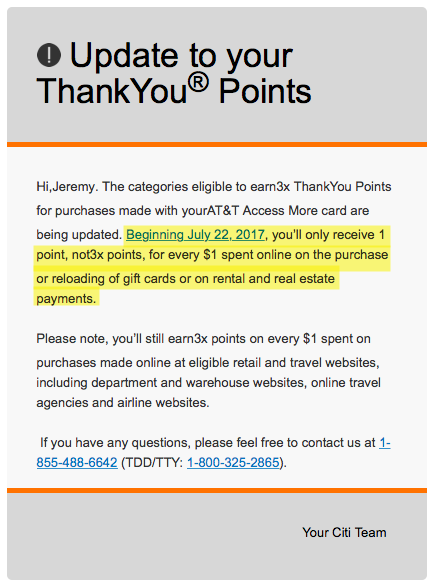

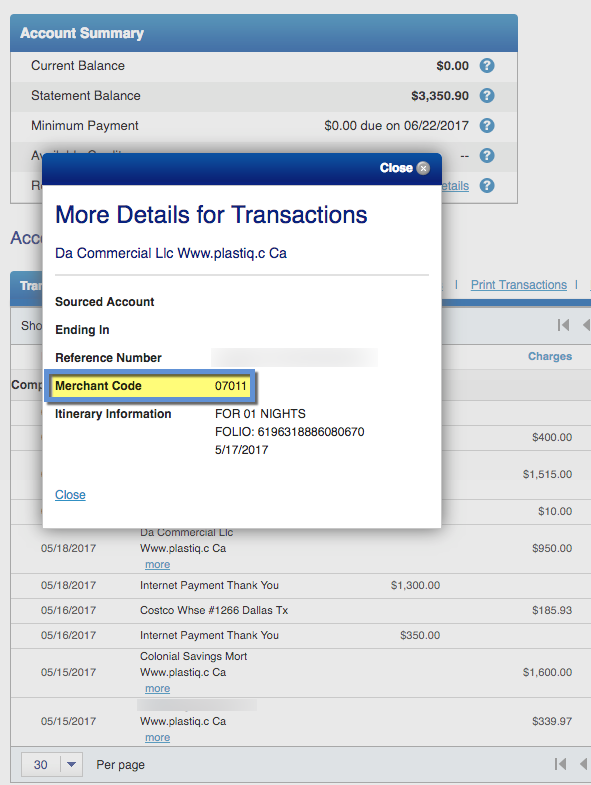

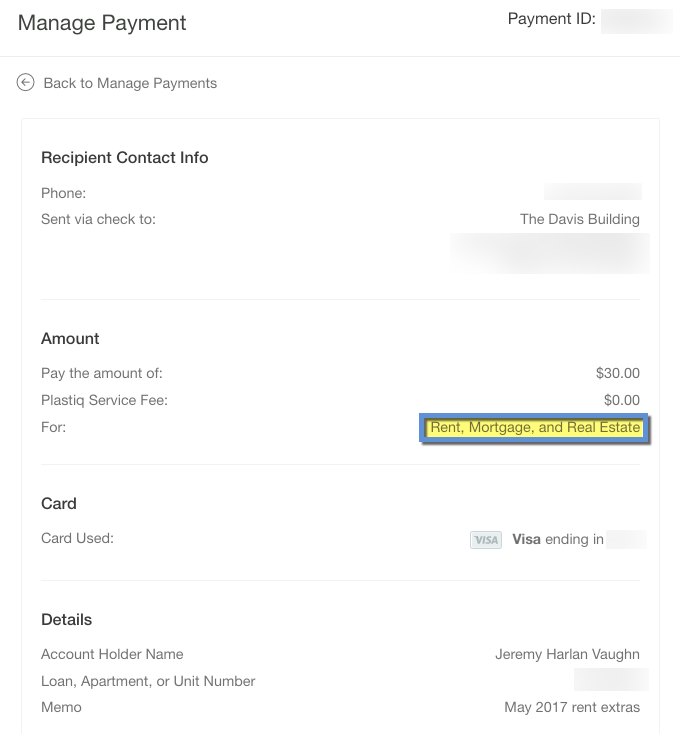

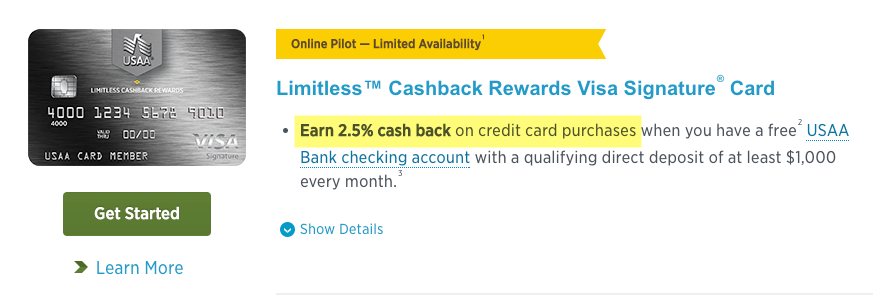

I am in a slough of despond. Following this morning’s depressing news that you can no longer use Visa cards for Plastiq rent and mortgage payments, I received the following email from Citi:

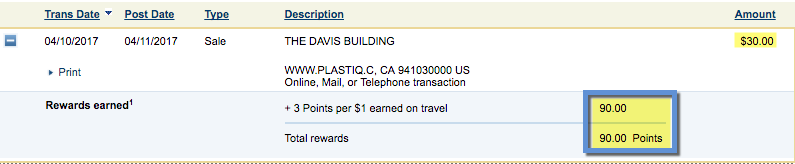

As of July 22nd, 2017, “rental and real estate” payments will only earn 1 point per $1 spent instead of the current 3X points. This was definitely going to be my backup for Visa cards.

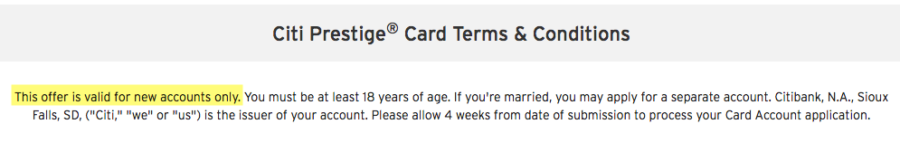

And, given that Citi Prestige is getting poopier on July 23rd, 2017, I am suddenly rethinking my entire relationship with Citi cards.