Also see:

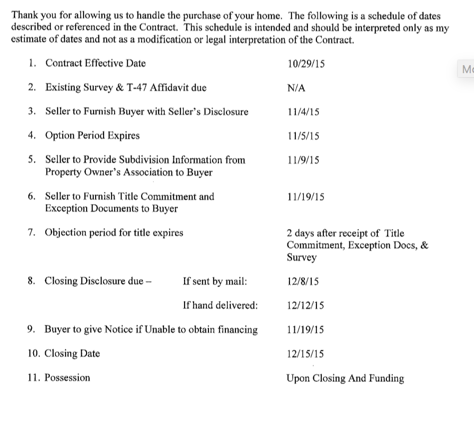

Back in November, I wrote about wanting to close on a house in Dallas. I did, in fact, close on a house in Dallas right on schedule, on December 15th, 2015.

That was almost 3 months ago, but it’s taken me this long to write about it.

A friend of mine said it best. We had lunch when she was scheduled to close on a house a few days later.

“OMG!” I exclaimed. “Are you like, so excited to be closing ?”

“Not really, actually. I’m just sort of… ready for the process to be over.”

I didn’t think much of it at the time because I still was excited to be moving toward a closing.

That is, until I got there.

Hurry up and wait

The process started easily enough.

All through late October and November, I stayed friendly with my closing team. They’d ask me for things every week or so, which, I’d never closed before, felt like they were on top of it.

I get that I was closing between a string of holidays (Thanksgiving, Christmas, New Year), and that December 15th was right in the middle of post-Thanksgiving and pre-Christmas craziness.

I actually told them from the beginning – we can push this to mid-January. I’m not in a hurry.

Oh no, they said. We must close on the earliest possible date, we buy Houston houses and we know that you have to be swift about these things.

Texas has a law that you have to wait 45 days to close. So December 15th was almost 45 days… to the day.

I started out friendly, like I said. Until it got to be December and didn’t feel like… it was actually happening.

And then, it was like everyone woke up. And the shit hit the fan.

The bonanza to actually close

I think I have mild PTSD, which is how my friend must’ve felt when I asked if she was “so excited.” Because near the end, I definitely wasn’t “so excited” about closing either.

Every day, frantic calls. Must have this today. ASAP. This can’t wait! Now now now! #stressy

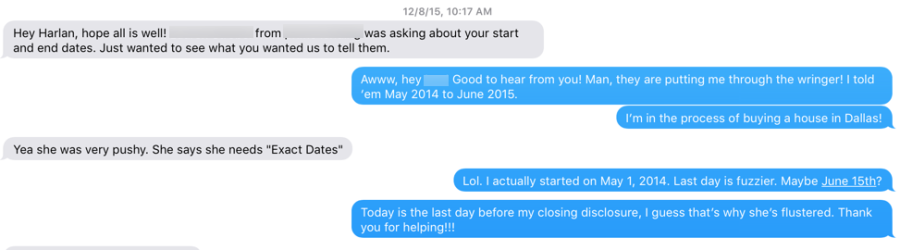

They had me pulling out files from 3 or 4 years ago, reconnecting with old employers for copies of forms.

They called them all, too. My current and former employers. They verified my employment like 20 times. Eventually, I gave them access to the Evernote notebook with all my bank statements from the past 3 years. It was just easier than having to send them in individual emails with frantic requests. (Thank god for FileThis!)

They wanted to know about every deposit. Some of which, I couldn’t even remember.

It got to the point where they had literally every piece of paper I’ve ever signed in my entire life (at least it felt that way).

The hitch

Two weeks from closing, my loan officer told me they’d have to switch my loan to different, more unfavorable, terms.

“You have the choice of Option A or Option B.”

At that point, the friendliness went away.

“Uhhh, how about the loan terms we agreed upon when you wrote my pre-approval letter?”

“Yeah, about that… [blah blah blah.]”

“Actually, I won’t go with either option. If you can’t close it on the terms we agreed on, forget it. I’ll find another company.”

A few hours later, he called me back, breathless. “Great news! My supervisor says we can push it through with the original terms.”

“Good.” Click.

Wrapping it up

The days leading up to December 15th were stressy AF.

They managed to locate forms they “suddenly needed” up till the very end.

Their data managers called me with my student loan company already on the other end. To verify my student loan. That was a surreal experience. What if I’d, like, been in the shower or something?

They called me at all hours, 7am, 9pm, to ask more questions. They demanded to speak to one of my former employers, who was cool with it.

He described them as “very pushy.” When we spoke again, he used more colorful terms.

Then they started combing through my credit history.

And, it was explained to me over and over, but:

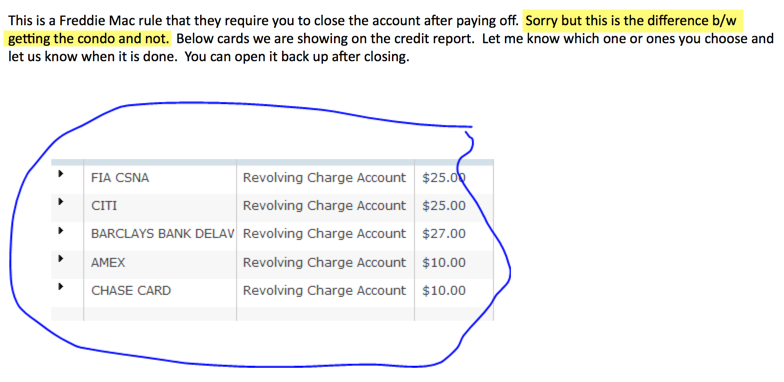

They demanded I close my Barclaycard Aviator Red card.

I really didn’t want to close it. I mean, WHY? It had no balance. It had been that way for… months.

But, they’d isolated THAT card as the one they wanted me to close.

Above is the exact email my loan officer sent me. With “Sorry but this is the difference b/w getting the condo and not.”

Closing that particular Barclaycard was the make-or-break? Really?

You can see my other accounts, the FIA Fidelity AMEX, and a Citi, AMEX, and Chase card. Dunno which ones or why they shows such weird, round amounts. Exactly $10 on two different cards?

I hemmed and hawed and told them this was the LAST thing that I was willing to deal with on a last-minute basis before closing.

They swore up and down that, yes, this was it. Then called Barclaycard to close the card.

“You know once you close it, it’s gone forever, right? You can’t reopen it.”

“Yep, I know. Yes, please close it.”

Then they called me again with Barclaycard on the other end to make sure I’d actually closed it.

At that point, no, I was not excited to be closing. I was just ready for the process to be over.

The closing

I closed in New York. It was too close to Christmas and flights back from Dallas were through the roof.

I met the notary, who was so patient, so thorough. Even with questions and explanations, I was done in 45 minutes.

“So that’s it?”

“The check.”

“Oh, right.” I handed her a cashier’s check made out for the amount of the mortgage, property taxes, fees, fees, and other fees.

She left. The money was transferred. The seller was paid and the loan was funded.

That was it.

Bottom line

I rate my closing experience somewhere between really easy and absolute hell.

It closed on time, smoothly, and for the original terms. It was just every step in between that was like pulling teeth.

I’ll be out of New York between April 30th and May 15th. And from that point forward, living in Dallas. I plan on driving down there – more on that soon.

So what’s next? I’d like to buy another place already. A true investment property.

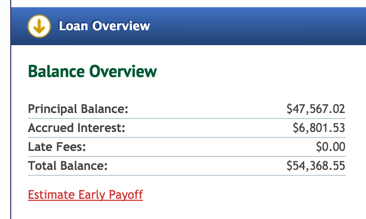

But I’m torn between buying more property and going really damn hard on my student loan.

I still owe about $54K. Which is so stupid. I hate having that hang over me.

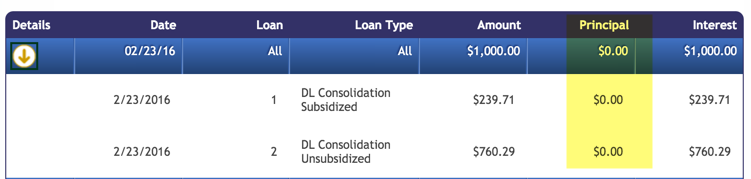

I made a $1,000 payment on it last week. None of it touched the principal.

It felt like throwing a glass of water on a fire. Useless.

It’s baby steps.

I’ve decided to keep two of my Airbnb rentals and sink the profits into a combination of:

- Funding my Solo 401(k)

- Paying down this student loan

- Saving toward another property

- Putting a *little* extra toward my mortgage

It’s all a move toward FIRE. And I’m already looking into new side hustles for when I get down to Dallas.

Just like closing on this house consumed me for a couple of months, now leaving New York is consuming me. There’s SO MUCH to wrap up.

But, here goes nothin’. Dallas, here I come!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Wait a minute, you bought a house when You have almost 7k of past due interest on your student loan or i guess it’s in deferment. Seems pretty stupid to me…

It’s in repayment. Why is it stupid? I need someplace to live, whether I rent or own. Why not own and repay the loan instead of rent? What’s the difference?

If you know something I don’t, feel free to explain a little more!

have you tried refinancing your student loan? I would pay that off asap before working on other part of your finances.

It’s a federal loan. So if I refi with a private company, I’ll lose the repayment plan I’m on, and likely have a similar interest rate anyway. If student loans are the devil, this is definitely the devil I’d choose to keep.

Plus, it’ll be forgiven in 25 years anyway. It’s just a matter of, do I want to deal with it for that long? I’ll see what the market is like down in Dallas, and then decide.

For now, I just want to get into the principal. It’s the interest rate that’s killer!

Mortgage loans are so stupid.

Why would there be a 45 day rule? Why not 44 days or 46?

If you went in to buy a car for the same amount, you’d likely be be driving that car within a day or two, if not the same day. You could drive off in that bad investment never to be seem again. Yet the mortgage companies worry about such minor crap. I hate the process.

Agreed. Apparently it’s a recent law (as of October 2015) in Texas. I assume it’s there to force people to perform their due diligence.

It definitely was a process. I’m just now starting to shake it off!

I’m very curious about the Aviator card. Any idea why they made you close THAT particular card? Seems odd that they would single one out. Why couldn’t it be any of the cards? Did the Aviator have the highest available credit and they were trying to reduce your credit card availability? I’m looking at buying a rental this year so curious.

As far as the student loan debt, look into consolidation if you haven’t already. Other than that, it’s pure numbers when deciding on an investment (in my opinion). If you can manage the payment and make high return on your dollar elsewhere, do that. If the student loan payment is weighing you down, tackle that for awhile.

YES. Choosing to the buy the house VS pay down the student loan first was a matter of pure numbers. I mean, I only put 5% down, so it’s not like I missed a huge opportunity to pay the student loan anyway. And the house has already appreciated nicely, even in the past 3 months!

I have no idea why they picked THAT card. They told me, close the Barclays card ending in XXXX. Close that one.

I guess, like you said, it worked better for all the ratios they were trying to squeeze me into. I spoke with other peeps and they’ve had similar experiences. Except they said paying off the balance (mine had $0 balance anyway) was enough.

So maybe I’m some sort of weird exception?

Re: consolidation. They’re already consolidated and refinanced. I’m happy with the repayment plan I’m on, and the interest rate. Now it’s a matter of, do I pay this off, or keep investing? It’s a dilemma I see a lot, and it’s definitely complex. It’ll depend on if I find a great deal or not.

If I find an excellent deal, they can wait. And if not, sure, I’ll go ahead and knock that out.

Isn’t the financial world just something else? Lol

Much agreed. I’ve been paying down my student loans for many years, probably too long. However at my interest rate, I’ve always had better earning opportunities that outweigh getting the loans paid off.

Good luck on the next property and keep us up to date with FIRE.

Absolutely! And ditto. Sounds like we have similar ways of weighing pros and cons with regard to finances. Not too worried about the student loans – plenty of time to sort those out!

Hey Harlan! We’re in the process of buying a co-op in Manhattan (submitted offer, received counter, blah blah blah) and I’ve opened 5 new accounts in the last 12 months, and about 25 the year before. I’ve been extremely open about my banking with our mortgage lender and they didn’t see it as a negative. They acted somewhere between indifference and mildly impressed.

Before reading your post I was only stressing about the co-op board and passing their interview. Now I’m getting nervous about closing. Were you dealing with a mortgage lender in NY?

Thanks for sharing your experiences and letting me know what I can look forward to in the coming months.

Congrats on your offer!

Like you, I opened a lot of credit cards in the years before applying. And I was open about it. In fact, I even opened a Citi Prestige card in the middle of the closing process. Oops. They grilled me HARD about that one. I told them honestly, “I opened it to get points for my upcoming trip to Barcelona.” They made me write a letter about it and sign it lol. #whatever

My mortgage lender was in Texas. I’ve never dealt with the sharks up here.

Just make sure all of your balances are $0 – and in the 2 months before closing, only use 1 card so there’s no history of a revolving balance. That’s what I did, and they still managed to find something. (I just used Citi Prestige to meet min spend.)

But yeah, keep it clean, stay honest, and let them know you just really like points & miles – emphasize that you aren’t looking for credit, you want the points. As ridiculous as it sounds to them, you’ll most likely get an eyeroll at worst and it’ll get pushed through anyway.

Once you pass the co-op interview, the bank won’t want to lose your mortgage. Remember YOU have the power as a buyer. As much as you want to close, believe me, so do they.

Good luck – I am sure it will work out fine! And again, congrats! 🙂

All bloggers boast about their travel patterns in luxury by staying at five star hotels and flying premium cabins but none of them is consumer debt free. I cannot relate to that life choice. You have legal and financial obligations to pay off student loan, despite the fact it’ll be forgiven in 25 years. Who do you think will pay it on your behalf? Not the lenders. I have no sympathy to most homeowners who lost their houses during the financial meltdown. The government did not bail me out. Student loans will never be discharged under any circumstances. It is not a wise property investment if you cannot afford the monthly operating costs of ownership. You do not own the property or the car until it is free and clear. The lender does.

Thanks for reading! Just to be clear, I am paying off my student loans. And I am affording the monthly cost of home ownership. I’m aware the bank owns it until I repay the loan in full.

One note, though. I don’t think having a student loan is the same as having consumer debt. As in, they are treated much, much differently in the eyes of lenders, and well, everyone else. Apart from my mortgage and student loan, I’m not carrying any credit card balances from month-to-month. Is that what you meant?

Just a few clarifications that might be helpful – my bet is that they were having issues with your available credit to income ratios and so picked a card that had a relatively high credit limit on it for you to close – or at least the card credit limit that would bring your ratios to an acceptable level. Freddie and Fannie DO have stipulations on the maximums that ratio should be so I’m betting that was done to assure that you’d be able to get a conventional mortgage (and thus a conventional rate). Separately, you can thank the CFBP, not Texas, for that 45 day bit — it’s now true nationwide. Unless you’re paying all cash, it’s going to be basically 45 days for everyone from here on out. For what it’s worth, the TRID rule – the new CFPB regulations – were really new at the end of the year and lenders everywhere were struggling to get all the paperwork done and on time. Sounds like you got caught up in the middle of that!

If they’d explained it like that, I would’ve understood it a lot better! The loan officer got caught up on me closing this card, and couldn’t tell me why in a clear way. But close it or lose the deal was pretty clear – although not exactly the way I wanted to hear it. So thank you!

And good to know about that new rule! I… definitely got caught in the middle of that!

Thank you for explaining – it makes things a LOT more clear!

You should have run from any mortgage company that told you to close a credit card. There are plenty of companies out there that will gladly take your business. Unfortunately, a select few view “available credit” as debt.

I also closed on my house in North TX December 15 and at the time had well above $400K in available credit across about 25 cards. If my mortgage company would have asked me to close any of them, I would have run! lol

Agreed. But this was literally 2 days before the scheduled closing. Otherwise, I would’ve done the same.

Ah well, c’est la vie – it’s been done and no going back now. :/