The other day, when I wrote about my experience booking a hotel room in Martinique, I pulled up the Mercez app to see what exchange rate I’d get on $1,118 Euros with the Citi Prestige card.

Lots of cards advertise “no foreign transaction fees” which means they don’t add extra fees to the amount they convert.

But what’s interesting is not all banks convert cash at the same rate.

The amounts can add up, especially if you spend a lot (or live) abroad.

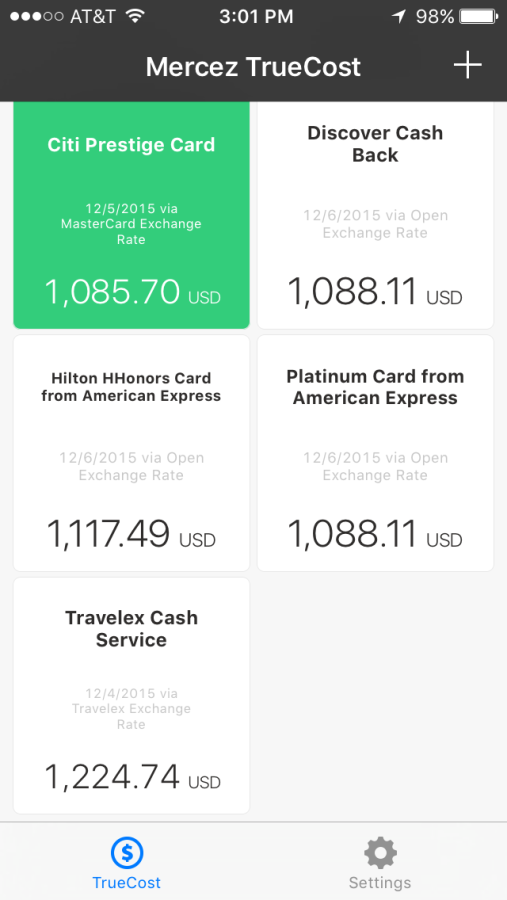

Rates according to Mercez

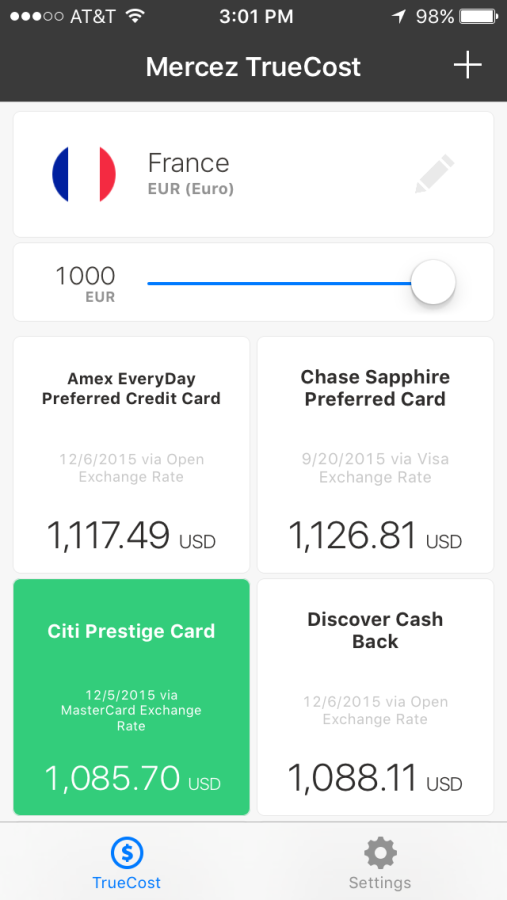

For simplicity, let’s look at the exchange rate of 1000 Euros into dollars.

According to Google, you’d spent ~$1,088 if you on a purchase of 1000 Euros.

A 3% foreign transaction fee (FTF) on that amount is an extra ~$33, so it’s easy to see why people want to avoid paying them.

Even if there are no FTFs, the bank that issues your card won’t necessarily give you the going exchange rate.

Mercez is a slim iPhone app that lets you plug in your cards, and tells you the final cost in USD of various foreign currencies.

Because I’m heading to Europe soon, and paying for a hotel room in Martinique (it’s on the Euro because it’s a French island), I wanted to see which could would give me the best rate.

I plugged in:

- AMEX EveryDay Preferred (which includes the card’s ~3% FTF)

- Chase Sapphire Preferred

- Citi Prestige

All of the cards have different bank exchange rates.

The best exchange rate comes from Citi Prestige, which is lucky because I’ll save money and get the 4th night free in Martinique.

Update 12/13/15: I confirmed via Twitter with Mercez this issue has been resolved. I still recommend checking Mercez for large purchases abroad, or if you plan on staying overseas long-term.

But surprisingly, the Chase Sapphire Preferred actually had the worst bank exchange rate – a full $41 more than Citi Prestige.

Mercez includes FTF fees in its calculations. You can see the difference between the AMEX Hilton and AMEX Platinum is ~3%

That’s because each card handles the exchange based on different issuers.

For example, the Chase Sapphire Preferred transfers are processed by Visa, Citi Prestige is processed by MasterCard, while AMEX handle the exchange for their own cards.

Even still, using a credit card for foreign purchases is still better than exchanging cash.

In this case, you’d spend a full $140 more than the best credit card exchange rate (Citi Prestige) if you had to exchange your US dollars into Euros.

Bottom line

While I like the idea of “no foreign transaction fees,” that’s only the beginning. Each bank has its own exchange rate. And who processes the transaction also influences the final amount you’ll pay (Visa, MasterCard, AMEX).

The Mercez app for iOS is all of ~9MB, so it hardly takes up any space on your phone. It supports nearly every card you can think of, and tells you this information for whatever amount you want to spend.

It’s worth a download if you spend a lot overseas, or if you plan an extended trip. Lots of transactions can really add up over time.

Anyway, thought this would be interesting to share. For real road warriors, I’d call this app a must-have.

Of course, it doesn’t take into account bonus points on certain categories. So even if you want a certain type of points, you still might be curious about how the bank exchange rate compares overall.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Date on Chase Sapphire and Prestige is different and hence the rate difference I guess

I’m not trying to defend Chase, but this looked odd; so I looked closely. NOTE: Chase Saphire rate is dated 9/20/2015, when 1 Euro was $1.1288. The others are from 12/06/2015.

Yes, I noticed that too. I’m going to reach out for an answer about that. Thank you for mentioning because it’s important!

Will update when I find out anything.

And thank you for reading and commenting!

Harlan,

I liked your article. I think it really does vary day by day though. When I checked the Chase Sapphire rate was worse that my other two no foreign transaction fee cards, but two days later it was tied with the best one. Maybe not worthwhile checking for everyday type purchases, but if I was making a big purchase in foreign currency, I might check.

Thank you, Kim!

Mercez just found a solution to the issue I mentioned, so this post needs an update already.

I agree, the app is useful for big purchases – or if you plan on spending a lot of time abroad.

Thank you for commenting!