It finally happened – I had to file a claim to use my card’s collision damage waiver benefit. I knew the day would arrive sooner or later.

After I hiked down from Granite Park Chalet, I found my rental car had a little *DING* on the front passenger side door. The parking lot was packed, and it was obvious someone parked too close and opened their door too hard into my rental car. It was nearly imperceptible to the point where I thought about not saying anything about it.

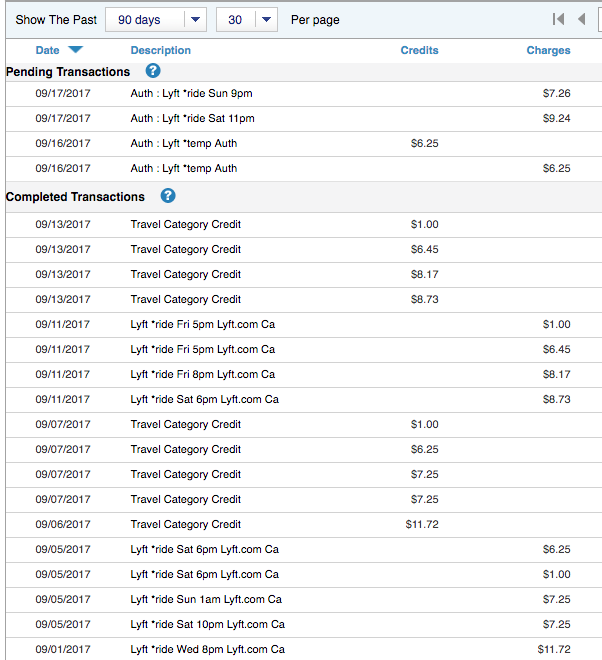

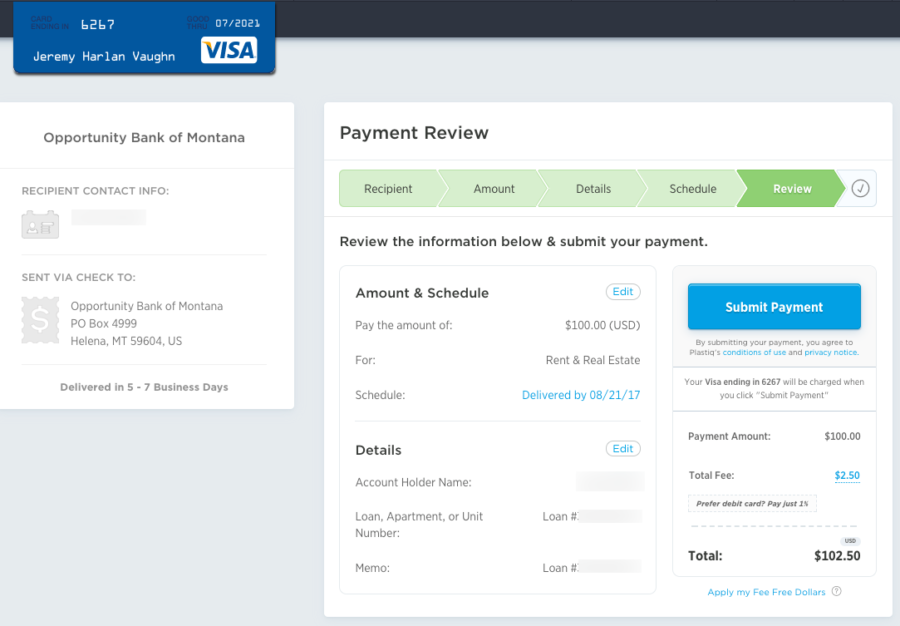

But, I was responsible and filed a proper report when I returned the car. I wasn’t expecting to ever hear anything about it again. Until one day, I got a random call saying they filed a claim against me. In a near-panic, I filed my own claim online through Chase in just a few minutes.

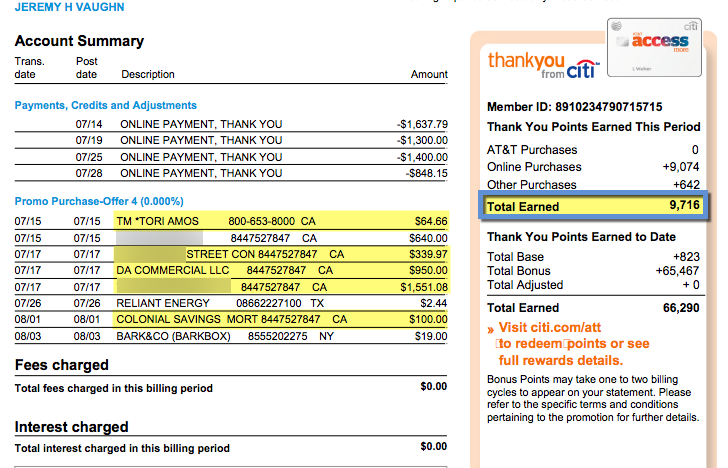

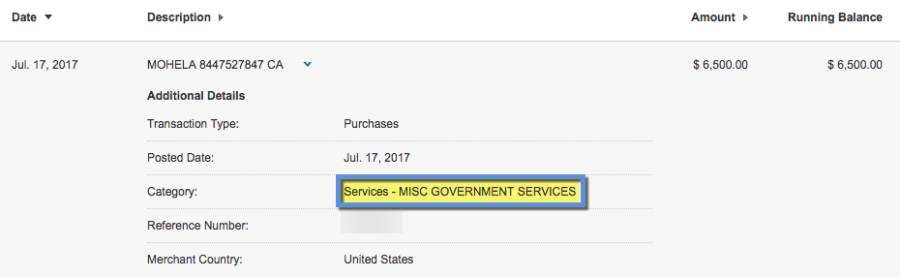

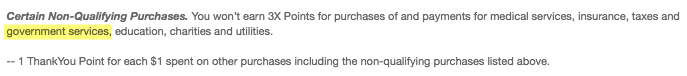

THANK GODS I waived the CDW and put the charge on my Chase Sapphire Reserve card. Taking those small steps saved me nearly $700 – for a little ding on a car door.