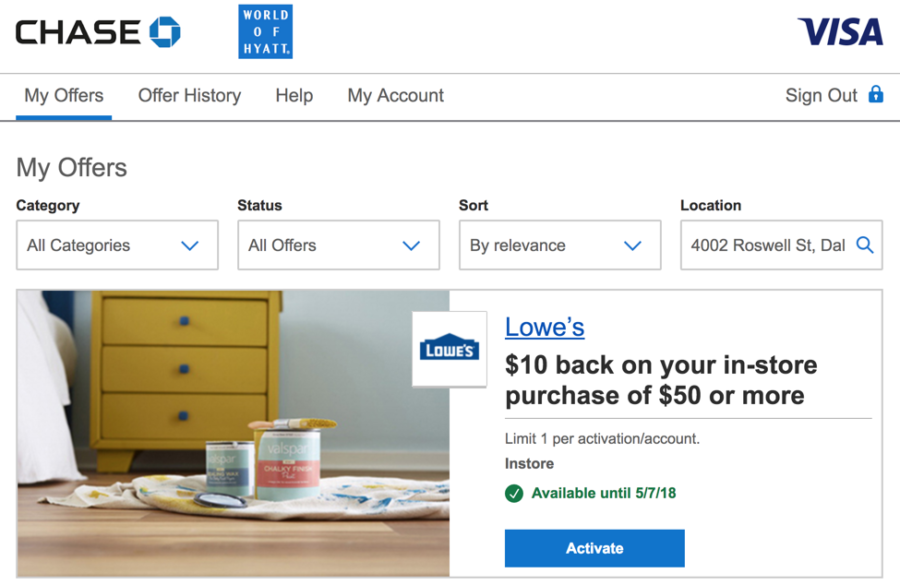

Just got this email from Chase. Peeps with a Chase Hyatt Visa can now sign up for an official offer page and activate offers – very similar to Amex Offers. The only difference is there’s a dedicated page for it – you can’t activate the deals from your Chase accounts page.

I have 13 offers on my card after signing up for access, to places like Lowe’s, Boxed, Hulu, and StubHub. Here’s how to find it!