Considering all the things I’m juggling all the time, my accuracy rate is pretty high. But more to keep track of means more things fall through the cracks.

Before I moved to Dallas ~7 months ago, I changed all my addresses to my new address. During this, I paused the shipping on my Dollar Shave Club account.

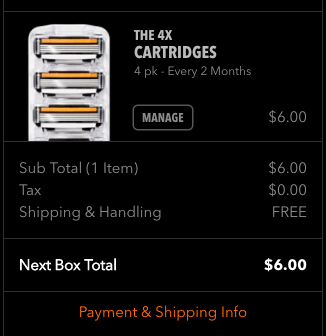

And somewhere along the line, I canceled my Amex EveryDay Preferred card because I wasn’t making 30 transactions on it per month. To help with the transactions, and because it was so low, I made it my primary card for Dollar Shave Club’s recurring $6 monthly charge.

You can guess what happened. Somewhere in the middle of everything, the shipping resumed.

And somehow, the charge cleared. Usually, when a card is closed, you’ll get an email from the merchant saying the payment failed so that you can protect your credit score. Not so with this one.

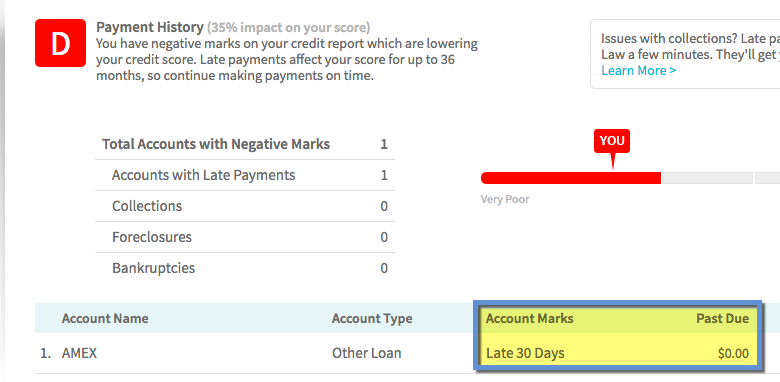

Amex cleared the charge. And I never got an email from or letter from them. Until one day, I saw my credit score dropped from 803 to 702 – because of non-payment of the $6 charge.

Amex has no idea what’s going on

Of course, I immediately called them and asked WTF? How could a charge clear on a closed account? And even still, why no notice – no statement, no “uh hey you owe us money,” nothing?

Every rep I spoke with said, yeah that’s definitely not supposed to happen. They admitted fault more than once.

This is the only blemish on my credit report. I’ve been so vigilant about protecting it for years. To say I was livid is an understatement.

What was alarming is no one I spoke with seemed to have any idea how to fix it. Or why it happened. They were clueless and didn’t have answers, which was frustrating.

What Amex did about it

Their solution was to “re-age” my account. I of course made the $6 payment over the phone. And they said they could extend the closing date of the account so it would appear as closed with a $0 balance (as shown in the image above).

Fine, I said. Do it. They said it would take a month to show up on my credit report. A month!

Well, a month later, my score was still in the low 700s. So I called again, and this time spoke with a supervisor. She could see the notes on my account. But it was never properly “re-aged,” whatever the hell that means. So she said she’d do it for real this time.

Another month passed. The mark is still on my credit.

To recap: I made the payment. It wasn’t my fault. How it slipped through their system is a mystery. IT WAS ONLY FOR 6 FREAKING DOLLARS.

My next steps

- Link: Equifax dispute process

- Link: Experian dispute process

- Link: TransUnion dispute process

So, Amex was and is useless to remove this strike from my credit report. I’m to the point where I just want this dumb thing removed.

So I’ve initiated disputes with the 3 major bureaus. And I WILL make sure it happens.

My biggest concern was I couldn’t get premium rewards cards any more. But so far, I’ve been auto-approved for several new cards (not that I get many of them anyway because of bank rules).

And the one time my account went to pending, the agent didn’t even mention it. Plus, a friend reminded me, 700 is still a good score.

Yes, but it’s not the 800 it once was before this happened. Over something so small.

So now I must wait 8+ weeks to hear back about my disputes. I have proof I paid the charge, the date the account was closed, and the date of the transaction. So it should be fairly obvious what happened.

What’s still most surprising is how utterly useless Amex was to remediate their mistake. And how much my score fell. I knew it was sensitive, but wow. 100 points for a $6 charge seems extreme.

Bottom line

So I’m going through the process of disputing my credit report with the 3 major bureaus. It’s a total PITA. And it seems like such an exercise in futility. Like, why can’t Amex just fix it?

I don’t want to go through it, but it seems I have no choice if I want the mark removed.

Just be careful with those recurring charges. Similar slip-ups have happened to me in the past, but I’ve always resolved payment directly with the merchant by simply using a different card. How and why this happened continues to elude me.

It just goes to show, you can never be too careful. And to double- and triple-check everything.

Have you ever had to dispute an item on your credit report? How did the process go? I’m hoping this is a quick and easy fix!

- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I had something similar in Canada. Had an Alaska card that I cancelled (got confirmation letter for cancellation). Year later I check Transunion, credit dropped dramatically (was 60 or 90 day late payment). Turns out the card wasn’t properly cancelled, meaning the fee was charged, and for some reason, no statements were sent.

Took a long time to resolve. Fortunately they recorded the calls, and then wrote to bureaus to fix. Major headache though.

Oy, that’s what I was afraid of. Guess when you have 30 cards for a few years, one error isn’t so bad.

Glad it got taken care of though!

The one way to avoid this issue, is to sign up for automatic minimum monthly payment with every credit card account using your bank account.

Excellent tip! I still prefer to pay all my accounts manually. Old habit biting me in the butt, currently.

Thanks for sharing!

That really is the best option. When I get a new card I immediately set it up for automatic minimum payments. I pay most of them in full every month so it won’t even matter. But if there is ever any small mix up, you’ll be covered. It’s like cheap insurance. Keep in mind that you can always make many payments per month regardless. My partner has a habit of paying his balances when they hit a certain amount and that generally involves in 2 or 3 payments per month.

Stinks you’re having to go through this. I know you’ll stay on top of it. Keep us updated.

Cheap insurance… I like that. 🙂 Thank you, Chad!

I hear ya – it really is excellent advice. I also make 2 to 3 payments per month on each card. I know for the Chase cards, they sometimes report the debt ratio mid-cycle so I pay it down when it hits a certain amount.

Will definitely post when the strike disappears and how long it took for my score to go back up!

Thank you for reading and commenting!

I canceled my Alaska card but the rep never refunded the $75 annual fee. I assumed the fee was refunded and 3 months later I get a credit Carma notification of an account delinquency. My score dropped 100 points as well, called Bank of America right away, and within 30 days the score went back up 100 points. I guess different banks do it differently. Good luck

Wow, that’s awesome. Yes, Amex has been pretty useless. I wish it were that simple.

Good to know though, and glad you had a good experience getting it corrected!

At least you have a redressal option with the bureaus. I approached my credit limit on my CSP in one payment cycle – the score dropped 100 points from 800+ . I have always paid on time. I do not even know what to do about it – just waiting it out.

I would say there’s nothing to be done. It’s the way the scores work and there is no data error or special circumstances. I never go over 20% or so of the limit on a card. The credit utilization ratio applies to cards individually – not just collectively.

And credit utilization is a highly weighted factor (like payment history and derogatory comments).

Thanks for the clarification @ Carl P.

Welcome to the world of AMEX. Not my favorite.

They’ve NEVER been my favorite. Every year or two, they make some hideous error and show how clueless they really are.

Interesting article. Thanks for sharing.

Several years ago my wife had a similar experience. W/o boring you with the details, we disputed the charges. A few years later we apply for a new mortgage. The pre-approval process went fine, but a week before closing we were told that there was a problem with the loan. Evidently during the housing crisis, people disputed their credit report to artificially bump up their rating. Even though we were getting the loan from a local bank, we were told that the loan would later be sold on a secondary market and Fannie May refused to purchase any loans from borrowers with disputed credit scores. They recommended removing the dispute, but said it might take longer than a week. Fortunately, I came up with the idea of putting the entire loan in my name (my wife wasn’t working at the time so I knew I’d have enough income to be qualified) and the deed in both our names. I’m sure there were lots of legal reasons not to go this route, but it worked out. Lesson learned– the credit agencies should really be more accountable and customers should have an appropriate recourse to deal with issues like yours…

Wowwww. That’s terrible that you can’t even stand up for yourself and correct an error without being later penalized for it.

I wonder if that’s still a concern with Fannie Mae? Glad it worked out for you.

Definitely some food for thought here – thanks very much for sharing that!

What tool do you use to keep track of your credit score?

The free FICO score from the banks, and Credit Karma and Credit Sesame for their instant alerts – they are both really good about sending you an email when your score changes.

Also, some credit card companies have their own credit score app. Capital one has credit wise. Credit Sesame is also another one that I have. MY score dropped from 666 to currently 629 and I am about to purchase in a few months. Over the roller coaster credit score game.

Having an excellent credit score is so essential to all we do with cards (not to mention a mortgage, car loan, insurance, a job, etc.). An excellent reminder to cancel services you don’t use… don’t cancel the card expecting the services to be canceled as well. Use a service like AskTrim.com to help you keep track of subscriptions.

Absolutely!

Luckily, I’ve only had to explain it once so far. Hopefully it’ll be cleared up soon and in the past!

I was out of the country toward the end of last year. All of my cards are auto paid. However there was an annual feww that billed for $50.00 on one of my BOA cards. That ended up being reported late. I had a drop of more than 100 points. I had to call BOA twice and they made sure it was fully removed. I also have a very strong and seasoned score. Clearly there are flaws int he system where a charge of this size (or 6.00 in your case) coul cause a rop like this. SOmebody posted welcome to AMEX. BOA would o the same thing.

In future, I recommend VGCs for recurring payments.

That’s beyond frustrating. I hate winding up in scenarios where I end up paying because of someone else’s mistake! Good luck with the disputes.