The Oklahoma house is closing on Friday after being on the market only 6 days. I’m thrilled, sad, nervous, etc.

Thrilled to no longer make two housing payments, sad because a ton of bad stuff happened to us in that house, nervous because I don’t want any last-minute surprises, and etc. because.

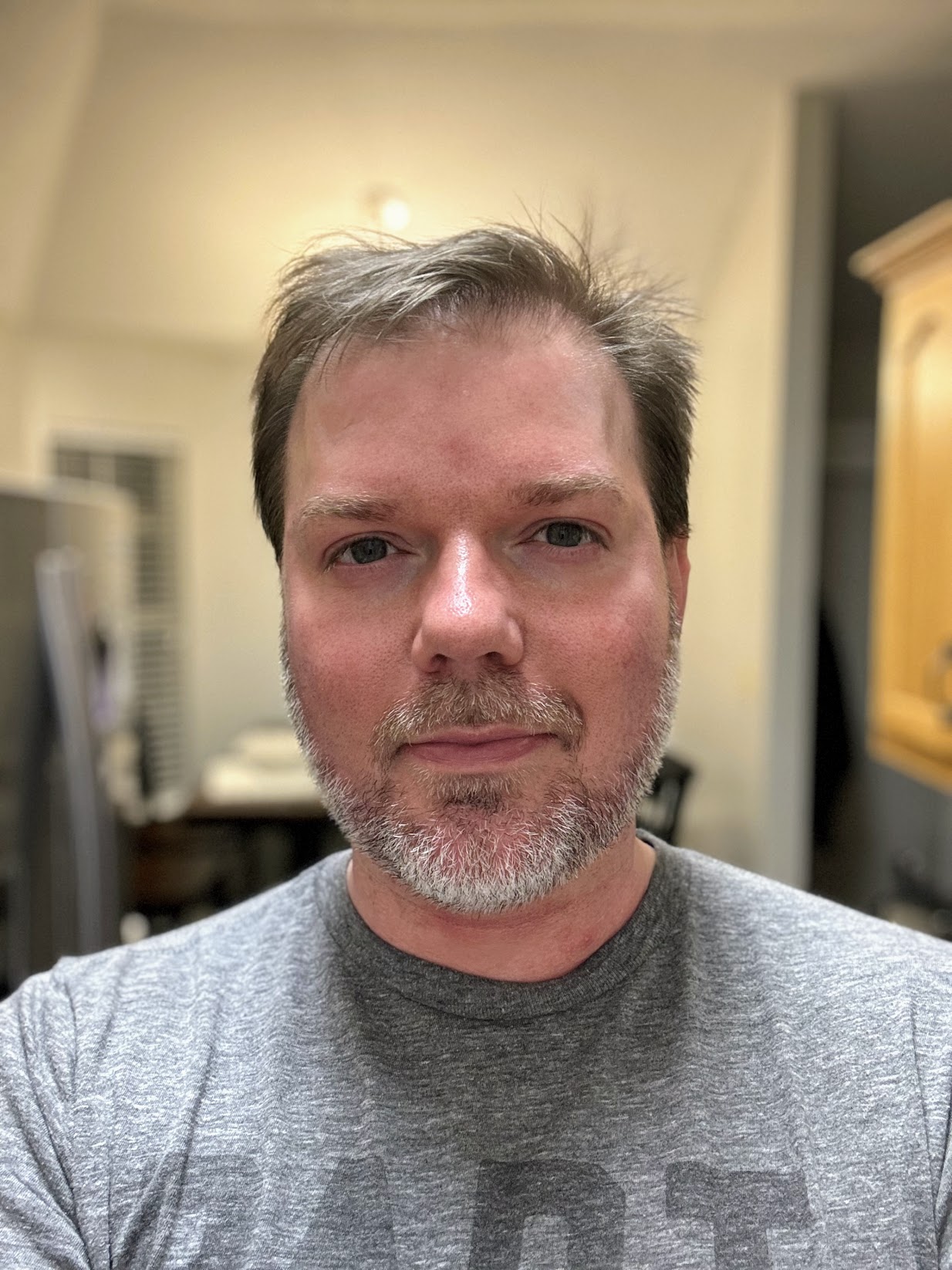

THIS BABY. Three months old

I’ve been using my credit cards to get us through this patch and very much looking forward to paying them off with the money I get from the sale.

But I also discovered a tax lien sale and have a few properties on a watch list. The auctions are in late April. So, I’m going to hold the money for a few weeks and see what I can do there. If nothing, then I’ll eradicate all my credit card balances.

And if so… well, I still have until October with my 0% APR rates. Either way, not too worried and seeing a lot of upside and potential.

One thing is certain: My net worth will see BIG gyrations this month. I am more at peace with it now, yet I remain hopeful.

For one thing, I didn’t factor in the $20,000 it would cost to sell the house…