It finally happened – I had to file a claim to use my card’s collision damage waiver benefit. I knew the day would arrive sooner or later.

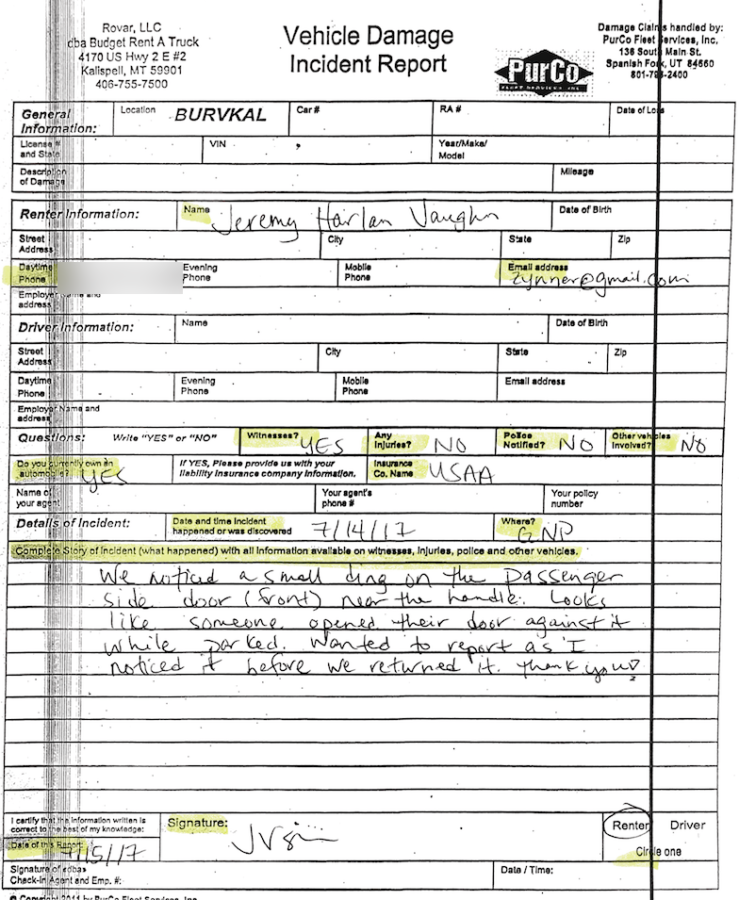

After I hiked down from Granite Park Chalet, I found my rental car had a little *DING* on the front passenger side door. The parking lot was packed, and it was obvious someone parked too close and opened their door too hard into my rental car. It was nearly imperceptible to the point where I thought about not saying anything about it.

But, I was responsible and filed a proper report when I returned the car. I wasn’t expecting to ever hear anything about it again. Until one day, I got a random call saying they filed a claim against me. In a near-panic, I filed my own claim online through Chase in just a few minutes.

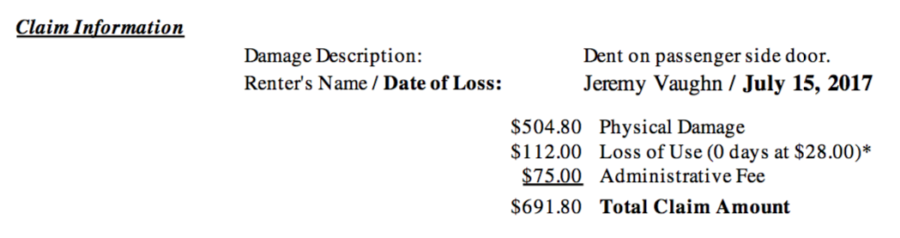

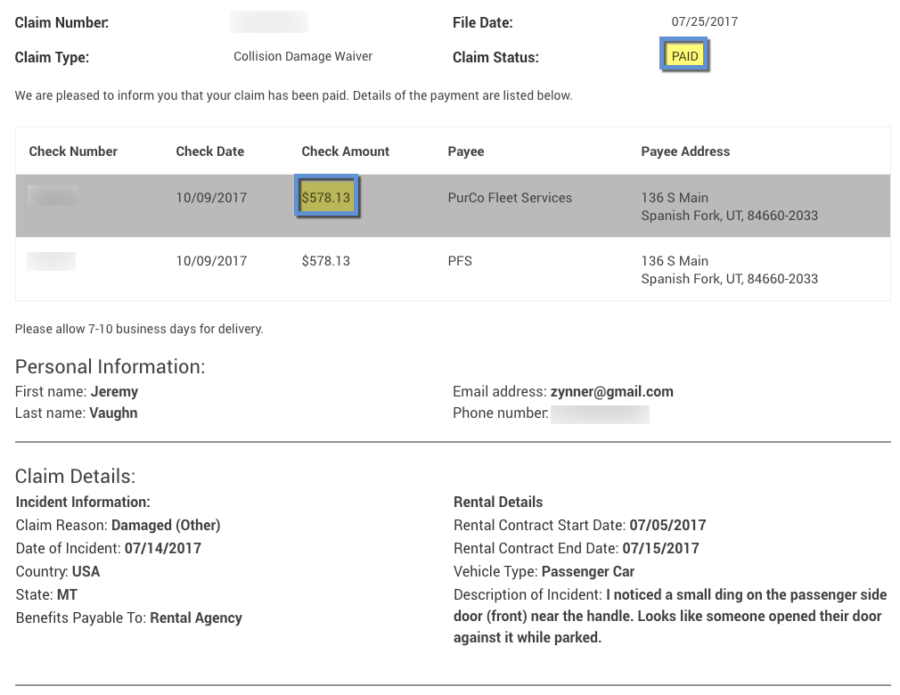

THANK GODS I waived the CDW and put the charge on my Chase Sapphire Reserve card. Taking those small steps saved me nearly $700 – for a little ding on a car door.

Chase Sapphire Reserve Primary Rental Car Insurance

I always ALWAYS use my Chase Sapphire Reserve card when I pay for rental cars. I’ve never been involved in an accident – touch wood – but in case anything ever happens, I want to use the primary car rental insurance so I don’t have to involve my personal insurance company.

Again, nothing major has ever happened. But I noticed a ding on the car door of the Chevy Malibu I rented from Budget in Kalispell, Montana.

Here’s a closeup:

And here’s the report I filed:

Lo and behold, they ran with it.

They filed a claim against me for nearly $700! For that little ding!

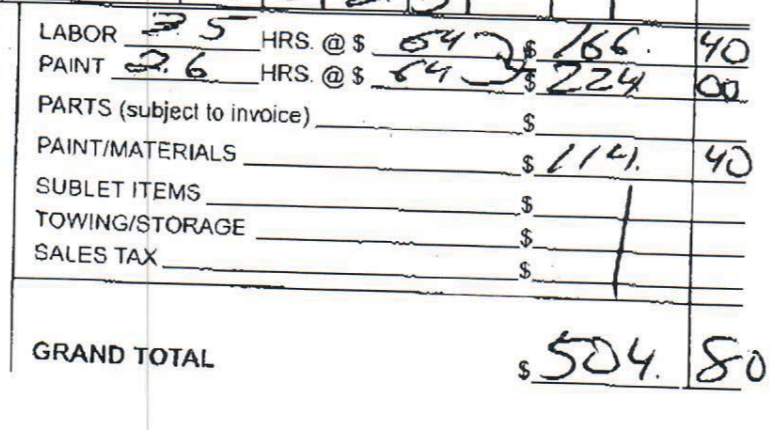

I find it hard to believe that little ding took 3.5 hours of labor, 2.6 hours to paint, and $114 for the paint to cover it up. At a cost of $505. Oh, plus “loss of use” to the car rental agency.

But… whatever.

I filed a claim electronically and uploaded my:

- Photos of the car

- Rental car agreement

- Credit card statement showing the full charge on my Chase Sapphire Reserve card

- Original reservation made via Priceline

- The report I filed before I flew home

Luckily, I took photos of EVERYTHING including the documents I filled out BEFORE I let the rental car desk agent run off with them.

I didn’t hear back until recently – nearly 3 months later!

Chase/Visa worked with Budget/Budget’s claims department to wrap this up behind the scenes without my involvement. They sent out a series of checks for all the fees.

Now, it’s been totally taken care of behind the scenes – with a few minutes of gathering documents and uploading them as my only requirement. And if it costs nearly $700 for that little ding… well, I can’t imagine how much they would’ve claimed for something much larger!

The habits I’ve developed with rental cars

I have a set routine when I pick up and return a rental car. For one, I use Evernote to scan all the documents. And to take a zillion photos of:

- The car’s exterior

- The gas level

- Mileage

- Tire level

- All documents

- The car in the lot at pickup and return

- The gas level upon return

- Because all of these are timestamped!

This way, if I ever have any issues I can simply find the photos and use them as proof. And because they’re in my Evernote account, they don’t take up space on my phone. I can retrieve them when and if I need them – which I never have until now.

But thankfully, I had photos to prove everything. And I will always use a card with PRIMARY car rental coverage!

Chase Sapphire Reserve to the rescue

- Link: Chase Sapphire Reserve

The annual fee on this bad boy is $450. Ouch, right?

But after the $300 annual travel credit, I see it effectively as $150 per year. I’ve written about why I got it and how easy it is to recoup the remainder of the annual fee with bonus category spending.

The card also comes with primary rental car insurance. In my eyes, not having to pay that $692 charge covers the annual fee for nearly 5 years ($692 / $150)!

I will continue to use it for every car rental for perpetuity. Not only for the coverage, but for the efficient way it was handled. Everything happened behind the scenes. I was only aware of anything at the beginning (when the claim was filed) and end (when the claim was closed).

Had I been involved throughout the process, I can’t imagine the level of stress I would’ve put myself through. For that alone, the Chase Sapphire Reserve is a forever keeper. If not this one, always always use a credit card with primary rental car insurance – I have seen the light!

Seriously though, what if I:

- Had been in a real accident

- Used another card

- Didn’t have photos and docs pre-scanned

- had to deal with it on my own, knowing nothing about the process

Anyhoo, the coverage is up to $75,000 per vehicle – and no car I’ll ever rent will be worth more than that. So that’s plenty for me.

Bottom line

I knew something would happen to a rental car of mine sooner or later. With the frequency I rent them, it was a numbers game. I’m just glad it was this minor and this easy to resolve. And shocked it would’ve cost nearly $700 to repair a little ding like that!

It’s also completely convinced me to always ALWAYS pay with a card with primary rental car insurance, like the Chase Sapphire Reserve. I found the claims process quick and painless – only a few minutes of my time required. Grateful and thankful Chase and Visa made it so easy to use the benefit!

I also wonder – was the rental car agency milking it because they knew Chase/Visa was paying it and not me? Or that I wouldn’t fight it at that point? I’ll never know, I suppose. But wow – ridic!

This was my first and hopefully last time ever dealing with the collision damage waiver benefit on my card. It’s one I’m glad to have but hope to never use again.

Have you ever had to file a claim to pay for rental car repairs? Was it as easy as mine? Would love to hear other experiences (and I’m sure other readers would, too)!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

i had the same experience with my diners card when one of the parking lights was damaged in a parking lot. i returned the car, filed a report, sent it to diners, and that’s all i ever heard about it. it wasn’t even charged to my card. diners and hertz dealt with it. whenever i think about cancelling my ancient, overpriced diners card i remember that incident.

Insurance is there for peace of mind and that’s exactly how I’m looking at it, too. That makes it all the more worth it to keep around. Glad to hear you had a similar and easy claim – very reassuring. Thanks for sharing!

What would have happened if you hadn’t filed a report? Did someone check your car when you returned it?

Sigh, I guess I’ll never know. But I assume someone would’ve checked in. With this rental return, you just park and return the key to the desk. So no one looked when I got back to the airport.

Would the Saphire Preferred also cover it?

Yes, it would! Any card with primary rental insurance would work in this case – including that one!

Not sure if I was reading their “estimates” correctly but their math looked……. questionable.

Also, I feel they were probably trying to milk you on that repair. I used to have the same car and got into an incident or two involving poles in a parking garage. My dealership’s body shop charged less than $50/hr for labour and a lot less than that for painting a much larger area.

Yes, it’s definitely questionable – that was my thought as well. But since I didn’t have to deal with it, I didn’t look too closely. If they wanted me to actually pay, though… I would’ve definitely fought and questioned all of that. I’ve never had a repair like that before, but $114 to paint an area the size of a dime does seem like…a stretch lol.

Thanks for weighing in! I definitely agree with your thoughts here.

Harlan,

Words of caution to you or anyone when renting from Budget. Last year i had reserved a car at MIA but after dealing with an extremely rude CSR I canceled my reservation and walked over to National and rented a car from them. Well you can imagine my surprise 2 months later when I got a bill for $579 from Budget stating I had damaged one of their cars. When I tried to call them Budget kept referring me to the auto body shop i was receiving the bill from. Finally after weeks I was able to get someone from the Budget corporate office to assist me. #neverbudget

Wow, that’s incredible – and not in a good way! Thanks for sharing this word of caution!