I’m in holiday shopping mode, and enjoying the many shopping deals available right now.

If you see a good deal, maximize it even more.

For example, I ordered some stuff from The Body Shop today and stacked:

- 10% off from The Body Shop rewards club membership

- $25 off earned from the rewards club membership

Plus, I got a tote bag stuffed with products for $35… including a product I wanted that usually costs $36 on its own. And free shipping and samples.

Here are a few other ways to save before Cyber Monday sucks you into a shopping frenzy.

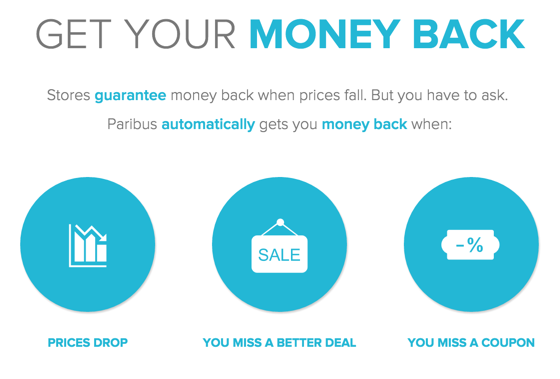

1. Paribus

- Link: Sign up for Paribus

Yes, I talk about this site a lot because it’s still largely under-the-radar but totally shouldn’t be.

Paribus scans your emails (and you can link it to your Amazon account) to check if the products you bought are eligible for a price adjustment.

If a lower price is found, they request the price difference on your behalf, and the money is refunded back to your card.

All of this happens automatically, and the only notifications you’ll get are when a better price is found.

They usually charge 25% of the price difference, but if you sign up with my link, you’ll pay 20% instead.

I like it mostly for Amazon, but lots of other popular merchants are supported, like Target, Staples, Gap, and NewEgg.

Get your money back if a price drops! Especially during the holiday season with so many sales going on. This is my #1 tip for online shopping this holiday season.

2. Giving Assistant for Amazon

If you shop at Amazon and can’t receive cashback for the category your products are in, help others instead.

Be sure to check Amazon on Cashback Monitor to see if you can get any cashback for what you’re buying. The usual categories are clothing, jewelry, and a couple of others.

You usually won’t find cashback on electronics, games, and most other random items.

The reason you should sign up for Giving Assistant is because you definitely won’t earn cash back on gift cards, but Giving Assistant has no category restrictions on the 2% charity donation.

Lots of folks are going to buy $1,500 worth of Amazon gift cards with their Chase Freedom thanks to the amazing 10% cash back (10X Ultimate Rewards points) at Amazon through the end of 2015.

On a $1,000 Amazon gift card purchase, you stand to gain either $100 cash back or 10,000 Chase Ultimate Rewards points.

Please please please use Giving Assistant to donate money when you buy Amazon gift cards. It costs you nothing, and you get $5 for signing up!

And clicking through Giving Assistant would donate $20 to a charity of your choice.

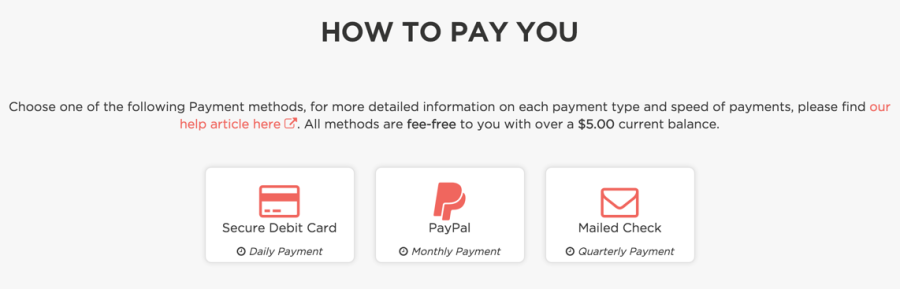

Plus, who knows, maybe one day they’ll add Amazon as a cashback category. There are over 1,000 stores on the website, and getting the cashback is very easy. Anything you earn is sent to your debit card.

Oh, and you get $5 for signing up, so it’s a total no-brainer.

I maxed out my Chase Freedom with Amazon gift cards. If you choose to do this, consider clicking through Giving Assistant to give 2% of your purchase to a charity. Helping others during the holiday season feels like the right thing to do.

3. Portals for everything

Almost every major portal has bonuses for holiday shopping. Commit to one and earn more miles, points, or cashback.

Here are a few popular mileage shopping portals, in no particular order:

Note that points earned in the Southwest shopping portal do count toward the Southwest Companion Pass.

Buy online as much as possible to earn the most amount of miles.

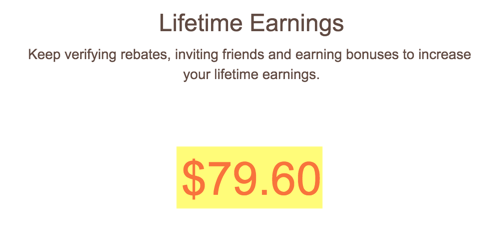

4. Ibotta for random stuff

- Link: Sign up for Ibotta

I went on a Costco trip, and then bought a few random items at CVS (including PayPal My Cash cards, but that’s another post), and earned a few bucks through Ibotta, which is an app where you submit your receipts when you purchase certain products.

It doesn’t seem like much, but since I first wrote about it back in June, I’ve earned nearly $80 pretty effortlessly.

The biggest downside is you have to manually “unlock” the discounts on each individual item, but this can be done after you buy them, and on a case-by-case basis. I usually just look over the app with my receipts nearby and unlock a discount if I bought an item with an offer. So I don’t really go out of my way to earn more money.

For a free app on your phone, earning a few extra bucks here and there is awesome!

5. Citi Price Rewind

- Link: Citi Price Rewind

This only applies for folks with Citi personal credit cards, like oh, Citi Prestige, but Citi Price Rewind can be a boon, especially during the holiday season.

You’ll need to register each item separately (and pay with your Citi card obviously), but it’s quite easy and can earn you a statement credit if Citi (or you!) find a lower price on an item within 60 days.

You can get up to $300 per item, up to $1,200 each year – and that’s per account.

If you buy anything with your Citi credit card (perhaps in conjunction with Citi Smart Savings), it’s a good idea to track it. Keep an eye out for sales too, because if you catch it, you can submit a claim with your own proof.

In my experience, it’s easy to get Citi to match a lower price – but most of the time it happens automatically when Citi finds a lower price for you.

A great idea especially for electronics, appliances, or big ticket items where you want more purchase protection or suspect it’ll go on sale either during the holiday season or right after.

Bottom line

Stack the discounts, save money.

It’s easy to get impulsive during the holiday season with all the spending involved.

Take a few minutes to set up a few things to save you money, mostly automatically:

- Paribus

- Giving Assistant

- Shopping portals

- Ibotta

- Citi Price Rewind

I’ve been combining shopping portals, category bonuses, discounts, promotion codes, and sale prices to save a heap – both on stocking up for myself, and on gifts for others.

There are lots of these types of services in the world, so feel free to tell me about any I missed.

Thank you guys for reading, hope you had a great Thanksgiving!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

[…] and remember to sign up for Paribus and Giving Assistant if you already haven’t – save money when you shop […]