Also see:

- Confirmed: RadPad Earns 3X ThankYou Points With Citi AT&T Access More Card

- The best card for shopping at Costco is… Citi AT&T Access More?

- Bye to RadPad, Hello to Plastiq for 2% Bill Payment Fees With MasterCard (Including Mortgages and Utilities)

Here’s my experience to add to the mix.

Getting the Card and Buying an iPhone

- Link: Citi AT&T Access More card

- Link: AT&T cell phone shop

I applied for the Citi AT&T Access More card in late January, and received the card on February 2nd, 2016. That same day, I bought an iPhone.

Here’s the link Citi gives you to shop for a new phone – it won’t work unless you click through from your Citi account because it tracks your purchase, much like a shopping portal. With that in mind, it’s a good idea to turn off your ad blockers so the purchase is tracked correctly.

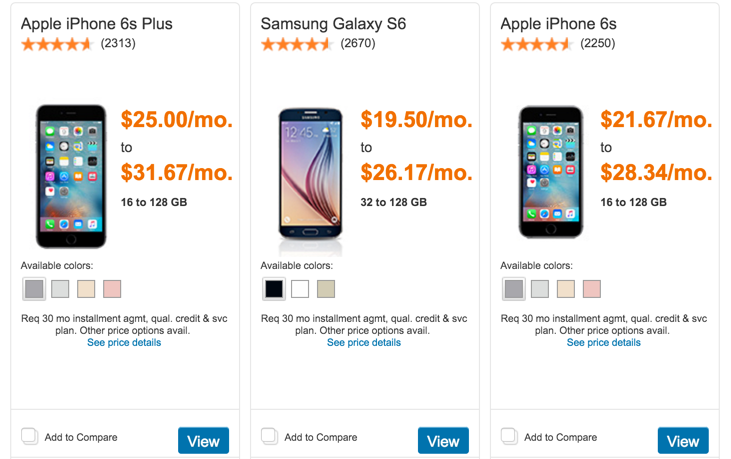

The selection of phones is the exact same as if you navigate to AT&T’s cell phone shop.

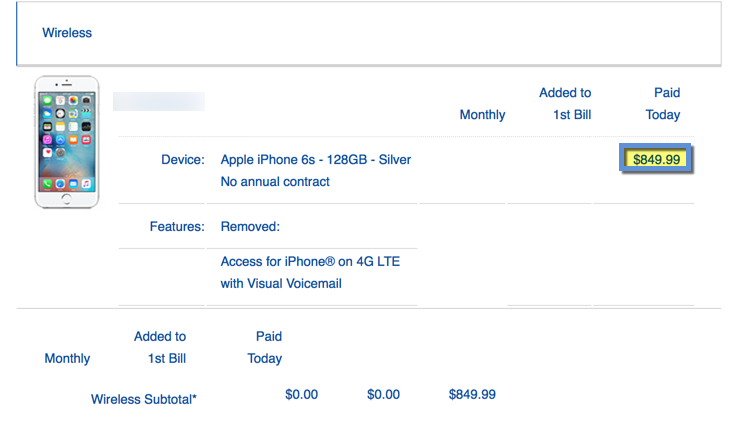

I sprang for an iPhone 6S with 128 GB of memory. The taxes for New York were ~$75. After the phone credit, that’s like paying ~$275 for a brand new phone with a lot of memory to burn through.

I had an iPhone 5 with 16 GB and was tired of deleting apps/pictures/the entire phone every time it needed an update.

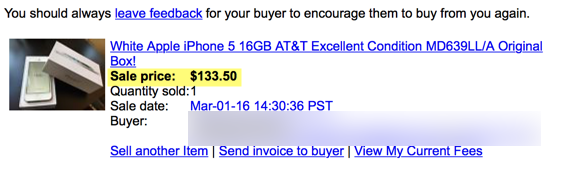

I sold it on eBay for ~$134.

There’s a FedEx ship center 2 blocks away. So I popped in and sent it. It took maybe 10 minutes to list and 10 minutes to ship.

Plus, the sale brought my out-of-pocket cost for the new iPhone down to ~$141 after taxes, which is a screaming good deal.

Do you HAVE TO HAVE AT&T service?

I called Citi in late March to check when my phone credit would post.

The rep sounded like she’d dealt with this a time or two and asked if I’d used the link in my Citi account. Yup, and I disabled ad blockers.

She verified I ordered directly from AT&T, used my AT&T Access More card for the purchase, etc.

“I even already had AT&T service,” I mentioned, “so the 15-day service requirement wasn’t an issue.”

“Oh, we don’t have any way of tracking that anyway.”

It was an off-handed remark. But I don’t think Citi has any way of knowing whether you actually ever got AT&T wireless service. The T&Cs state:

You must activate the phone with qualifying AT&T postpaid wireless service (including voice and data as applicable) and keep the phone, and remain active and in good-standing, for at least 15 days.

As far as Citi and AT&T are concerned, they want you to keep the phone for at least 14 days because after that time, you can’t return the phone for credit.

If that’s true, you could have AT&T unlock the phone you purchase to use on any network. Or, you could turn around and resell it and pocket the extra.

I couldn’t test this because I already had AT&T service. But you could always wait and see if the credit posts without any AT&T service… the T&Cs don’t say you have to activate service immediately when you receive the phone.

Based on my convo with Citi, it seems you’ll get the statement credit so long as you use their link to make your purchase – and that’s the extent of their tracking to earn the $650 credit.

2 months later…

The $650 credit posted on April 11th, 2016 – a little over 2 months (or 2 billing cycles) after I bought the phone, which seems to be the norm.

The credit posted automatically without any followup on my end.

The card is worth getting even if you don’t want or need a new phone

The Citi AT&T Access More card is worth adding to your repertoire because of the 3X bonus category for online purchases.

It’s the best card for shopping at Costco when other cards aren’t offering 5X bonus categories for it (like the Chase Freedom is doing this quarter).

And, you can earn 3X points on rent payments via RadPad through June 1st, 2016.

Fret not about the nearby end date, because you can replicate the earnings with Plastiq. Even better, you can earn 3X Citi ThankYou points for mortgage payments with this card via Plastiq. So whether you rent OR own, you can do well with this card.

You also get 10,000 bonus Citi ThankYou points when you spend $10,000+ on the card within a year – that easily offsets the $95 annual fee. And you should have no trouble hitting that if you’re making rent or mortgage payments.

Pair with Citi Prestige to get rebates on American Airlines

My favorite way to use Citi ThankYou points is to pair this card with Citi Prestige to buy American Airlines flights. It’s like getting ~3% back, even after Plastiq’s 2% fee for MasterCard payments because Citi ThankYou points are worth 1.6 cents each with Citi Prestige (1.6 X 3 = 4.8 – 2 = 2.8%).

You can find the Citi Prestige card here if you want to pick it up:

It’s perhaps my favorite card in the cannon right now because of how much money it’s saved me.

More places to look

Here are other great guides about this card and the $650 phone credit:

- Which Merchants Earn 3X ThankYou Points with the AT&T Access More Card: Complete Guide & Resource (Miles to Memories)

- All you need to know about Citi AT&T $650 Phone Offer (Doctor of Credit)

- Citi AT&T Access More credit card (up to $650 credit with phone purchase) (FlyerTalk)

Bottom line

Getting the $650 phone credit with the Citi AT&T Access More card couldn’t have been easier – it just took a couple of months for all the dots to connect.

In the end, I’m pleased because I got the newest 6S iPhone with 128 GB for ~$141 after the credit and the sale of my old iPhone 5.

I use this card for rent and mortgage payments because they earn 3X Citi ThankYou points under the online purchases category (so do Costco cash cards online). So it’s an incredibly easy way to rack up a ton of Citi ThankYou points.

In retrospect, the new phone was actually gravy. I’d say the card is worth getting even if you don’t bother with the phone credit.

Plus, I don’t think Citi knows if you activate AT&T service one way or the other.

Suffice it to say, there are a lot of possibilities with this card for its $650 phone credit, 3X bonus categories, and Citi ThankYou points earning potential.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Where did you see the AT&T link in your Citi account? I can’t find mine anywhere.

Near the bottom of the page, on both the main screen and after I clicked through to the Citi AT&T Access More transactions page. It says something like “Offers for You” or similar and has a list of 1 or 2 card benefits.

The link doesn’t work anymore. Once you submit the application, it returns error messages. The promotion might be over.

Hmmm, according to this landing page, the promotion lives on: https://creditcards.citicards.com/usc/ATT/rewards/2015/Mar/access/dual/digital/default.htm?BTData=PIx.B.gAB4f.J.Bl9.RO3T.b8P.iTK.rJ1.Bj.Mx.g7.E&m=43Y5111111W&ProspectID=B2B8816A5F5D4422A4881964DD7A4014#/menu

I’d call Citi and have them adjust the credit manually if you can’t find the link and/or to confirm the sign-up bonus. Sucks to deal with the added step, but worth it for $650.

Do you know if it will be possible for my wife to apply for the card and then buy the phone but then I can use it on my existing at&t service to fulfill the activation requirement? that way she wont need to open another at&t account. Any ideas? Thanks.

From what I gathered with Citi, they have no way of knowing whether or not you activated the AT&T service or not. You could always buy the phone and use it the way you described and see what happens. If the credit doesn’t post, you can add service and then drop it. But my feeling is that it will work fine for you.

Hi. I purchased iPhone in March and have spent $2000 in less than a month.But now they say $2000 should be spent only on at & t. Did you spend like that ? What should I do now

No, they are wrong. You don’t have to complete the minimum spending requirement on AT&T purchases. But the $650 phone credit is only for phones.

Thank you. Should I wait and check until my next billing cycle or call the customer service regarding this? I purchased iPhone 6s using the citi access more card and their unique link .

I’d wait. It took 2 cycles for me to get my credit.

I bought iPhone from at&t with this card and made use of their price rewind feature. I did it with my iPhone 6s 64gb which was $200 less in boost mobile. So I got $650 + $200. My phone cost was only the annual fee.

Wow, that’s very smart. Congrats, you! 🙂

that’s awesome Ed. did u request for price rewind after u receive ur credit?

I think this offer got expired. I could see the access more AT&T co branded credit card in city website, but it did not say any thing about the sign up 650$ bonus.

Do you have the link? They often put it in the terms & conditions. I’m pretty sure the offer is still on the go.

How to get the 5X bonus for shopping in Costco using this card? Thanks.

The best you can do is 3X: http://outandout.boardingarea.com/the-best-card-for-shopping-at-costco-is-citi-att-access-more/