in real estate in New York lol.

No courses other than simple division and expected occupancy rates…

You set your own average, so it can be whatever you want it to be. Mine is between 3 and 14 days. Usually 4 or 5.

“and arrange the cleanings once per month” ugh… nasty! shouldn’t you clean after every checkout?!?!!?!?

Lol, they are cleaned after every checkout. What I meant was I sit down and schedule them all once per month. :p