I just made my last round of rent, mortgage, and HOA payments through Plastiq with my Citi AT&T Access More card because Citi is removing those transactions from earning 3X starting next week.

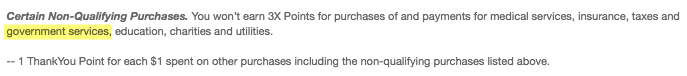

But as I reviewed the transactions, I noticed they weren’t coding as rent like they had before. Instead, they’re coding as “Misc Government Services.” That gave me pause because of the language in Citi’s T&Cs:

But upon further review, I earned 3X in this very same category as early as this month. Which makes me wonder… will 3X live on for rent and mortgage payments with the Citi AT&T Access More card?

A history of Plastiq 3X With Citi AT&T Access More Card

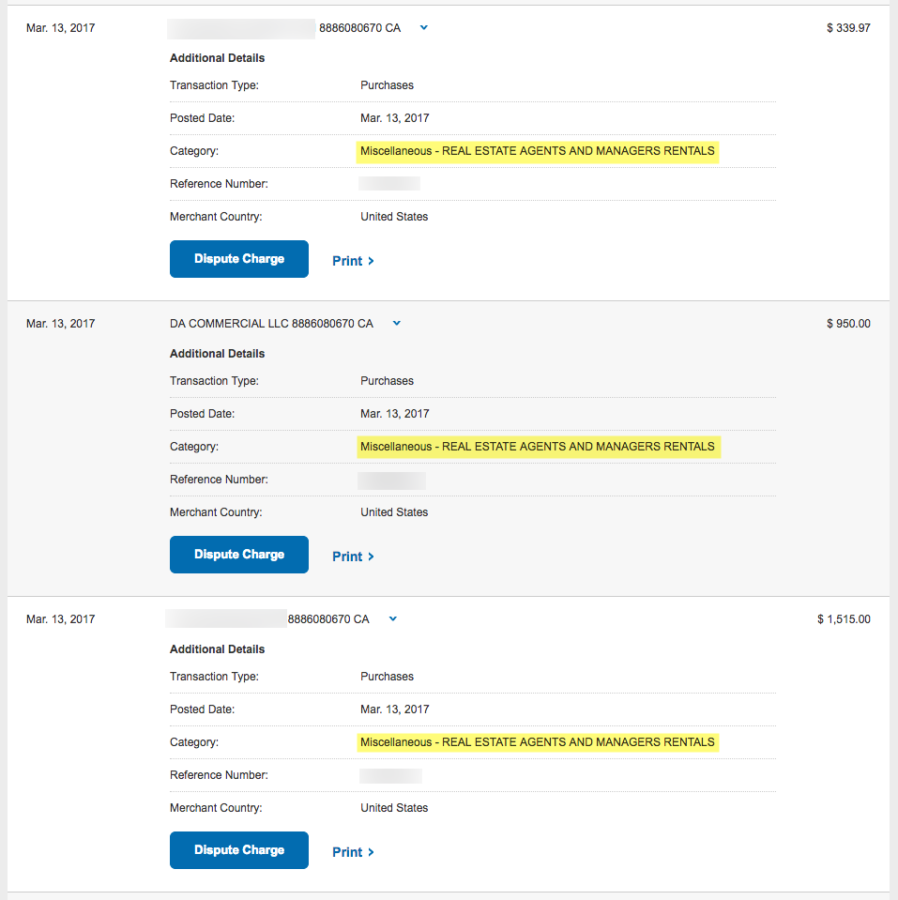

The last time I used this card for rent/mortgage/HOA was in March 2017 (after that, I use my SPG biz Amex and then went some min spends).

Through Plastiq, those charges coded as “Real Estate Agents and Managers Rentals:”

Which was awesome, because at the time, 3X was going well for this category.

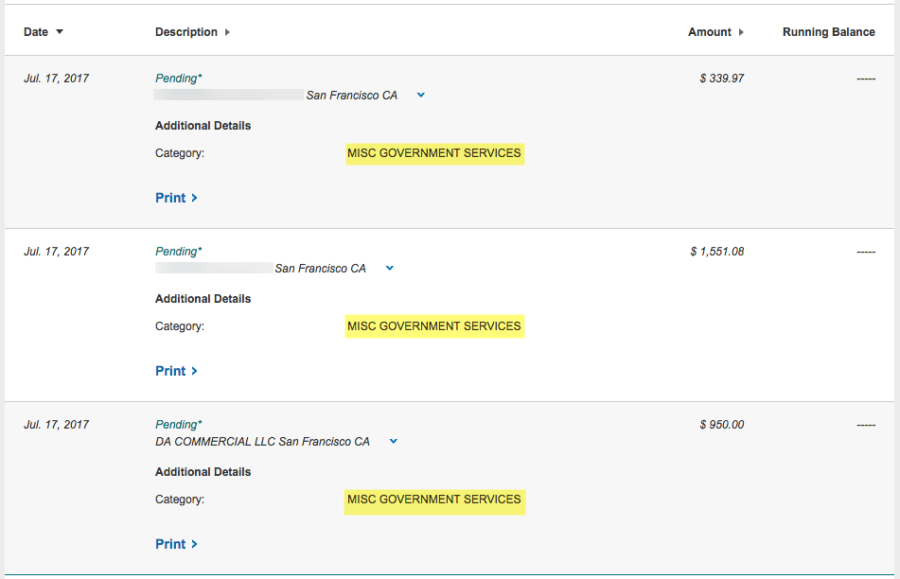

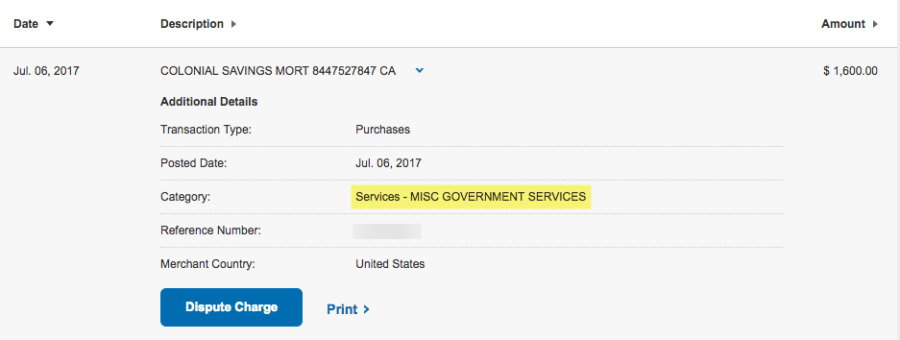

Flash forward to this week in July 2017. I made the exact same payments. But noticed they now code as “Misc Government Services:”

I haven’t edited the payees in any way. They’re simply coding differently. Something’s changed in the past couple of months.

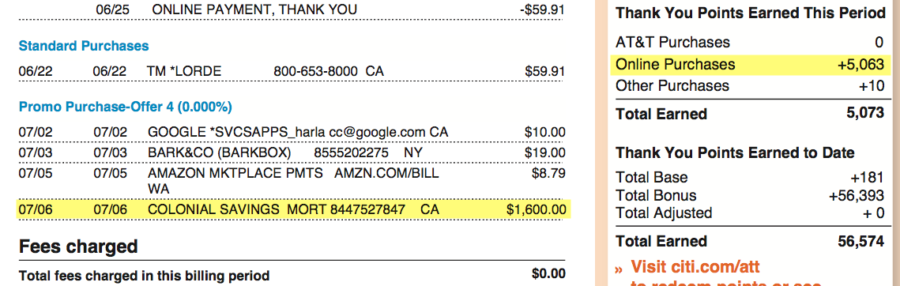

The Citi T&Cs specifically say “government services” only earn 1X (see screenshot above). But, I made a mortgage payment earlier this month that coded the same way AND still earned 3X on my last statement:

I only had 5 transactions on my last billing statement, and 4 of the 5 charges – including the Plastiq mortgage payment – earned 3X Citi ThankYou points.

Here’s how that $1,600 charge coded:

Misc Government Services! (I never thought I’d type something like that with an exclamation point at the end.)

If that’s any indication, the charges from this week should earn 3X as well. It remains to be seen if they’ll earn 3X after July 22nd, 2017, but my hunch is they will… unless Citi really starts cracking down next month. Which I don’t think will really happen.

Either way, I’m going to do one more round of payments because this is enough to convince me that:

- Citi is coding Plastiq rent, mortgage, and HOA payments differently

- For whatever reason, they’re earning 3X even though they’re “government services”

- 3X for these payments might live on beyond July 2017

Bottom line

- Link: Sign-up for Plastiq (Get $500 in fee-free payments)

There’s no doubt Citi wants to stop giving 3X points for Plastiq payments. But I don’t think they’re flagging them well enough to actually prevent the charges from earning 3X. Unless something drastically changes by next week, which is doubtful.

I’m going to stick with this one more time for a couple of payments in August and see how they code. But seeing this, and how they’re coding, gives me a little hope that Plastiq 3X with Citi AT&T Access More will live on.

However, it will very much be a month-to-month scenario. I won’t be surprised if this gravy train comes to a sudden end. But until that happens, I’m gonna keep riding for as long as I can.

The 3X from this card, combined with the 10,000 annual bonus points, would make the case to continue using Plastiq payments. When this stops working, see why the Blue Business Plus Amex card is the next best card to use for rent and mortgage payments.

If you have recent data points, please share!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I dunno. I tend to doubt it will work next week but obviously it woiuld be awesome I if it did. I just made my august and Sept mortgage payments this week. Keep me posted if it still works

I will def keep trying until it’s clear it doesn’t work any more. I don’t have much faith in Citi to actually fix their IT/coding rules lol. Will keep you posted for sure! 🙂

Question is whether specifically selecting the “rent, mortgage” category causing this to code this way? If so, are their any other categories within Plastiq that would code as 3X if Citi is just stopping the rent and mortgage coded directly by Plastiq as the default category.

I hope that makes sense.

Thanks

I like where your head’s at! That’ll take some more playing around with. Maybe “Business Services?” I’ll see how it goes next month and tinker from there. 🙂

Thanks! Hopefully there is some new category within Plastiq that qualifies for 3X!!

I will also keep you posted on my experiments

Thanks for sharing this Harlan. I will give it another try. I agree that sometimes I think Citi’s best means of changing an IT rule is to simply announce it to customers and hope customers change their actions in anticipation…. knowing their IT team has a less than 50/50 chance of actually accomplishing the rules change!

I’m going to give it another go with rent this month, since I don’t have a minimum spend to hit at the moment.

My thinking exactly! Let me know how it goes if you can. Thank you!

Any new Datapoints after July 22nd? Was hoping someone’s statement closed and had transactions on or after July 22nd.

My statement doesn’t close till August 10th.

Thanks

I’m doing one right now – but my statement closes on the same day. Will share as soon as I find out.

Ok. Thanks. Please let us know.

My statement just closed yesterday. I made a mortgage payment to US Bank on 8/3, which was coded as Misc Government Services and I received 3x points!

Yay! Thank you for the data point – that was what I was hoping for! 3X lives on!

Looks like this is dead now. US Bank Mortgage payment posted on 3/1 as 1x . Previous payments posted as 3x.

Dang! 🙁 Guess I’ll go back to using the Amex Blue Business Plus: http://outandout.boardingarea.com/blue-business-plus-amex/

Thanks for the data point!

Have you used the Amex Blue Business Plus recently to make a mortgage payment thru Plastiq? I thought I read somewhere that Amex restricts those.

Ah, you’re right! You can still use Amex cards for rent and HOA dues, but NOT for mortgages – only MasterCard and Discover are accepted.

I don’t think I have any MasterCards that would be worth using unless there’s a spending promotion or something. What a bummer. My AT&T statement closes tomorrow – I just wanna see if it earned 1X or 3X. Will have to think about what to do going forward. Do you have a card in mind to use for your payments?