All sorts of cards are getting my attention with my impending sub-5/24 status looming near.

High on the list: the Wells Fargo Propel Amex. This card has:

- A sign-up bonus of 20,000 bonus points (worth $200 in cash back, travel, gift cards, or other rewards) after completing minimum spending requirements

- Really good 3X bonus categories

- NO annual fee

- Up to $600 in cell phone insurance when you pay your wireless bill with the card

While I usually prefer cards that earn points toward award travel, there’s a lot going for this cashback card – especially considering it’s free to keep long-term. It’s a strong card for active lifestyles, and for peeps who don’t want to pay an annual fee.

Eat out, order in, travel, unwind… the Wells Fargo Propel Amex earns 3% cashback in some of the best bonus categories and has NO annual fee

Let’s take stock!

Wells Fargo Propel Amex review – A hidden gem with no annual fee

- Wells Fargo Propel Amex

Most cards I use earn miles or points for award flights or hotel stays. But when I slip below 5/24 in July, I can get a card just because it has a decent sign-up bonus. Like the old daze!

With the Wells Fargo Propel Amex, you’ll earn 20,000 bonus points (worth $200 in cash back, travel, gift cards, or other GoFar rewards) after spending $1,000 on purchases within the first 3 months of card opening.

$200 in rewards is a decent offer for a card with NO annual fee. While that’s reason enough, let’s talk about those bonus categories.

Color me very impressed with the 3X opportunities

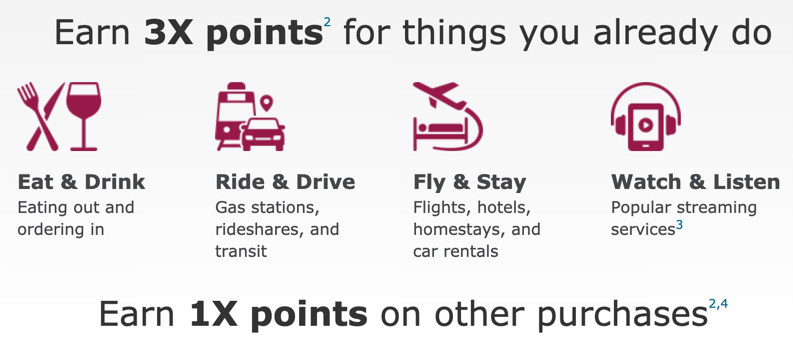

You’ll earn 3 points per $1 spent on:

- Eating out and ordering in (so restaurants and delivery services)

- Gas stations, rideshares (like Uber and Lyft), and transit/commuting passes ⛽️🚘🚉

- Most travel, including flights, hotels, homestays (like Airbnb), and car rentals

- Eligible streaming services, like Apple Music, Spotify, Hulu, and Netflix 🎶🎬

And 1 point per $1 spent everywhere else.

The lifestyle-focused 3X categories include streaming services, dining, travel, and transit

That’s awesome! If you travel, spend a lot on gas, eat out often, commute, or subscribe to streaming music and movie services, you can do well with this card.

I like how it’s tailored for an active lifestyle, but also rewards relaxation, like ordering takeout or watching movies at home.

Other bennies

When you use the card to pay your monthly cell phone bill, you’re covered against damage or theft with up to $1,200 in cell phone insurance per 12-month period (with a maximum of $600 per claim, subject to a $25 deductible).

You’ll also get:

- Purchase & return protection

- Extended warranty

- Lost or damaged baggage insurance

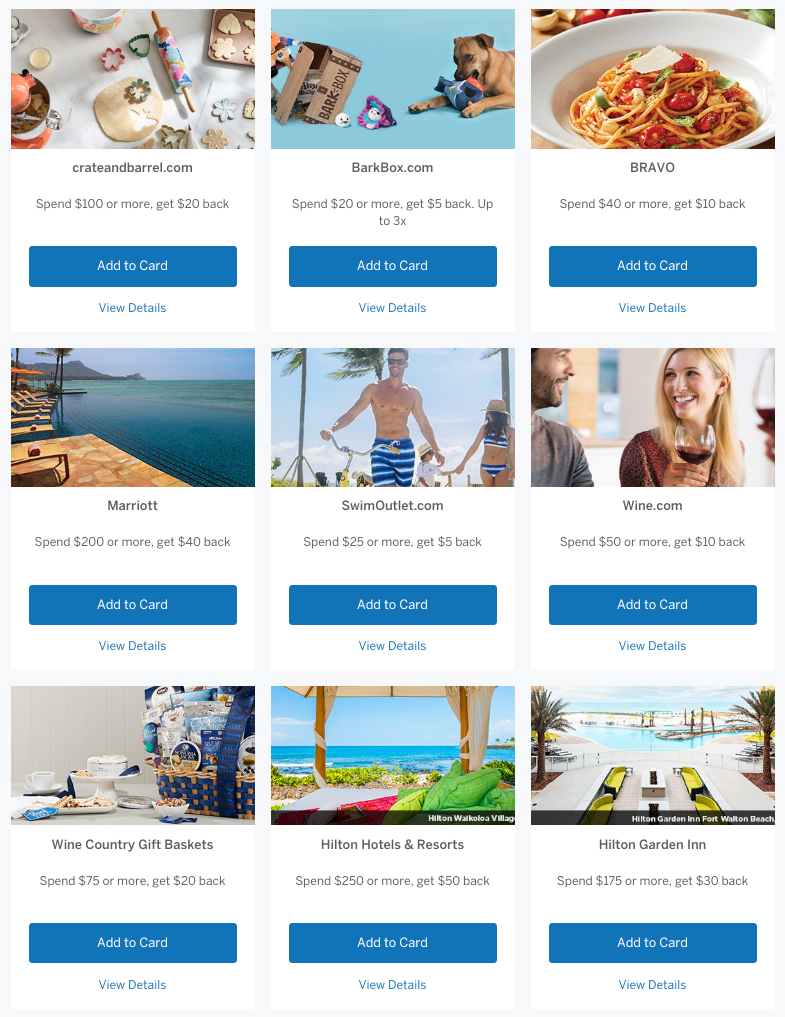

- Wells Fargo Propel Amex Offers and presale access (some of the offers are actually worthwhile)

There are also NO foreign transaction fees, which is great for a card with no annual fee.

Keep in mind when you use this card to pay for car rentals, the insurance coverage provided is secondary and only available for rentals in North America. So I’d recommend using a card with primary insurance instead, especially when renting a car overseas.

Still, I’m impressed with the bounty of bennies – and cashback earnings – you get with this card.

How does the Uber Visa compare?

Inevitably, someone will say the Uber Visa is the better pick because it earns:

- 5% back on Uber and Uber Eats

- 3% back on airfare, hotels, dining, and homestays (same as Wells Fargo Propel Amex)

- 1% back on everything else

Basically the same, but with a bigger category for Uber (duh)

You’ll also get a $100 sign-up bonus when you spend $500 on purchases in the first 90 days.

It also has no forex fees, and $600 in cell phone insurance – just like the Wells Fargo Propel Amex. And it’s a Visa card, which is more accepted than Amex card.

So which is better?

TBH, they’re basically the same but with one big difference: the rewards you earn with the Uber card are to be used for Uber rides. The rewards you earn with the Wells Fargo Propel Amex are cash rewards. If you’re a big Uber rider and don’t mind earning what’s essentially a rebate for Uber rides, then the Uber Visa is marginally better.

That said, I’d prolly go with the Propel Amex, which also has a much better sign-up offer, and other benefits are mostly the same or better.

Well Fargo Propel’s Amex Offers are surprisingly useful

So it’s a bit of a wash and will come down to personal preferences… but I’d go for the Wells Fargo Propel Amex over the Uber Visa, if only for the better $300 sign-up offer (versus just $100 with the Uber Visa). All else being equal, I’d recommend most peeps do the same.

Bottom line

- Wells Fargo Propel Amex

The Wells Fargo Propel Amex has everything I look for in a credit card: great welcome offer, excellent bonus spending categories, useful ongoing benefits.

All said, the sign-up bonus is worth $200 after meeting minimum spending requirements, and ancillary perks like cell phone insurance, no forex or annual fees, Amex Offers, and travel/purchase protections make this card worth opening, using, and keeping long-term.

While I’ll stick to my points cards for most purchases, I’ll likely scoop this one up after I’m under 5/24 for an easy $300. This card was recently refreshed, and I gotta say: Wells Fargo did an excellent job with it.

Would you consider getting this card? Why or why not?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Hi Harlan – Good review, thanks. Between your article and a WF mailer sitting on my desk, I’m tempted to apply for the Propel. One question – given that the Propel is a third-party Amex card, would I be able to add an Amex Offer to the Propel through Connect and also add the same Amex Offer to an Amex-issued card? I’m reading a guest article on Doc a few weeks ago where the guest author seems pretty confident that the answer is Yes (in a couple of replies in the Comments section, not in the main article). Not sure if my comment will go through here if I post the link, so you can find the article by date and title if you’re interested: 3/26/2019, AmEx Offer Trick: Add Amex Connect Offers to Your Amex Issued Cards. If the Propel would indeed allow me to “double up” on some good Amex Offers (e.g., I’m seeing several Hilton-family Offers on Connect right now, as well as Marriott, Kimpton, and a few other hotel Offers), that’s big and would really make me want to apply for the Propel. What do you think? Many thanks. ~Craig

It’s a nice lil card! Does the mailer have a bonus for more than $300? Curious.

You can stack Amex Offers between Amex-issued cards and Amex cards issued by other banks. That’s because Amex uses your SSN to track offers across all your cards, whereas with the WF Propel, for example, they wouldn’t get that info from WF – just your name and card number. I just now enrolled the same offer on both types of cards (one from Amex and an Amex card from Citi).

In this case, you should be good to go! Not every Amex Offer is available through Connect, but many are – and when it works, it could be a nice win. And you can def double up.

I say go for it!

Hi Harlan – Great stuff. Thanks for the detailed response. That’s a pretty valuable feature, to be able to double up on the Amex Offers. And no, sadly, the mailer bonus is only for $300. Good question. I know there have been times in the past when higher bonuses have been available. I’m not in a hurry, but I’m putting Propel on my short list of cards to consider when I’m ready for new apps! ~Craig

Schweet! July can’t come fast enough (when I finally dip under 5/24 lol)!

Harlan,

You forgot to mention that you can increase the value of your Wells Fargo points by having a Visa Signature. With a WF Visa Signature you can redeem your points for travel at 1.5x, effectively getting 4.5% back on travel.

Yes, that’s right! Even better! I love how so many cards work better in pairs – that’s a prime example. Thanks for the reminder!

Yes, the Propel Amex can be a great card in combination with their Cash Wise Visa.

An important caveat to keep in mind is that Wells Fargo will not offer you the sign-up bonus if you have opened another card in the previous 15 months. I was able to get in on the Propel World before they pulled it, but was within 15 months of a previous application, so missed out on the sign-up bonus points. Right now I’m purposely waiting until it’s been 15 months from my last application before trying for another WF card.

This incarnation of the Propel Amex basically replaces the Citi Premier card, and Synchrony Marvel MC (3% on streaming), but without the Citi’s annual fee.

The intro offer prior to 12/31/2019 was 30,000 points and has now been reduced to 20,000. Wells Fargo gave no notice that this DOWNGRADE would be occurring. What terrible communication. I applied a few days after the deadline and let them know that I didn’t realize this was happening and they were not willing to retroactively change it. This is the lack of transparency their company has. I have been extremely disappointed with my experience.