Also see:

When my little brother (he’s 24) told me he wanted to get a place with his girlfriend – their own place – the first thing I asked was, “How’s your credit?” because I knew they’d check.

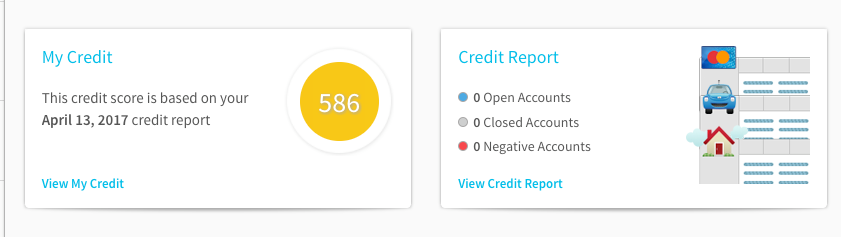

He didn’t know. When we checked, his score was a dismal 586. It wasn’t because he had bad credit. But because he had no credit at all. Literally, zero accounts ever in his life.

I think I have 30 credit cards by now (?), a paid-off auto loan, and about to have two mortgages. With regard to my brother, hopefully I’ve helped create a path to his own points and miles journey.

But first things first.

Address matters when you add an authorized user

We don’t live together. He’s in Memphis, and I’m in Dallas. So I wanted to get him a card with a bank that DOES ask for a Social Security Number for authorized users.

Citi and Chase do NOT ask for this information. Without an SSN, the account can still appear on the authorized user’s credit report provided the addresses match – which ours obviously wouldn’t (unless I said he lived with me). Even still, I didn’t want to wait for the pairing to happen on the back end.

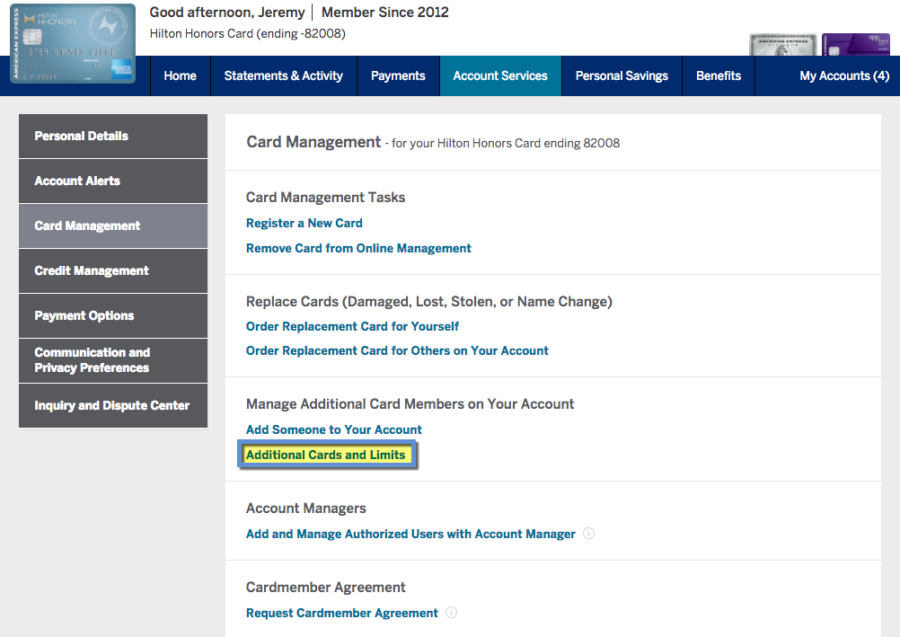

Amex, Bank of America, Barclays, and US Bank DO ask for an SSN for an authorized user account – perrrfect. I added him to my Amex Hilton account because the card was new and the statement was set to close the soonest.

Plus, the address thing didn’t matter because I tied his SSN, and therefore his personal credit report, to the card.

Amex has the best authorized user controls

With most banks, you can’t adjust the spending limit on an authorized user’s card. Meaning they have access to your entire credit line.

Bank of America and Chase let you set spending limits on employee cards if you have a small business card with them. But Amex is the only bank that lets you set controls on personal cards.

You can also set an alert if the user approaches their limit. This is helpful to know when there’s a lot of activity on the card.

When the card arrives, the authorized user can create their own login, and get access to Amex Offers. You can NOT link the new card to your existing Amex account. You have to create a new one if they want access. Although you can still make payments and see the charges in your own account.

What happened after a month

After the statement closed, I wondered if everything had “plugged in” correctly. And asked my brother to pull his updated score from Credit Karma.

Between April 13th and May 18th, his score went up over 100 points – to nearly 700! I wasn’t expecting it to rise so high that quickly.

As of now, the authorized user card is his only account. And even though I set a spending limit on the card, the credit report shows the entire credit line – which is a nice side effect.

He probably can’t open his own credit cards with only one account on his report. And I thought it may not be enough to get an apartment. But the landlord said they only look at the score – and as long as it was “good,” that’s all they wanted to see.

He got the place and they’re moving in this weekend. Now I’m wondering how long before I can sign him up for a few Chase cards (of course). Although I’m thinking a secured card might be the way to go for now?

Should you do this?

If you have kids, or someone you really trust, it’s nice to get them started early with a good credit score and well-aged accounts. Looking back, I wish I’d added him to one of my cards years ago.

Just remember, whatever charges they make on their card, YOU are ultimately responsible for paying. Yup. Even though they can make their own payments, if they don’t, it’s your credit that’s ultimately on the line.

Giving someone a boost to their credit score is awesome if you can do it. Go for it, just be responsible.

Bottom line

I wanted to boost my brother’s credit score by adding him as an authorized user to one of my cards. Well, it worked – his score shot up over 100 points within a few weeks.

I’m hoping this is the beginning of a journey to responsibly use credit and eventually get him on the points and miles train. 😉

He had nothing on his credit report before this – good, bad, or otherwise – so I don’t know how much it would’ve helped if he’d had derogatory marks. But, I’ll keep him on the account – the card is free to keep anyway – and that’ll help to age his account over time. If it goes up to 720ish, I might see if I can get him a card of his own.

Wanted to share this – thought it was really cool. Has anyone else had a similar experience helping someone’s credit score by adding them to an account?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Nice! I have a brother that’s 27 and I’ve been hounding him for years to get a credit card to establish some credit activity, but he’s always been coasting through life. A month ago he tells me he got a full time job (the first job he has ever had by the way) and he wants a CC. I was so proud of him! Referred him for Freedom a few weeks ago but haven’t heard from him since.

I was thinking Freedom or Discover It… hopefully we’ve planted the seeds lol

I added my niece to 3 AMEX cards over about 5 months. I live in Virginia, she lives in Florida. The cards came to my house. She doesn’t have possession of any of them. Her score went up 100+. Situation very similar to what you’ve described with your brother.

Ain’t that cool! Good on you for helping her score increase. Here’s hoping it helps long-term, too.

I like it!

Me too! 🙂

Can Chase AU set up their own profiles and see their spending and make payments?

They can make a payment over the phone but can’t set up their own account. :/

It appears that if the score and history appear on the report so positively that your brother could therefore bypass secured credit cards. There may be some benefit to becoming a “US Bank” customer if U.S. Bank doesn’t have local branches to him, wait a few months.

That’s my hope too. I want to help him build his credit so that might be a good route.

You realize credit karma is FAKO and meaningless right…?

I do, but it’s a nice guideline. I’ve found it to be pretty similar to my FICO score.

In this case, I’m happy for any increase in his credit score at all, so thought it was good by this metric, too. 🙂

Hello Harlan,

Nice post, I have a very quick question. I am new to the States and my brother has a credit score of 730. I want him to add me as an authorized user on one of his credit cards.

You said you did the same for your brother and his score went up over 100 more points. My question is what are kind of expenses he made for that month that made his score higher. Was it just any expenses or bills as long as he didn’t exceed the limit? I am just quite confused here.

I actually didn’t spend anything on the card! Just opened it and left it – easy as that!

But yes, using the card for small expenses is a good idea if you can swing it.

For those that added and AU to thier AMEX card and saw a score jump, were any of those “charge cards” as opposed to their credit cards? I was wondering about the score jump even though the “charge cards” have no preset spending limit and AMEX doesn’t back date the credit history. They instead show up on an AU’s credit report as a new account based on the day they were added.

Hello – any insight into how adding an AU to a regular AMEX charge card – as to the AU’s credit report view – would be appreciated…

How long till it shows up?

What sort of effect does an AMEX Charge Card have on an AU’s credit, if AMEX doesn’t report any credit limit, and the account shows as “new”?

Any effect?

Or just aging their average of their account ages down ( not good for the AU ) …

How is this measured by Experian’s score models, if it doesn’t report the limit, and the balance is zero every month?

Hey there! I’m not sure what the impact would be with a charge card… but it should show up within a month or so. The balance as zero every month should, if anything, have a positive impact. I’ve only done this with credit – not charge – cards, so can’t definitively say. Might be worth a try unless you think it would have the opposite effect and cause the AU’s credit score to go down.

Tbh … lol, this test scenario is probably best left to someone who has time and funds in their accounts to not “need” to utilize an AU strategy in the moment lol!

Maybe one of your future readers can try this and report back…

Or maybe I will after I clear the current hurdles towards getting my 7-years-of-perfectly-paid-on-time-business-and-personal-credit-cards-and-credit-lines-but-still-getting-declined-by-the-lenders-issue, fixed…

🙂

I have a situation where I am 100% perfectly paid, 7 years and counting, but carrying a 79% Debt to Available Limit Ratio on my Revolving Credit lines debt load, and need to obtain a 100k business loan for my business – to get us to the next chapter in our 19+ year history of still going and growing 🙂