Happy New Year! I thought I’d hop on the bandwagon with the predictions. So here’s my effort.

2015 was a crazy year

- The Chase British Airways Visa became worthless

- The US Bank Club Carlson Visa became worthless

- The Barclaycard Arrival Plus became worthless

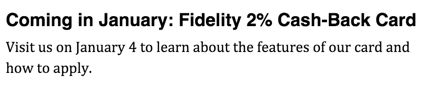

- The Fidelity AMEX went the way of the dodo (new card coming January 4th, 2016 – in 3 days)

- American Airlines miles finally dropped 1 of their dirty little shoes (is NOT the knight in shining armor)

- Citi Prestige became the most interesting card in town

- Hyatt pissed a lot of people off, pleased others

- REDbird died

- PayPal My Cash + RadPad rages on for easy MS

- IHG had a whole bunch of semi-interesting promotions

- Citi introduced Smart Savings, redefines “failure to launch“

- Discover It was/is so worth it for the 1st year double cash back promotion

Out and Out’s Points and Miles Predictions for 2016

And 2016 looks to continue to madness. My predictions to throw into the mix are:

1. Citi will add American Airlines as a ThankYou transfer partner

It’s time. American Airlines miles will be worth much less in a few months. So why not make them easier to earn? But that devalued currency into circulation, baby!

2. American Airlines will “get in bed” with Hilton

A la Delta and Starwood, or United and Marriott. It makes sense, they both have Citi co-branded credit cards. And you know it’s allll about the banking relationships.

3. AMEX will step up the Platinum Card’s game, finally add bonus categories

AMEX is dying. They need to compete with Citi Prestige, which has 3X and 2X bonus categories already.

Plus, AMEX took a lot of terrible blows to their brand in 2015 (loss of Costco, Fidelity partnership possibly over, increased competition, generally dated benefits on their cards [you dropped forex fees on the SPG card? welcome to the century!], will lose SPG to Marriott/Chase, loss of American Airlines lounges, pressure from Delta to worsen Delta lounge perks, etc. etc. etc.).

I feel a revamp is not only coming, but completely necessary if they want to remain a player.

4. Citi Prestige will get a little less shiny

I’ve been tracking my numbers since I got the card in November 2015. In just 2 months, I value the perks at an astonishing ~$1,600.

That rate can’t sustain itself forever. I predict Citi will claw something back from this card. I don’t know what they’ll target, but something will have to give.

And people will criticize them greatly for doing it, probably even me.

5. Fidelity and Schwab will compete in the cashback arena

These rumors have been swirling for over a year now. 2016 will be the year of cashback cards. I’m excited to see what both banks bring to the table.

Fidelity will want to keep their engaged customers.

And Schwab will want to A). freshen their brand and B). take some market share.

Let’s have it.

6. All 3 legacy airlines will make the exact same positive change

It’s been a race to the bottom, but it can’t get any worse… can it? (Jinxies!)

I predict one of the airlines (probably Delta) will actually add or revalue something, be it elite status, award chart sweet spot, or something else… and that United and American will hop right on it, too.

7. Hilton will step it up a bit

Again, it’s just time. They’ve been riding along just fine, but it may be time for some sort of Hilton renaissance.

Maybe they’ll add elite benefits, reconfigure Diamond status, add another elite tier, or tinker with HHonors. I think they’ll change something, and it’ll be for the better.

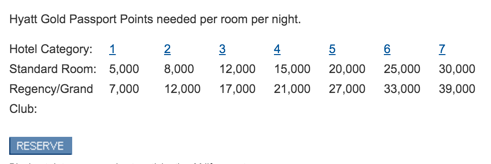

8. Hyatt (and thus Chase Ultimate Rewards) will devalue

Hand-in-hand with #7, Hyatt will finally make a big ol’ “enhancement” to its unsustainable award chart. Oh, peeps will howl when they see the new chart. It will be Hilton-esque in its destruction.

It will come right along with Marriott figuring out how to fold SPG into the mix. And for a while, both chains will suck.

Ultimate Rewards will not look as good, and Chase will just let it ride to 2017 while everyone complains about it. Then in 2017, they’ll finally get their act together.

9. Manufactured spend won’t be worthwhile

MS will become like mileage running – good for specific situations, but generally no longer worth it.

10. There will be at least 2 SCREAMING flight deals

I’m talking $300 to Europe r/t in Business Class level of good. It will be either an unintentional “sale” where lots of discounts get stacked, a good ol’ fashioned “fat finger” mistake, or simply just an incredible deal. Look out for this to happen at least twice, and be ready when it does.

11. Barclays and BofA will stop sucking so much

No one wants to be the underdog forever. I expect Barclays and/or Bank of America to really pull out the punches with at least 1 rock-solid card or promotion this year. Maybe the 50K Alaska Airlines card will make a return? Hopefully it’s something even better.

12. Club Carlson will do something to remain relevant

Forget airlines. Watching the hotel chains was a blast in 2015! Club Carlson basically imploded due to an unsustainable BOGO promotion.

Wyndham is coming back to life. SPG is about to get butchered. Hyatt bungled their promo good, too.

Club Carlson will surprise everyone and figure out a way to get back on everyone’s radar. I think they enjoyed the spotlight while they had it, and miss having it. It’ll be with a great promotion everyone will love, but nowhere near their BOGO levels from 2015 and earlier, sadly.

13. Southwest will finally add more T&Cs to the Companion Pass

And it will sting. It’s been very easy to get forever by now.

In 2016, Southwest will finally tighten the rules to make the Companion Pass something you have to earn.

14. British Airways will keep fuel surcharges

There was a moment where I wondered if they’d finally nix them. But nah, they’re here to stay.

Fuel barrel prices will continue to be very low, and everyone will keep fingering British Airways over the junk charges they add to their award tickets.

British Airways will smirk right back, shrug, and continue to keep them. Too bad.

15. An international airline loyalty program will gain new prominence

I’m thinking Qantas… or Copa… or one that’s currently under the radar. They’ll do something super pro-consumer, like add a transfer partner, update their award chart, or join an alliance, and it’ll be very good for a lot of peeps. Maybe when Aer Lingus joins Oneworld?

I dunno when or how, but there will be some airline loyalty program that lots of people switch to in 2016.

16. United Airlines will actually improve

Yes, they’ll finally clean up their act a little, and maybe gain some respect. Delta will continue to kill it with their fantastic operations and smug demeanor.

American Airlines will hit a period of “what the hell am I doing?” now that the merger is mostly over and the new award chart is out. And they’ll kinda suck while that all happens.

United Airlines will get a chance to breathe and catch up, and actually start to be a customer-friendly airline. You know, like their ads claim they are.

Bonus: Alaska Airlines will steal the show

The little engine that could… will. Will what?, I dunno. Maybe they’ll simply continue as they are, which is good enough.

While the legacy airlines duke it out, and Alaska Airlines will reveal itself to be a workhorse airline. They’ll add improvements to their planes, credit cards, route network, and loyalty program quietly, behind the scenes. And at the end of 2016, everyone will be Team Alaska.

Bottom line

Any way you slice it, I guarantee surprises are in store. Some will be good, some will be bad. Ya know, like every other year. :p

Anyone agree? Am I way off? Wanna add predictions of your own?

Sound off in the comments – I wanna know what you think is on the horizon for 2016.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

[…] And, I don’t expect Alaska to make big changes to their program in 2016. […]