I wrote earlier about my wishes for the Citi ThankYou program and increasing fascination with Citi.

Today, I had some sort of psychic break and picked up the Citi AT&T Access More card.

I applied for it instead of the Citi ThankYou Premier card. Based on my current spending habits, and the fact that I already have Citi Prestige, the Citi ThankYou Premier seemed redundant.

Except for its broad 3X category for all travel including gas. But then I thought, you know, no.

Before I go all-in with Citi ThankYou, I wanna see what’s next. I can pick up that card up any time. And use my Chase Sapphire Preferred (or some other card) for gas/other travel.

And then, thinking more on the Citi AT&T Access More card, I thought about why it could be better. Including for paying rent at RadPad, a topic I’ve mined frequently.

About the Citi AT&T Access More card

- Link: Citi AT&T Access More card

- Link: RadPad rent payment

When you sign-up for the Citi AT&T Access More card and spend $2,000 on purchases in the first 3 months of account opening (the minimum spending requirement), you get:

- $650 toward a new AT&T phone, if you activate and maintain service with AT&T for 15 days

- 3X Citi ThankYou points for every $1 you spend on purchases made online at retail and travel websites – this is key!!!

- 3X Citi ThankYou points for every $1 you spend on products and services purchased directly from AT&T (meh, maybe good for your phone bill, assuming you don’t have a Chase Ink card)

- 10,000 anniversary bonus points after you spend $10,000 in the prior cardmembership year – this offsets the $95 annual fee which is not waived the 1st year

OK, let’s peel this out a little more.

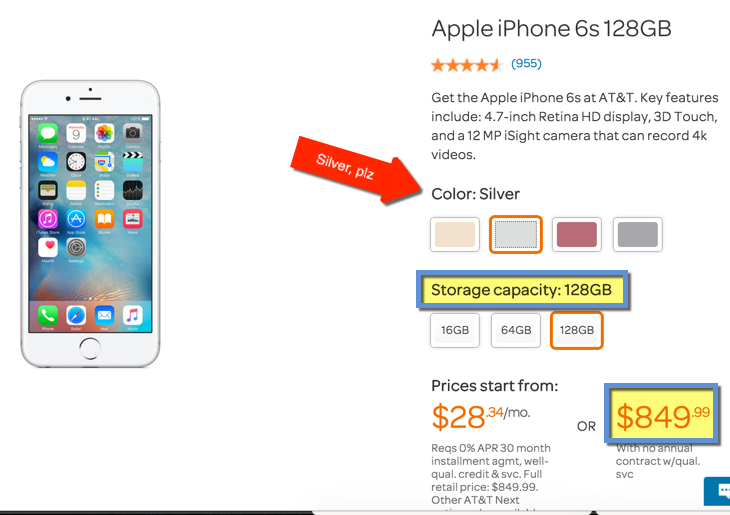

First things first, looks like I’ll be getting a new phone in a few weeks. I don’t need a new one, but eff it. I’ll get an iPhone 6S and spring for the 128GB version because I am sick of running out of space on my current iPhone 5. I’m always deleting apps and pics to make room for updates.

It was that or 50,000 Citi ThankYou points, worth $800 on American Airlines flights (with Citi Prestige). Or $625 in the Citi Travel Center (with Citi ThankYou Premier).

The bonus on the Citi AT&T Access More card is worth $650 (the amount of the credit) – no more, no less. I figure I can sell my iPhone 5 on eBay or something for a little more. Say it sells for $100. That’s net $750. Comparable to the bonus on the Citi ThankYou Premier.

I’m a current AT&T customer, so there’s no additional phone plan to consider.

For me, the real gem is that 3X category – online retail and travel purchases.

And, according to a commenter at Doctor of Credit, RadPad is eligible for the 3X category.

I can’t yet personally confirm this works. But because purchases on RadPad are treated like any other online purchase (as a signature transaction), I see no reason why it wouldn’t.

Assuming it all works out, this could be a great way to lazily manufacture some spend – and even come out ahead.

By the numbers

My numbers assume you have either the Citi Prestige or Citi ThankYou Premier. Having 1 of these is the key to unlocking value with the Citi AT&T Access More.

I’m partial to Citi Prestige personally, especially if you like to travel. Read my experience getting the card and see how much I’ve saved so far. Apply for it using my links.

(If you want Citi ThankYou Premier, I’d pick it up sooner rather than later, as the bonus might decrease in late January 2016. It’s available via my links, too.)

Assuming your rent is $1,000 a month, here’s the breakdown.

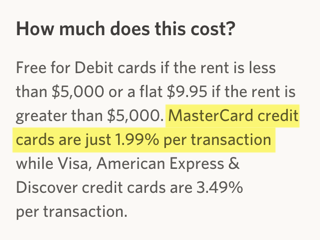

- RadPad charges 1.99% for MasterCard payments. (Citi AT&T Access More is a MasterCard.)

- Pay $1,000 in rent, and $19.99 in fees.

- Earn 3,060 Citi ThankYou points

3,060 Citi ThankYou points is worth:

- $30.60 in cash (1% back)

- ~$49 toward American Airlines flights (~3% back with Citi Prestige)

- ~$41 toward flights on other airlines (2% back with Citi Prestige)

- ~$38 toward travel in Citi Travel Center (1.76% back with Citi ThankYou Premier)

- ~$61 if transferred to travel partners and redeemed at a rate of at least 2 cents per point (with Citi Prestige or Citi ThankYou Premier)

So you are paying ~$20 for at least ~$30 in value. You get at least $10+ in profit per $1,000 in rent.

Peeps who fly American Airlines and have Citi Prestige do better, because it’s like paying $20 for nearly $50 in flights.

And assuming you redeem them for 2 cents each, you triple your outlay ($20 fee turns into ~$61, with ~$41 in profit).

Over the course of a year, you’d pay ~$240 in RadPad fees. And you’d earn 36,720 Citi ThankYou points, worth at a minimum ~$367. Or ~$588 on American Airlines flights. Either way, you come out ahead.

Of course, this can scale up or down depending on how much you pay in rent each month.

And don’t forget the extra 10,000 Citi ThankYou points you’ll earn when you spend at least $10,000. For me, that offsets the annual fee of $95. But it’s worth $160 toward American Airlines flights because I have Citi Prestige too, so I’ll still come out ahead $60 in that scenario.

Other stuff

Also, RadPad aside, you earn 3X Citi ThankYou points for online shopping and travel. That includes:

- Amazon.com

- Costco.com

- Apple.com

- Walmart.com

- Target.com

- Expedia.com

- Any other website where you won’t earn a category bonus with another card

Don’t forget to click through a shopping portal, for the love of god. With so much online shopping, check Cashback Monitor to earn even more points, miles, or cashback.

So this could be a nice little gravy machine when combined with Citi Prestige because it’s essentially 5% cashback toward American Airlines flights (3X Citi ThankYou points x 1.6 cents each = 4.8 cents).

Bottom line

I’m excited to get a new Apple iPhone with my new Citi AT&T Access More card. (I’m not looking forward to the setup and activation process.)

But once it’s said and done, I anticipate the new card will be a great way to earn extra Citi ThankYou points.

And a decent option for earning close to 3% cashback in pure profit (4.8 – 1.99 = 2.81%) when you pay rent with RadPad and apply Citi ThankYou points toward the purchase of American Airlines flights when you also have Citi Prestige.

Or even just 1% back from your rent assuming you straight up cash it out and don’t have Citi Prestige or Citi ThankYou Premier to pair it with.

The card has a $95 annual fee that I don’t mind paying because I’ll easily spend $10,000 and earn 10,000 Citi ThankYou points. So it’s more than offset.

The 3X category for online spending is all bonus.

I shop online for most things, and usually get 1 point or mile per $1 spent. Or 2% cash back with the Fidelity AMEX. But this’ll pair nicely with Citi Prestige and bolster both firmly into my wallet.

And if you want to pick up the Citi Prestige or Citi ThankYou Premier, thank you for using my links to apply.

So what do you guys think?

Have I finally lost my mind? Or is this crazy enough to actually work?

If you have the Citi AT&T Access More card, I’d love to hear your opinions.

And when I can confirm RadPad earns 3X Citi ThankYou points, I will be sure to update.

Also see:

- How to pay bills with PayPal My Cash + Business Debit Card + RadPad + Evolve Money

- Get an Easy 1% Cash Back on Your Rent and Other Debit Card Purchases

Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Good post Harlan, I thought you bought a house in Dallas so why are you still throwing your money away renting?

Also for people with mortgages can one spouse setup a radpad account and act like they are paying rent to the other person or does Radpad charge a fee to the “landord” too?

I still pay rent for my Airbnbs, so RadPad has been a lifesaver for me! And I’m still keeping my NY apartment through the summer before I let it go forever. :/

Mortgages are on my mind now. The next thing on my list is to figure out how to pay it with a credit card!

Technically Access More card is supposed to give 3x only for online retail purchases, which does not include Radpad. But let’s see… Keep us informed.

Absolutely will do!

AT&T is on my list of ultra-evil corporations, so no…

LOL, I feel you. I’m on a family plan I’ve had forever and it just works. I’ll consider Google’s Project Fi when they support phones besides the Nexus. And I’ve even looked into T-Mobile for their international plans.

I see AT&T, for the purposes of this card, as a middleman for the Apple iPhone – nothing more.

After you purchase the phone from them, you can unlock it and use it on another carrier.

And then use the card for the 3X online shopping category. That way your experience with AT&T itself is brief, limited, and then over.

I just used your link to apply this citi card, and I was provided with a ID number and asked me to call citi, which I did right away. They put me on hold and told me that they had to turn my application for other department to review, and I would be notified in about 7 days. I just applied the citi Thankyou card last week. I had to call in to get an approval, and the Thankyou card is on the way to my home. Is it because I just received one citi card and they cannot approve me another one?

Thank you for using my link!

Citi has certain application rules they follow: only 1 card application per day, at least 8 days between applications, and no more than 2 applications within 65 days.

So if you got the Citi TY Premier last week, they might make you wait until 8 days after the date you applied to get a new Citi AT&T Access More card. If you got the other card last week, you might have to wait a few more days to get the new one. But they should be able to push it through after the 8-day mark.

Hope that helps!

Thank you for the help!

You are very welcome!

HI – do you know if I could get the card now, and then use the phone credit later this year in September when the iPhone 7 comes out?

I thought of that too, but didn’t wanna wait 8 or 9 months. The T&Cs don’t specify a time limit to earn the credit. And Citi specifically says you can get the phone later.

Lots of folks still have 2 year contracts and need an incentive to get this card.

As long as you keep it open/in good standing, you should be good for a credit on the iPhone 7 in September.

How do you get 1cpp on cash back redemptions for Citi TYPs? I was under the impression cash back was only 0.5cpp. Unless you are using the mortgage/student loan check method?

Yes, exactly. Although I’d never recommend redeeming that way. AA flights and transfer partners only!

Great post! Sorry, can you explain this:

“It was that [getting the iPhone] or 50,000 Citi ThankYou points, worth $800 on American Airlines flights (with Citi Prestige). Or $625 in the Citi Travel Center (with Citi ThankYou Premier).”

How would you get 50K TYP with this card instead of the $650 iPhone credit?

Ah, yes!

At that point, I was comparing the sign-up bonuses on the Citi AT&T Access More card vs the Citi ThankYou Premier card.

I have Citi Prestige already, so I was considering both cards to pair with Citi Prestige.

Citi AT&T Access More has the $650 phone as a sign-up bonus. And Citi ThankYou Premier has 50,000 Citi ThankYou points as a sign-up bonus.

So I was weighing the pros and cons of each, as they relate to pairing with Citi Prestige.

I’m so glad you asked that question to clear things up! Hope that made sense.

Got it, makes perfect sense, and thanks for your quick response!

You’re very welcome, any time!