Upon logging into my US Bank online account, I noticed something weird.

I have a decent amount of points from using mobile pay at Costco for 3X points (a 4.5% return because each point is worth 1.5 cents toward travel). And I have my Real-time Rewards threshold set to $10.

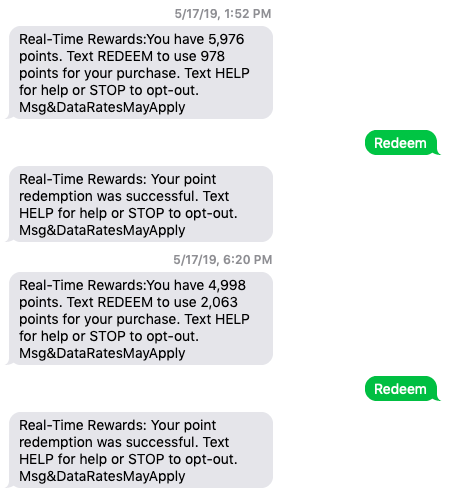

So when I make a travel charge over $10, I get a text asking if I’d like to redeem points to “erase” it.

Just say the magic word and your charge is gone. (The magic word is “Redeem”)

I used this for a few Uber rides recently. Great, great, love it.

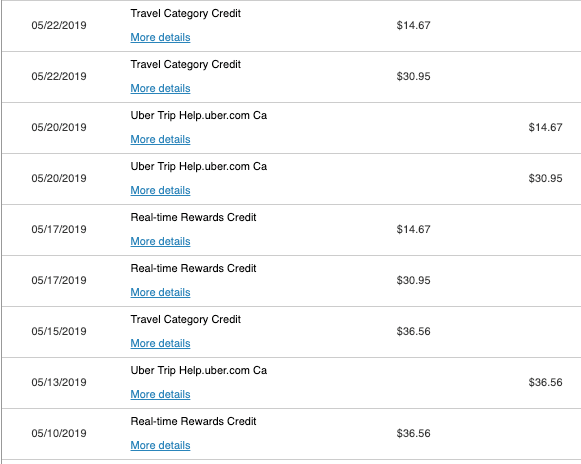

But then… I noticed my $325 annual travel credit had recently reset – and doubly covered the charges.

~$82 of charges got double credited – one from Real-time Rewards, the other from my travel credits

Not only did I redeem points for those charges, but somehow it ate up ~$82 worth of my travel credits, too. If I’d known this would happen, I would’ve saved my points.

So when your travel credits reset, DO NOT use Real-time Rewards to erase your charges. You’ll end up paying double!

Oh, and US Bank was beyond lame when I alerted them to what happened. So lame that I’m thinking of dumping this card altogether – after I drain the remaining credits and points, of course.

US Bank Altitude Reserve travel credits don’t play well with Real-time Rewards redemptions

I called to explain what happened. The phone agent didn’t pick up what I was layin’ down. I was like… basically, I used points AND my travel credits on a single purchase. I “paid” twice.

“Can you either put the points back in my account, or reverse the travel credit?”

Either would’ve been fine. Instead, they submitted a request to “research” it. And said they’d send a letter within 5 to 7 business days. Why should I wait a week to correct an obvious error? Whatever. Sure, that’s fine.

A week later, I got the letter. (Yes, a paper letter in the mailbox.)

It said they could not put the points back because I authorized the redemption, and there was no way to reverse the automatic travel credits. I should’ve kept it, but I was so miffed, I threw it in the dumpster next to the mail area.

I don’t understand why I had to wait a week, or why it wasn’t obvious to them I was double-credited.

While it’s only ~$82, it got me thinking about my overall card strategy. And something’s gotta give.

Smell ya later, sucka

Because I recently pondered if I had too many ultra-premium rewards cards with big annual fees. And also:

- I just upgraded to the Amex Hilton Aspire with 150,000 Hilton points and I’m so freaking excited because

- My Chase 5/24 status gives me a new Chase slot to play with next month

- I’m thinking about downgrading my Chase Sapphire Reserve and getting a new Ink Business Preferred

- And maybe one more personal card

Sayonara, it was real

I could probably push US Bank a little harder. But you know what? Nah.

I recently paid the annual fee on May 24, so I have time to use the remaining credits and points.

Then I’m gonna close it.

While I firmly believe:

- This is the best card for Costco shopping (and mobile payments)

- Its perks completely cover the annual fee

- Real-time Rewards are revolutionary

I don’t use it much beyond Costco. And if I have a Chase Freedom Unlimited, well, I can just use that to earn 1.5X Chase Ultimate Rewards points when I shop there.

Plus, yeah, I just got that Amex Hilton Aspire (click here), so that’ll keep me occupied in ultra-premium card land. Thanks to Frequent Miler for spelling out the upgrade deets (no hard pull, same account information, and won’t affect 5/24!).

Also, what a lame response from US Bank. I was an early adopter of this card and never had an issue with it until now. This was the first time I asked for help – and they told me to scram. So I’m walking out on my lil feets… and shifting my overall points strategy to:

- Citi ThankYou points and Amex Membership Rewards points for award flights

- Hilton points for hotel stays

- Chase Ultimate Rewards points for Hyatt stays here and there – I find myself moving away from UR points these daze (!), but that’s another post…

Bottom line

Def not happy that ~$82 bucks worth of my travel credit were wasted for nothing. If you have this card, be careful to avoid using Real-time Rewards until your travel credit is used up – otherwise you’ll use your travel credit AND your points for a single purchase.

I’ll prolly get Uber gift cards via MIleagePlus X to quickly eat up my remaining travel credit and points balance, and call it a day on this card.

I’m about to fall under 5/24 and can get new Chase cards, plus I just got an Amex Hilton Aspire card. If US Bank is gonna make it hard for me to use my rewards, I’ll take my business elsewhere.

Just a heads up so the same thing doesn’t happen to you!

I am also entertaining any thoughts about the “state of the game,” random travel observations, and bank customer service in general (😡) – hit me up with a comment!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

So basically you converted your points to cash (statement credit) at 1.5 cents per point. Use it to offset your Costco charges. What’s so upsetting about that? Seems like a no-brainer.

You only get the 1.5 cent rate on travel purchases. In this case, I got two statement credits for single purchases so that’s not cool. All good though, was the push I needed.

Why is getting double credit “not cool”? As long as you don’t get double charged for the actual charge, you’re not wasting the credit.

BTW, Does the travel credit work for Uber Eats? Or do they get coded differently?

You’re absolutely right – I just got this one completely wrong and posted before I realized what was going on.

I’m not sure about Uber Eats codes on this code at the moment as I no longer have it, but it definitely code as a dining purchase on my Citi Prestige, for what it’s worth.

FM said in a recent comment that it no longer works (https://frequentmiler.boardingarea.com/us-bank-real-time-mobile-rewards-what-works-where/#comment-2286202) and there’s a Reddit thread that says it stopped working about a year ago (https://www.reddit.com/r/CreditCards/comments/c963tn/uber_eats_doesnt_count_towards_travel_credit_for/). My hunch is that it’s probably considered a dining purchases and wouldn’t be eligible for the credit. Hope that helps.

Thanks for reading and commenting!

Glad you will be under 5/24 again. We will have to discuss card strategy at the next meet up. I need another one too!

Hey Edward! I’ll look at the calendar now and get that set up. I’m thinking Blue Mesa again. Will post shortly. Will be fun to catch up with you!

This was actually a great deal. For those travel charges you got reimbursed double what you spend. That gave you a negative net balance for those three purchases. So your statement total will be all your other purchases plus the travel and then minus the travel TWICE. I had the same thing happen and can confirm that getting double-credited left me with a net positive balance. This is a great deal. Don’t complain and don’t alert them to it.

I guess viewed that way, it IS a good deal. I just wanted to keep my travel credit to use later. I realize it’s crediting the balance twice. So nothing is lost – just didn’t know it worked that way. Would’ve saved the credit for flights or a hotel stay later this year and used it more strategically.

And yes, if you like getting double credit, by all means go for it! It does produce a positive balance. Thanks for comparing notes, Jeff! Always love to hear a different viewpoint. 🙂

Am in complete agreement that this is an overall positive. I pay rent and insurance via apps with mobile payment. The double crediting on Ubers that you mentioned has just offset part of those other non-Travel expenses that already earn 4.5% cash back.

For me it just means I don’t need to even think about this travel credit. Easy peasy!!!

I love USBAR even more for this convenience.

Take that Amex Plat credits!!!

I think y’all are changing my mind on the whole premise of this post! I’ve truly enjoyed the discourse!

AND

What apps let you pay rent and insurance with mobile payments? Cuz that… would really make me reconsider. *head exploding emoji*

I’m not clear on one thing, If you “wanted to keep my travel credit to use later” why did you use the redemptions in the first place?. It seems that you got the same value you were going for to start with (if no annual credit had been credited). You could look at it as you got the redemption of points you asked for and turned some annual credit to cash.

I didn’t realize the annual travel credits had already reset. I would’ve kept it for later and made a bigger purchase for $325+ to trigger it all at once instead of having to keep track of smaller charges like these. Just a personal preference, I suppose. Not a huge deal, but something to be aware of if you want to store your travel credits up for a bigger redemption later on.

And you’re totally right, that’s an excellent way of looking at it! Just wasn’t expected, that’s all. Would be the same end result either way, it’s just the timing/keep track of it.

Thank you for reading and commenting, Carl! What’s Always on the Road? Do you have a blog?

Before retiring last August I was just on the road a lot for IT work and happened to be looking for my own domain for personal email, etc. I was checking for availability and happened onto it. I don’t have a blog , but sometimes think about it.

I have built a good stash of points/miles and I now have time to use them. I likely won’t be able to earn as much and in as many ways.

I do think something is missing in the points/miles blog community. I rarely see any coverage of how retirement affects things. I am looking now at reducing cards (I have 26 and $250K CL) . I guess I also need to report lower income and not sure what step card issuer will take, so I want to pare down things on my own rather than card issuers doing their thing first. I guess I’ll see how things work with new cards / bonus opportunities and existing cards.

Why would you want to get the travel credit back rather than cash (if that had been an option)?

I do read but this is a stupid post and a stupid reason to cancel – for reasons already articulated by others. And why do you only use this at Costco? This is the card to use anywhere you can use mobile payments (which do not qualify for other bonused spend) – which is a lot of places . I will actually probably cancel my AmEx Blue with 6% back on groceries since I can use this card at all grocery stores (at least if you have a Samsung) – the fee on the blue is no longer worth the incremental 1.5% I earn, especially now that AmEx only let’s you redeem an offer once across all accounts (it was so worth it when you could redeem the same offer multiple times).

Lol they can’t all be brilliant. 😉

That sounds like a good strategy, especially if you have a Samsung! TBH, I also have other cards with bonus categories that cover the bulk of my other spending. And I guess the upshot is if I had to get rid of one card right now, this would be it. I got about 30 others!

Thanks for reading and commenting, Noelle!

You really should take this post down. The whole premise is based on incorrect math/logic, and it’s such a basic error that it really calls into your credibility.

Totally agree. Found this post while googling info for the travel credit. My year reset today and I have 26k points, plan to use up the credit and points then cancel the card (unless there’s a downgrade path).

At first glance, I thought he actually got screwed out of $82. Glad I looked back at the transactions screenshot and realized he was credited $164 for an $82 purchase. I don’t know anybody that would have a problem with that.

Take the $82 gift they gave you to pay for travel later this year. It’s the same end result. Except you got to put $82 in your bank account for awhile.

Agreed. The “math” used by this blogger should indicate need for remedial studies in basic logic. Regrettably, the only thing wasted with this piece of misinformation is my time and the OP’s mental sanity. What an embarrassment.

Like others have already mentioned, this blogger needs to re-enroll in elementary mathematics. Nothing financially was lost, other than my time and the blogger’s mental sanity.