UPDATE: One or more of these offers are no longer available. Click here to see the latest deals! And Plastiq’s fee is now 2.75%.

I’ve come out of my slough of despair (kinda slash not really) following the news that Citi AT&T Access More cards won’t earn 3X on rent and mortgage payments starting July 22nd, 2017. And the Chase Sapphire Reserve trick stopped working, too – although I’ve heard you can still make payments with it for 1X (AKA it does NOT code as travel).

In the midst of all this, Amex came out with a brand new card: the Blue Business Plus (learn more here). And it holds some promise for payments with Plastiq. Of course, the numbers aren’t as good as they once were. But you can earn 2X on the first $50,000 spent per calendar year on the card.

I got the card last week. And starting next month, it will be my go-to for Plastiq payments. Because I still want the points.

Here’s a look at how it works, by the numbers.

About the Blue Business Plus Amex

- Link: Blue Business Plus Amex – learn more here

So there are a few “Blue” Amex cards. This one’s called the “Blue Business Plus” and is a brand-new card in the Amex lineup.

There’s no annual fee – so it’s free to keep forever. Because it’s a small business card, it won’t show on your personal credit report – and therefore has no bearing on your Chase 5/24 status. And for that same reason, you need to have some quantifiable business income.

You get 2X Amex Membership Rewards on the first $50,000 you spend per calendar year on the card. So it’s a great card for non-bonus spending (which Plastiq payments are now). That’s good for an extra 100,000 Amex Membership Rewards points per year.

My experience getting Blue Business Plus Amex

Firstly, I didn’t get a hard pull when I applied. Which is awesome. This is my 5th Amex credit card – so I may be at my limit there (my others are SPG personal and biz, Hilton Surpass, and no AF Hilton).

I was instantly approved… with a $2,000 credit limit, which isn’t much.

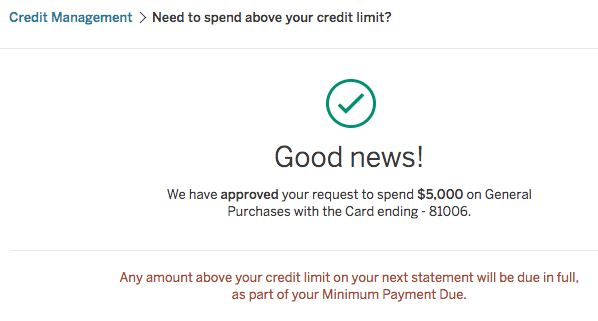

Luckily, this card has a feature where you can “spend above your credit limit.”

I checked what would happen for a $5,000 charge, and they said no prob, bob. That’s good, because my rents and mortgage are more than $2,000 a month. The hitch is, you must pay off the amount above your credit limit at the end of each billing cycle. Also not a problem – I do that anyway. So far, so good.

Worth it for Plastiq payments?

- Link: Sign up for Plastiq (Get $500 in fee-free payments)

So I spend about $4,500 on my various rent payments. Which is $54,000 per calendar year – literally perfect for the 2X points on $50,000 in spending each year.

But, Plastiq has a 2.5% fee for payments, Previously, this was worth it at 3X because the value of the points outweighed Plastiq’s fee. How does that scale down to 2X?

I value bank points for at least 2 cents each – period. So the 2X is worth 4 cents, or like getting 4% back.

After Plastiq’s fee, you come out ahead by 1.5% if you value your points similarly (4% – 2.5% = 1.5%).

If you max out the spending threshold on this card, you’ll pay $1,250 for 100,000 Amex Membership Rewards points ($50,000 X 2.5% fee).

So it is worth paying $1,250 for that many points? I value 100,000 points at $2,000 in travel at least. But with that amount, you could easily come out way beyond, with an international Business Class ticket, for example.

Even on the low end, you come out ahead by $750 ($2,000 – $1,250).

Is that as stellar as it was before? Of course not. But considering the card has no annual fee – and that the points will likely be worth much more – it’s still a good deal to use this card for Plastiq payments.

Another way to look at it is, you’re paying roughly 1.25 cents per Amex point (100,0000 / $1,250). If you redeem them for 4, 5, or 6+ cents each, you come out ahead. And that’s certainly not impossible.

So while it’s not as amazing as it was before, it’s still worthwhile.

Bottom line

- Link: Blue Business Plus Amex – learn more here

The Blue Business Plus is now the best card for Plastiq payments. For a card with no annual fee that doesn’t affect your Chase 5/24 status and might not even incur a hard pull on your credit report – I must say I’m pleased with the card overall.

The value proposition really fades for 1X (unless you’re meeting a minimum spending requirement). But at 2X, it can still be valuable.

The days of 3X were pure gold – and I’m sad to see that go away. But we knew it would, one day.

Anyway, that’s my plan moving forward. Does it sound like a good one? Or is Plastiq totally dead now? I’d love to hear your opinions on this!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

But how much would you have been willing to pay out of pocket for that $2000 in travel or the business class ticket that you redeem the points for? The difference between the $1200 you spend on those points and what other method you would have used to get that FC/BC ticket is really the value of the card, since I’m pretty sure that you – like nearly everyone else in this hobby – would NEVER have considered paying full fare for that ticket. While the card may indeed reduce the cost of your miles because it had no fee, etc., it’s only offsetting costs you would have spent elsewhere.

True enough, but even that is worth it to me. Everyone values their points and miles differently, but all things considered, it seems this card is the best possible deal for Plastiq payments right now.