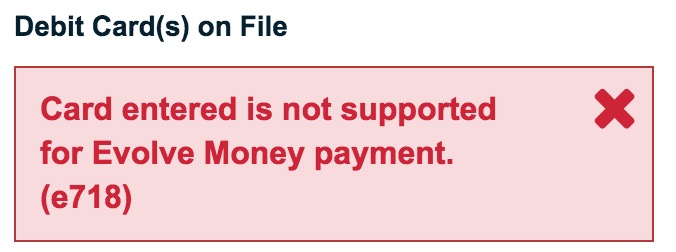

UPDATE 1/26/15: A few readers have reported that their PayPal Business Debit Cards no longer work with Evolve Money. Indeed, when I deleted the card and went to re-add it, I got this error message:

Apparently other users that added the card previous have been grandfathered in, but new users are not able to add the PayPal card as a new payment method. Major bummer. I have updated posted to reflect this. RadPad is still working great though!

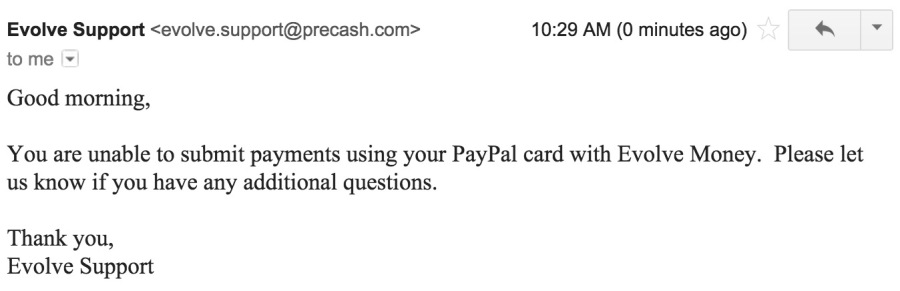

UPDATE 2: Just got this email from Evolve Money:

#deadinthewater

I’m going to dub February “Manufactured Spend Month” for Out and Out.

I still have the intention to make that data point about the REDbird (see link above), and I’ve been eyeballs deep in FT/Milepoint convos about it the past few days. All signs point to: it should work. I’ve been nervous about killing my Serve card only to find that it can’t be loaded in NYC – which is already kind of a barren wasteland for MS to begin with. If the Target in Brooklyn doesn’t let me load REDbird, the next closest Target is in Harlem, which is a bit far for me. But, positive vibes.

With the Serve card, I can reload $1,000 per month from my computer or phone without leaving home. With REDbird, I’d have to make at least two in-store visits per month. But I can reload 5 times more per month. And I won’t have to worry about cash advance fees, which means I am free to use any card I want (although I’ve heard US Bank is beasting about the reloads and flagging them all as fraud.)

With all of this in mind, and with all the other work I have going on, I have decided to make my data point in February and get one more round of loading out of the Serve card before I kill it. Hence February being declared MS Month.

Anyway, aside from REDbird, I started adding up the ingredients for an addendum to the madness. It could be another way to run an additional $4,000 of MS through credit cards and a great way to pay rent, student loans, and everyday bills, or to load Serve or REDbird.

Stop! HT time.

Before I get any further, I have to stop and do some HTs:

- I found out about the PayPal business debit card from Travel With Grant.

- I found out about the PayPal My Cash cards from The Miles Professor (initially in person).

- I found out about RadPad from Doctor of Credit.

Finally, I thought I had coined the term “Perpetual Points Machine” (PPM). No. That would be Frequent Miler, who began using the term as early as 2011. It’s one of those terms that you read once or twice and it just gets stuck in your head. FM has lots and lot of great stuff about manufacturing spend, and I’m not surprised he is original user of this phrase.

PayPal My Cash Cards

To begin, you need a PayPal account to begin with any of this (duh). Furthermore, you need a Premier or Business PayPal account to get the business debit card (more on that in a sec).

You can load these cards up to $500 bucks. It’s just like Vanilla Reloads in nearly every regard. Same fee to purchase, you load ’em up, then liquidate the cash. You can get them at CVS and Rite Aid and… I think I saw one at Duane Reade here in Brooklyn last night. I think.

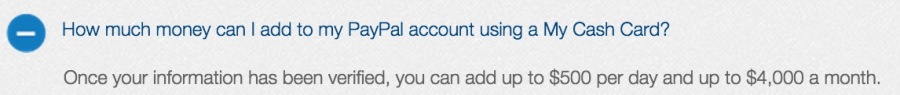

PayPal has limits on these cards to load accounts: $500 a day and $4,000 per rolling 30-day period. NOT calendar month. Update 1/20: It is now based on calendar month NOT a rolling 30 days. Easier to manage, IMO.

There is a $3.95 activation fee per card. Here is a link to the FAQs just in case I missed anything pertinent.

When you unload the My Cash card, it goes directly toward your PayPal balance.

OK, on to the next step.

PayPal Business Debit MasterCard

You gotta make sure it’s the business debit card, not the regular one.

To be eligible, you must have a Premier or Business PayPal account. I guess I had a Premier account and didn’t even know it. You can upgrade your account my exploring the “My Account” options near the bottom of the page. The fees are the same regardless of what kind of account you have, so you might as well go for it.

Here is the link to the debit card you want.

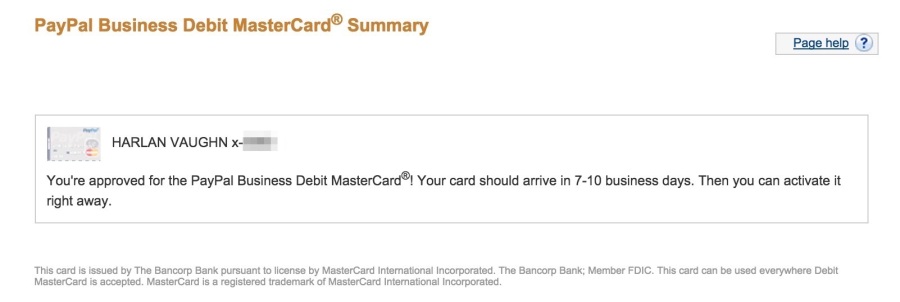

Signing up was super simple. I logged into PayPal, entered in my SSN, and pressed submit. BAM!

It spit out an approval and account number in under 2 seconds.

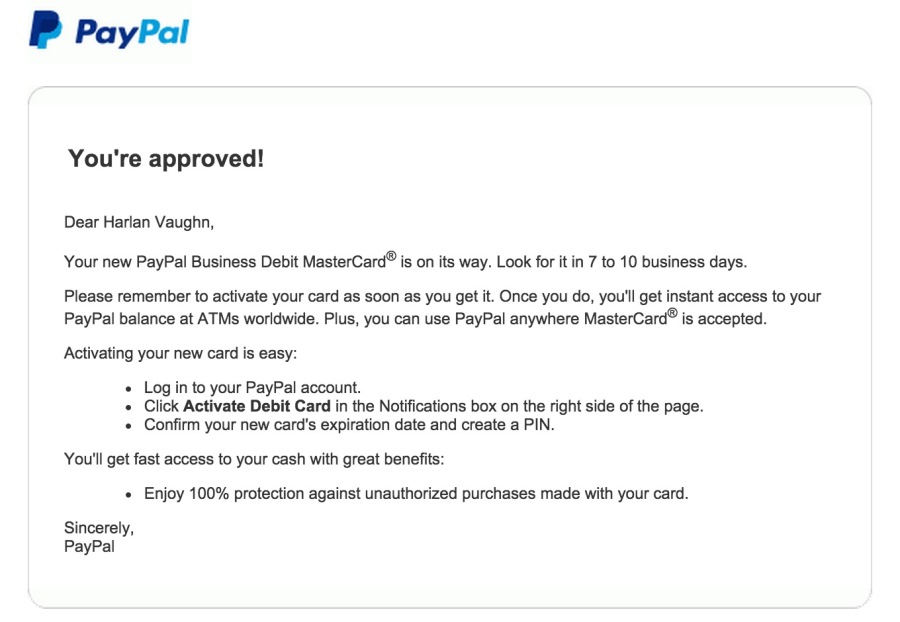

And then the email came:

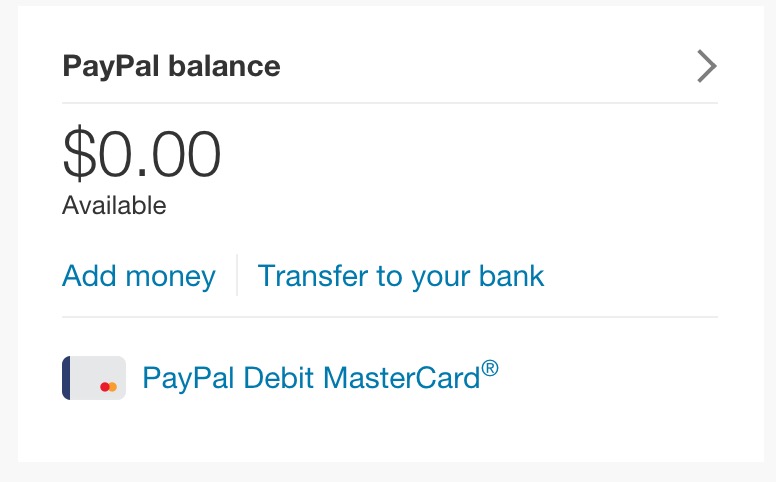

And then it showed up in my PayPal account home page:

All very seamless.

BUT WHYYYY

Why get these reload cards and this debit card? What’s the end result here?

You can buy the My Cash cards at CVS with a credit card. It’s case-by-case, but many people are reporting success with buying them using credit cards (just like Vanilla Reloads).

- The business debit card offers 1% cash back on all non-PIN purchases

- The 1% cashback works with RadPad for rent payments FOR SURE

- The 1% works with Evolve Money for payments to student loan companies, mortgages, electric bills, and all their other merchants but this is very YMMV. If the cashback doesn’t post, an email to PayPal is usually enough to get the cash credited to your account from what I understand

This is another data point I am keen to make in MS Month in February.

Introducing RadPad

RadPad is a new service that lets you pay your rent for free with a debit card.

You simply add your landlord, and pay using the PayPal Business Debit MasterCard. Then, 1% cash back posts to your PayPal account. The Radpad FAQ actually mentions specifically that this will work.

This service is similar to WilliamPaid, same idea and concept, except that site charges 2.95% as a fee to use the service. No bueno.

Evolve Money

Evolve Money is basically a bill pay site. They have a lot of merchants on there and are adding more every day. You shouldn’t have any problems paying with the business debit card. It is, after all, a debit card.

I’ve written about Evolve Money before, and I use them from time to time to liquidate Visa debit gift cards. However, this new angle may make it all worth it, especially when you factor in the 1% cash back.

Even if the 1% doesn’t post as it should, this is another way to pay your bills with a credit card, albeit in a roundabout way. BUT, don’t be discouraged, I think it’s an issue with the coding, and people have reported that PayPal ends up crediting the 1% back in the end. It just might take a quick email to customer service.

Other angles

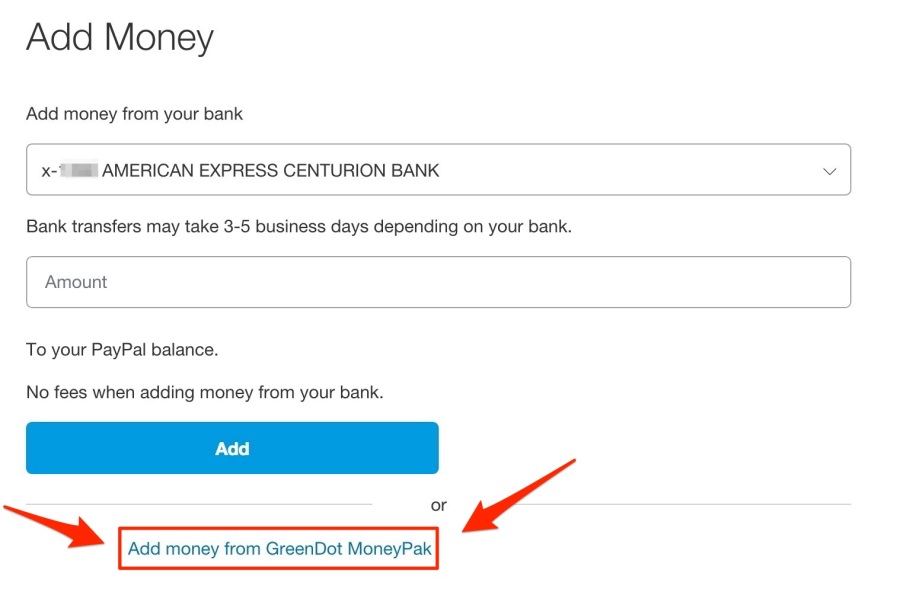

You can also get one of those GreenDot MoneyPak cards and load it to your PayPal account. If CVS or Rite Aid gives you any issue about paying with a credit card, you can always try that. (Pardon me if this is not at all helpful; I’ve never known a use for the “green cards.”)

In the image above, you can see a link for adding the GreenDot MoneyPak cards. In addition, there is an option to transfer money in from another bank… maybe from REDbird?

The other option would be to transfer money to REDbird, but PayPal is notorious for shutting down accounts that just load up and withdraw. For money consolidation purposes, I’d recommend moving money into PayPal and using the business debit card as the means of liquidation. Since it’s a debit card, you can pay bills using RadPad or Evolve Money. Don’t use it at an ATM: it charges $150 per withdrawal plus whatever fees the host ATM has.

Pro tip: Mix up the transactions a little so it’s not so obvious that you’re liquidating.

Another option would be to send money using PayPal (the most obvious option of all lol). If you can pay your roommate your part of the rent using PayPal, go for it. Or if your landlord accepts PayPal, awesome.

Can anyone else think of ways to get the money out once it’s in? Maybe pay your taxes with the business debit card?

The math

So why all of this?

Let’s take a rent payment of $1,000 as an example.

That’ll run you 2 $500 PayPal My Cash cards for $3.95 each, or $7.90.

You’ll get 1% cash back from paying for free with RadPad (or bills on Evolve Money), or $10.

So, you profit $2.10. Not huge, but the bigger implication is:

You get credit card points FOR FREE.

And not only for free, but at a tiny profit.

This also means you can earn FREE points for paying your rent or everyday bills. Truly free.

Even if I only earn 1 point per dollar, that’s still up to 48,000 free points per year, which I personally value at $960.

Other card point payouts:

- If I use the Barclaycard Arrival, it’s 96,000 points, worth $1,056+ in travel credits.

- If I use the Club Carlson Visa, it’s 240,000 points – easily enough for a lot of Club Carlson stays.

- If I use the Amex EveryDay Preferred, I get 72,000 points (assuming I get 1.5 points per dollar by meeting the 30 transactions per month)

- If I use the Fidelity Amex, I get an extra $960 added to my IRA, which could turn into much more in 30+ years.

- If I use the Chase British Airways Visa, I get 60,000 Avios (at 1.25 points per dollar) PLUS the Companion Certificate for running over $30,000 through the card.

Combine this with the math I calculated by maxing out REDbird in a year and well, you’ll have a $*!# ton of points.

Bottom line

I do not think this replaces REDbird. Contrarily, I see it as a complement to REDbird, a #2, a sidekick.

Just like how REDbird offers FREE credit card loads, this option also offers precious points for no out-of-pocket cost. In fact, you even earn a little.

The only things I can point out that may be gaps in the armor are:

- PayPal is a finicky system and they’ve been known to shut down obvious load-up-and-withdraw accounts

- There is no guarantee the cashback works with Evolve, but I don’t view this as a dealbreaker necessarily

- Your local CVS or Rite Aid may not accept your credit card as payment

Basically, just use all the same precautions that you used when Vanilla Reloads were still a thing. Beyond that, you should be good to go. It certainly feels very low-risk.

The gift card rack at CVS will certainly be a walk down memory lane for me. I look forward to MS Month next month and to making new data points about all of this and sharing them here.

Of course, if anyone has an experience they’d like to share, please proceed to the comments section and let’s hash this thing out!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Hey Harlan! I’m also from Brooklyn! Were you able to find out if you can reload the redbird at the Target in Brooklyn? Do you know if we can use radpad to pay apartment monthly maintenance fees? Thanks!

Hi Ang! Great to meet you!

I’m waiting on the permanent card to come in (should be any day now, as in today or tomorrow) then I will run up there and see how it goes. I will DEFINITELY be updating about that.

Re: RadPad for maintenance fees. You know, I think you could. All it asks for is for you to enter in the info. Just type in who and where you normally send your payments to, and see if they will deliver (you can test this with a free account before you go and grab PayPal cards). But I think there’s a great chance it’ll work.

Thank you for reading!

Tried a few months ago, paypal business debit card doesn’t work with evolve, you can not add the card to your account, have you really tried?

Whoa, really? It worked for me no problem.

Let me know into this – I am newer to this than it sounds like you are so don’t know what the issue could be.

I will call them in the morning and will report back.

New users can no longer add their PayPal cards per a conversation with Evolve Money today. Just updated the post to reflect that new info. Really a bummer!

I tried a few months ago and also tried just now, to no luck. How recently did you sign up for the card? Wonder if something is different about yours

Like 2 weeks ago! I did a small test payment to my student loan company (Mohela, just for the record) and it worked fine.

My first 4 digits are 5581… I am searching online now and seeing different things about error messages, success with payments, and the 1% cashback posting and not posting.

Something funky is definitely happening here. Did you have other payment methods already added or was the PayPal debit card the only one in your account?

I had a few Visa gift cards hanging out in there before I added the PayPal card.

If it is not working for new customers, I will have to come back and edit this post. Their office is closed now, but I will reach out to them in the morning and see what they have to say.

Anyone else new to this where it *HAS* worked?

Thanks for the feedback!

New users can no longer add their PayPal cards per a conversation with Evolve Money today. Just updated the post to reflect that new info. Really a bummer!

Omg this is amazing! I’ve been avoiding MS that required loading cards with CC money because it just seemed like too much trouble. But when I saw that you were able to pay your rent vis-a-vis a couple intermediaries, you caught my attention. I spend too much in NYC rent to leave potential points on the table! And the fact that once you own the paypal card, I can do all the rest from my computer – way easier than trekking to Target (although, I do live in Harlem).

Thanks!

Sounds like you’ve connected the dots and made a system that will work for you – congrats!

How do you go from your example of $1,000 monthly rent to “Even if I only earn 1 point per dollar, that’s still up to 48,000 free points per year”?

Shouldn’t it be 12,000 points per year?

Thanks for pointing that out!

The end calculations were based on if you max out the $4,000 monthly with the My Cash cards, which would bring 1 point per dollar to 48,000 points per year.

Sorry if that isn’t clear – I get a little stuck in my head sometimes – I will try to make the point more solid.

Thank you!

Thanks Harlan.

Susana and I met you yesterday at the miles meet-up. Thanks for explaining this. I never quite understood this method, but with RadPad seems like it’s worth it. Just applied for the Paypal Debit and will see what happens.

Do you strongly discourage any transfer to bank account whatsoever? Like if there’s a few dollars left over after paying rent?

Or the 1% back I suppose, what else can you do with it? I don’t use Paypal very much.

Hey Justin! So great to meet you!

I just got my cashback from PayPal for paying rent last month – not a lot but enough that I might want it out of the PayPal account. I’d say it’s OK to transfer amounts under $100 back to your bank account, but I’m just gonna leave it in there to keep accruing and apply toward future rent payments.

The RadPad system with the PayPal business debit card works flawlessly. I love it. As long as CVS keeps accepting credit cards for the My Cash cards, I will keep this as part of my MS arsenal.

I suppose you could also buy something with the debit card, like a gift card or something… or pay a bill to a merchant that accepts debit cards.

Cool, sounds great!

One more question, can we use the Paypal Debit to pay of Citi cards on the phone and get 1% back? Or can we load online with Bluebird/Serve and get 1% back?

As long as you load as a credit card, not a debit card, you should receive the 1% back. Can you pay off Citi cards with a credit card? They might process it as a debt transaction…

Good point you’re right. That wouldn’t work.

I’m reading more and more about this, and it seems like a lot of people get shutdown. But it seems like they are usually buying MOs and transferring to their bank accounts. Using RadPad won’t be suspicious?

Hey Justin,

I have been seeing the same things. Those people are asking to be shut down.

RadPad is a legitimate bill payment – you are paying your rent to a landlord or company. I have paid my rent twice now, maxed out my $4K My Cash reloads, and even gotten the cash back applied to my account so far. No problems.

Stay legit and you shouldn’t have any issue. Just keep it clean and you’ll be fine.

Should I be worried if I used the Paypal debit card for Radpad only? Or do you think it would be necessary to mix in some other spending?

Thanks!

I’m just using it for RadPad and haven’t encountered any issue and have even had cash back post. I think you’re good with just RadPad.

That’s good to know. And just to be sure, the Paypal debit card requires my SSN, it’s a soft pull, right?

Correct. No hard pull, but you will need to enter in your SSN.

Hey Harlan,

Sorry I keep bugging you on this thread.

Quick question, could I for example, max out 4k on PPMC.

Then send ~$2000 for Rent on RadPad to my landlord (an individual), and then send -$2000 to another individual… as in, my girlfriend?

Kind of like issuing a Bluebird check, but from RadPad, so it wouldn’t be Rent, but using it as a check issuer.

Too far I’m guessing? What do you think?

Ah, no worries, I love talking about this stuff!

If RadPad thinks you’re trying to run money through their system for non-rent payments, they make request more info from you, like a copy of the lease, or other proof that you are sending rent to an owner/landlord.

It may work once or twice, but they’re pretty smart, so I wouldn’t even try that.

What I’ve been doing is maxing out the $4K, then I let the extra cash sit there until the next month, so sort of “pre-paying” my rent (unless I use the debit card for something else).

Hope that helps! I’m loving the RadPad/PayPal combo so far!

Hey Harlan, first time reading your blog, great post! If my plan to open a restaurant goes smoothly, I’ll be paying a lot of rent each month, my question is, I hate doing business with ebay and PayPal, are there any other cards I could buy to replace PayPal?

Hmmm… You could definitely use REDbird or Serve to pay your rents (I’ve used Serve for this before).

You could also look into other prepaid cards that accept GreenDot MoneyPak (I see those next to the PayPal cards often).

I also don’t “trust” PayPal, but I feel like as long as you use the service as it was intended, you won’t have any issue. I am loving the RadPad/PayPal combo so far.

Thanks, Harlan.

Hey Harlan,

We’ve been going strong with this for months! It works perfectly so far.

Do you have any recommendations for how else to liquidate the PPMC? We buy 4 a month and use to pay rent, but would like to max out Paypal to 4k, but don’t have any other way of using the extra $2000. Any ideas?

That’s the million dollar (or $2,000 dollar) question. I really wouldn’t advise you to withdraw, and bill payment services like Evolve charge a fee to use the PPMC. You could use it as a debit card, but that’s boring. And PayPal is super finicky about most everything. RadPad is all I know of that works and is legit with PayPal. I’m in the same boat as you – if anyone knows a way to use the PPMC as legit spend, I’d love to know about it too!

Hey Harlan,

Thanks, yeah as a regular debit card is boring!

Can we add it as an online debit load to Bluebird or RedCard? Would Paypal flag that?

100% they’d flag you.

Awesome post!

Now that redbird for cc is summarily dead, would you recommend or discourage using the CC-PayPal Cash-PayPal debit-Redbird?

Meaning follow all the above steps and liquidate balance by charging (perhaps in odd amounts) the PayPal debit onto redbird at target (in person is fine).

In person REDbird debit reloads might be the ticket to liquidating PayPal at Target… I hadn’t thought of that.

The only way to know for sure is to try it. I’d just wonder if they’d (PayPal) know that you’re reloading REDbird and not actually buying anything at Target… but I don’t see how they could. Hmmmm… Interesting idea!

Hey Harlon,

Thanks so much for the great blog. This Paypal method works great (so far, ran $500×3 this week). My question is, if I keep just buying the Paypal My Cash and loading it to my PayPal, then sending it directly to my Bank Account, will I get flagged for this? If so, is there a way to avoid this? I don’t pay rent, so the RadPad addition is a bit useless to me.

Let me know!

Steve

They will definitely flag you eventually if all you’re doing is loading up and withdrawing. Liquidating PayPal is the big question no one can seem to figure out, including me. I’d love it if Evolve didn’t charge a fee on the PPBDMC. But they do, so all I know – for now – is RadPad.

Hey Harlan,

Using Paypal Debit to send Western Union to a bank account? Any thoughts?

I used the Paypal Debit for the Western Union $20 amazon GC, and it worked, and I got the 1% cashback.

But she called me.

First, she confirms that the account is back in service, and that the transaction was covered under PayPal Seller Protection. OK, I knew that already. I’m not sure whether she’s aware that this news is several hours old, but I politely nod my head and thank her for taking care of it.

But then she brings up the my-cash reloads. She says that my-cash is meant only for purchasing *online* and that pretty much any use of my-cash funds with the debit card is grounds for adverse action. Basically, it sounds like she’s saying that the debit card swipes cannot exceed the funds credited to PayPal from legitimate business transactions.

I briefly mention that I spoke to someone else about it earlier, and it seemed like it could be used for anything online. (Obviously, the card has a magnetic strip and is swipable, so I understood that to mean anything except withdrawing physical cash.) But she claims that the terms and conditions prohibit it.

I didn’t want to get into an argument, so I left it at that, saying I didn’t know it was a problem, but I’ll be more careful with my accounting in the future.

So what does everyone here think? Who’s right, with regard to official PayPal policy? Did the Serve debits trigger (at least in part) the account shutdown, or is it just something that people noticed once they were manually reviewing the account? Is it safe to resume in the future? In six months, perhaps? Did I play my cards right? Should I have done something differently? If so, what?

Epilogue:

I got another email from executiveoffice@paypal.com at 12:45 AM. Somebody there works interesting hours. Here is the relevant part of it. What do you think?

————————

I would also like to take this opportunity to provide you with additional information regarding PayPal MyCash.

As we discussed, it appears you have added funds to your PayPal account via PayPal MyCash, and those funds have been exited from your account using your PayPal Debit Card ending in xxyy. The MyCash feature is for making deposits to your PayPal account for retail purchases. To be completely transparent regarding our Compliance policies, any other usage of funds added from PayPal MyCash can result in interruption in service or limited access to your PayPal account.

You can find more information about our acceptable use policy here:

https://www.paypal.com/us/webapps/mpp/ua/acceptableuse-full

You can find more information about restricted activities in our user agreement here:

https://www.paypal.com/us/webapps/mpp/ua/useragreement-full#9

[Whoops, this was posted out of order. I thought new posts come up on top. The post above is the last piece. Start here.]

Interesting story here, I’d love some data points, suggestions, comments.

I’ve been doing the CC> PayPal > Serve thing for a few months, obviously no more than 1k a month (because of Serve limit).

(As of 4/2015 or so, Serve no longer allows CC loads, except for Amex CC’s, which won’t get you points.)

Started off buying the PP in Duane Reade. (I should add that I’m also in NYC.) I have a small DR on my block, and they’re not really used to $1,000 transactions. Usually, it worked, depending on the which store manager was on duty, but the staff were starting to ‘get to know me’. (Like I said, small, neighborhood store.)

Not wanting to attract too much attention, I went exploring, and discovered a nice big CVS in a commercial district. (I see I’m not the only one who made this discovery 😉 ) Jackpot. The helpful salesperson rang it up without batting an eyelash. So far so good.

I always made a point of ‘mixing things up’. I do buy on eBay (legitimate, real, genuine, purchases), I use PP on other sites, even made sure to physically swipe the debit card in B&M stores for good measure. No big transactions, everyday things like the supermarket, or the subway.

All of these things ‘cost’ me points. Paying directly out of your PayPal balance [online] doesn’t earn the 1% cash back, and even using the debit card, when I could be using a CC, is a ‘loss’. (Remember, you can’t load Serve with a CC anyway, so no loss there.)

But, obviously, *most* of the money (~$800 out of $950, let’s say) was going to Serve, $150 or so at a time. (Serve has a $200 daily limit for debit card loads, and I made a point of staying below that.)

OK, that’s the background. Now here’s where things get sticky.

About a month ago eBay ran a promo for new sellers. Sell something, and they’ll match the purchase price, up to $100. Easy money, right? I did a bit of searching on eBay, found that Amazon GC’s go for a few percent over face value. (This makes sense, since the buyer is making portal cash back + eBay bucks — plus CC points, probably, but for that they don’t need eBay.) So I listed a $100 Amazon GC, and away we went.

A week later, I had a buyer. A very suspicious buyer. Foreign sounding name, funny address, c/o ‘XYZ’ (all caps). But the buyer’s account is verified on eBay. The shipping address (U.S. address) is confirmed. Two days later, PayPal sends me an email telling me that they’ve received payment, and that I should ship.

What can I do? Cancel the sale? Will eBay even let me do that? Because I don’t like the sound of a guy’s name??? So I went out and bought a $100 AGC, made damn sure to save the receipt, bought postage with USPS tracking from eBay, paid with PayPal, and mailed it out. According to the tracking, it was delivered two days later (three days after PayPal told me to ship).

About five days after this (a WEEK after the auction ended) eBay sends me a message that they’re cancelling my buyer’s bid, because he’s not registered on eBay. Huh? He was verified a week ago……

If I didn’t ship yet, I shouldn’t. If I did, I should contact the shipping company and try to get the item back. I’m laughing to myself, how do I get an item back when it was delivered five days ago?? eBay’s email didn’t tell me to contact anyone, or take any specific action (other than the ridiculous one mentioned above), so I ignored it.

PayPal had already released the funds to my account, and a few days later I had my eBay $100 coupon, which covered the purchase price of the AGC. I paid my Ebay seller fees as soon as they came due, leaving about $90 net profit.

A few days ago, (more than three weeks after the auction ended), I get an email from PayPal, saying that the transaction has been disputed, and that I need to respond. Well, I was half-expecting this to happen, sooner or later, though I wasn’t expecting it to be *three weeks* later.

No problem, I think. I have the tracking number, I have PayPal’s email telling me to ship to the buyer’s confirmed address, I have the transaction record for the postage. What more could they want?

I log into PayPal, go to the resolution center, start entering the requested information into the webpage. While I’m busy copying and pasting the information, two emails come in to my mailbox, a minute apart. Who do you think they’re from?

One says that my account has been limited, because of “a pattern of account activity that, in our experience,

is usually high risk”. The other says (in the subject line, no less) that “Your PayPal Debit MasterCard has been deactivated”. Charming.

What I find very interesting here, is that the account was *not* limited when I signed into it a few minutes earlier. (When your account is limited, you get greeted with a notification at login.) The first email (the one asking me to respond to the dispute) arrived at 1:00 AM, and I didn’t log in till 8:30 that morning, so it’s not like these three emails were sent out one after the other. It almost seems like me logging in and **trying to resolve the dispute** somehow triggered the account shutdown. Strange, no?

Well, I entered the information requested, and left a nice little note in the box provided for additional comments, explaining how basically everything they had requested was actually available on their own website, if they bothered to look.

Then I called a friend with a knack for dealing with corporate bureaucracy, and he googled the email addresses for the CEOs of PayPal and eBay (why didn’t I think of that?) He wrote a quick note, saying that I had always been a happy buyer on eBay until this invitation to become a seller turned into a nightmare, and sent it out from my email.

Two days later, I get a call from the PayPal executive office; a nice young lady is on the line, and it actually seems like she wants to help. She wants to know where I got this gift card, and how much I paid for it. She calculates (correctly) that after deducting PayPal and eBay fees, I’m selling at a loss.

I explain to her (without getting too deep into specifics) that eBay was having a promotion for sellers, and that I did make money at the end of the day. Nothing to see here, perfectly legal, I’m not the only guy selling GC’s on eBay, move along.

She then tells me that because GC’s are cash equivalents, they’re not covered under seller protection. I tell her that I have an explicit email from PayPal saying otherwise, and offer to forward it to an inbox of her choosing. She accepts my offer.

Then I ask her about the note I left on the account, where I connected all the dots, showing that the address and tracking number are actually sitting right on PayPal’s own servers. She doesn’t know about any note. Could she perhaps take a look in the resolution center, and try to find it? She seems like she genuinely wants to help, but it’s just not there.

Luckily, I saved a copy. As my friend put it, his three line complaint with spelling mistakes, bad grammar, and messy punctuation, went to the executive office. My carefully worded explanation of the facts ended up in New Delhi.

So I send out two emails. One is a forwarded copy of PayPal’s email telling me to ship, with the buyer’s confirmed address, and confirming this transaction’s eligibility for seller protection. The other is a copy of the note that went to non-executive customer service in India. The second one includes screenshots of the PayPal transaction for the original sale, fresh off the website, showing the buyer’s confirmed address, as well as screenshots of the PayPal transaction for the postage, showing the tracking number.

And I wait for someone to get back to me.

While I’m waiting, (several hours later) I decide to try my luck with eBay. Maybe they can sort this out. I dial eBay customer service, get a really bad accent (though I’m sure it sounds much better in Hindi) and explain that I sold an item that was delisted by eBay after it was delivered, and now I’m in trouble with PayPal to boot.

The CSR tells me that eBay has no dispute on file regarding this transaction, and that the best they can offer me is to transfer me to PayPal. Well, it can’t hurt, I guess.

PayPal’s CSR can actually speak English, a bit of small talk confirms that he’s in Arizona. Believe it or not, he actually has the emails I sent. He puts me on hold for a few minutes while he goes through them, comes back on the line saying that everything checks out, and he has no problem releasing the clawed-back funds. It seems like he actually made this decision on the spot, in less than five minutes. More than twelve hours have passed since I sent the emails, with no response from the executive office.

Then he asks me if I’m aware that my account has been restricted. I tell him that I’m quite aware of the fact. At this point, after he has read the emails, I can tell he’s starting to sympathize with me. But he asks me if I know why my account was restricted.

I tell him part of the truth, the part I want him to hear. I tell him that it happened at the same time that the transaction was disputed, and that as far as I can tell, it seems to be somehow related to that.

Now he takes another look at the account, and notices the my-cash reloads, and Serve withdrawals. He asks me where the money’s going. Again, I tell him some of the truth, that it’s going to pay my credit cards. After all, you can’t pay credit cards directly from eBay, right? (Even if you could, I doubt eBay would pay you 1% on ACH debits 😉 ) I conveniently leave out exactly what it is that I’m buying on those credit cards.

I ask him, in my most innocent voice, if that’s a problem, does he think I should stop doing it. He says that as long as the money is being used for online transactions, it’s fine. They’re worried about money laundering, he says, so basically he just wants to make sure that I’m not withdrawing it as cash.

I guess I must have convinced him, because next thing I know, he’s telling me that the restrictions on the account have been removed, my debit card has been reactivated, and I’ll be receiving a confirmation email shortly, and is there anything else he can help me with today?

I tell him that he’s been really, really helpful (an understatement if there ever was one), and that I’ll be sure to call him if I ever need help with my PayPal account.

And they lived happily ever after. Or so I thought.

But the story is not over. No. We still haven’t dealt with the young lady from the executive office, the one to whom I addressed the emails. Whatever happened to her, I wondered? I wasn’t exactly going to call her and find out. I already had what I wanted, and I was enjoying the thought of her surprise, when she discovered that I had left her hanging on the vine, a decision-maker with no decision to make.

[Go up to first post for the last chapter ]

Hi Harlan,

Can I use VGCs or one vanilla debit GCs to pay rent using radpad? They don’t charge any fee if using debit card and monthly rent s below $5000. Also does the payment have to be for rent? How do they know if the payment is sent to landlord or not, for e.g. I can send payment to myself. correct?

I’m planning to use my cash to load my paypal account and then use the debit card to pay rent through rad pad. (Not planning to transfer to bank account) I need to upgrade my paypal and they are giving me an option to create a new business account, or change my existing account to a business account. Is there one option that is better than the other, meaning, for instance, if i choose to create a new business account, and it gets shut down, would my personal account still be safe? If so, should I go that route?

on the other hand, i can’t remember everything i read, but there was something about needing to have history with paypal to get the business debit so i’m wondering if i should just upgrade the existing account.

I just upgraded my existing account. But they shut you down, though, you lose the account because your personal account “becomes” a business account.

If you’re worried about that, you can create a new one. But I upgraded mine and haven’t had any issues. Plus, you’ll come with built-in “history” which will qualify you to get the debit card.

Hope that helps!

Hi!

I just have a personal Paypal account and I do see the option to upgrade to business account. But it’s asking for the business name and address. I don’t really have a business. So I’m wondering what I could do to get the PP business debit card. Thanks!

Just use your name. You shouldn’t have an issue opening it that way.

Instead of using RadPad you can use Plastiq. No fee for PPBDMC. I’m trying it now you can pay rent, but also pretty much any other bill like student loans etc. (can’t pay credit card bills). Another possible option is free credit card processing with Square. You can process $1,000 for free by signing up using this link (it’s free): https://squareup.com/i/EF2A3251

Hey Harlan,

Just wondering if PayPal frowns upon loading up your paypal account using PayPal MyCash cards but then paying rent with RadPad using the PayPal Business Debit card. To them, is this viewed as loading up your account and withdrawing, or a legitimate way of using the PayPal Business Debit Card?

As long as your spend goes through the debit card, you should be fine. Withdrawing would be loading up and transferring to your bank account – definitely do NOT do that!