Also see:

- Is the Citi AT&T Access More Card + RadPad a Viable MS Option?

- I’m Prestigious! Getting Citi Prestige and First Impressions of the Card

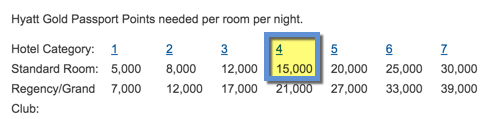

Hello from sunny and HOT Martinique! I’m at Hotel La Pagerie (which I booked with the 4th night free through Citi Prestige).

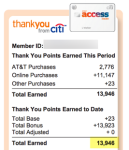

Quick update because I just received my first statement on my brand new Citi AT&T Access More card.

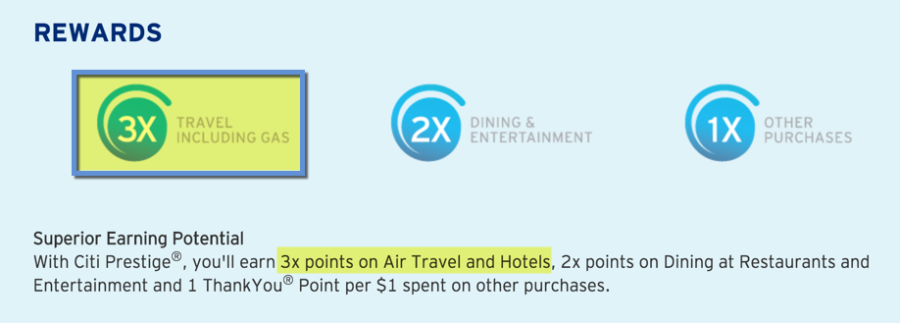

I didn’t go for the Citi ThankYou Premier to get the full 3X on all travel including gas. Instead, I hedged my bets and got the Citi AT&T Access More card.

The main draw for me was paying rent through RadPad and earning 3X Citi ThankYou points.

And because I also have Citi Prestige, each point is worth 1.6 cents toward American Airlines flights (including codeshares). So even with RadPad’s 1.99% fee, I’d still get close to 3% back of value (4.8% – 1.99% = 2.81%).

Which is awesome – and better than a 2% cash back card obvi.

I outlined the numbers in detail here. And commenters on both Doctor of Credit and Reddit said RadPad earns 3X Citi ThankYou points per $1.

But I just had to confirm it for myself. It really does!