Also see:

- Earn Points for Rent and Mortgage Payments With Plastiq (2% Fee With MasterCards)

- Bye to RadPad, Hello to Plastiq for 2% Bill Payment Fees With MasterCard (Including Mortgages and Utilities)

I made a test payment to my student loan company through Plastiq and earned 3X Citi ThankYou points with the Citi AT&T Access More card.

I’ve written how easy it is to boost your ThankYou points balance by paying rent and mortgages via Plastiq with that card.

Literally the devil

And now, there’s another way to earn Citi ThankYou points if you need to make student loan payments.

About Plastiq + Citi AT&T Access More

- Link: Plastiq

- Link: Citi AT&T Access More card

The Citi AT&T Access More card earns 3X Citi ThankYou points on AT&T purchases, travel, and online purchases. And 1X everywhere else. The card has a $95 annual fee.

The “online purchases” category is broad and includes:

- Amazon

- Some eBay purchases

- Department stores

- Clothing stores

- Costco

- Pretty much any other online merchant

The 3X category also includes Plastiq, a service that lets you pay bills with a credit card for a 2% fee (with a MasterCard, which the Citi AT&T Access More card is).

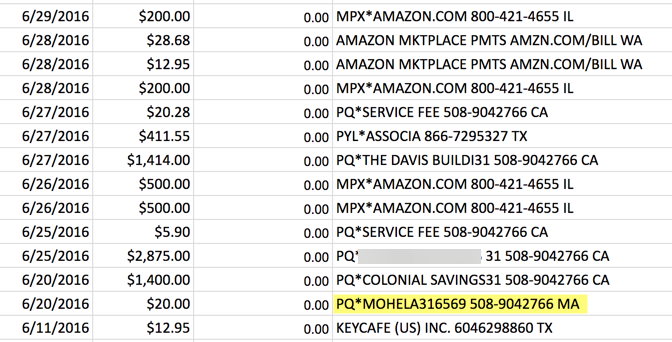

I used an Excel Solver formula thanks to the writers at ‘Dem Flyers to check the earning on my student loan payments.

ALL my Plastiq payments code as 3X, including to Mohela, my government student loan servicer

I wasn’t sure if my student loan payment would qualify for 3X because Citi says:

“You won’t earn 3X Points for purchases of and payments for medical services, insurance, taxes and government services, education, charities and utilities.” (Bolding mine.)

Coded as “Tuition and Education Services”

And Plastiq definitely codes student loan payments as “education services.”

Regardless, I still earned 3X Citi ThankYou points on my student loan payments.

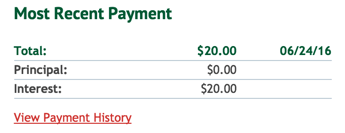

My Plastiq payment posted in 4 days

Moreover, I haven’t had any issues with my payments through Plastiq. My test student loan payment of $20 posted within 4 days.

By the numbers

- Link: Apply for Card Offers

If you owe a lot of student loans, I know, it sucks. I’m in the same boat.

But. If you love to travel and run all your student loan payments through Plastiq and the Citi AT&T Access More card, you could do well with the 3X earnings.

Citi Prestige is perhaps my favorite card available on the market right now (and you can apply for one here).

It gets a lot of help from its trusty sidekick, the Citi AT&T Access More card. When you combine the points, they’re worth 1.6 cents each toward American Airlines flights. Or you can transfer the points to travel partners including:

- Etihad

- Flying Blue

- Singapore Airlines

- Virgin America (soon to merge with Alaska Airlines!)

- Hilton

Let’s say you paid $20,000 of student loan debt this way. You’d:

- Pay $400 with Plastiq’s 2% fee

- Earn 61,000 Citi ThankYou points (including on the fees)

61,000 Citi ThankYou points are worth ~$979 toward American Airlines flights if you also have Citi Prestige. So you come out ahead by ~$579, even with the 2% fee considered.

Seattle summers are actually splendid – go visit!

61,000 Citi ThankYou points is also easily enough for 2 round-trip domestic flights on United via Singapore Airlines (at 25,000 Singapore miles for each).

Yep, those are my feet on a beach in Hawaii, like a basic

You also earn 10,000 Citi ThankYou points when you spend $10,000 on the card within a cardmember year. 71,000 Citi ThankYou points is enough for 2 peeps to fly from anywhere in the mainland US to Hawaii round-trip in coach on United (at 35,000 Singapore miles for each).

Or you could fly one-way in Singapore Suites (First Class) from New York to Frankfurt for ~57,000 Singapore miles. That’s definitely worth more than the $400 you’ll pay in fees. Not to mention you’ll take a chunk out of your student loans!

Even if you cash out the points for a cent each (but please don’t), they’d be worth ~$610. At the lowest points value rate possible, you’d still come out ahead.

There’s no reason to leave money on the table while making bill payments with Plastiq and the Citi AT&T Access More card.

Bottom line

I’m loving this. I pay all my rent payments, my mortgage, and now my student loans through Plastiq and charge it all to my Citi AT&T Access More card. And here’s my experience getting $650 toward an iPhone through AT&T with the card.

I charge about $10K a month and therefore earn about 30,000 Citi ThankYou points AKA 360,000 Citi ThankYou points a year. I also earn points with Citi Prestige and my new Citi ThankYou Premier card. Safe to say I’m rolling in Citi ThankYou points (and therefore Etihad and Singapore Airlines miles).

I dare venture the Citi Prestige/Citi AT&T Access More combo is as good as Chase Ink Plus/Chase Sapphire Preferred.

At any rate, they’re both valuable combos in different ways. And so far, I’m loving the Citi ThankYou program – more on that coming up!

Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

My first payment via Plastiq has not been posted as received by Ditech.

Unfortunately that means that I’m waiting for the mortgage payment to settle somewhere, out of the money until it settles somewhere, had to make a second payment from another account, and potentially have been coerced into an additional principal payment equal to a full months’ payment because any payment received before the 1st is applied to additional principal, not the next month that is due. 🙁

Update – mortgage payment was requested on the 1st, was sent as a check on the 5th, and Ditech posted the payment as of the 13th. Not the quickest turnaround for sure, but the payment did make it.

Ditech also now posts the second payment as the next payment in sequence. Looks like I’ll be using Plastiq again.

Yay! Thanks for the update!

My payments usually take 5(ish) business days. Maybe the 4th of July holiday interfered? In any case, glad it posted and all is well. And hopefully the next one is a little quicker.

Can you still get this card? I can’t find a working app anywhere.

As far as I know, for now, it’s gone. 🙁

I’ll DEF post a new link if one ever emerges.

If you have another Citi card, you may be eligible to do a Product Conversion (PC) to the AT&T Card.

Keep in mind that PC’d cards aren’t eligible for the new phone discount, charge the annual fee from day #1, but they do get the 3% TYP for online purchases.

I’ve heard mixed results about this. But if you are OK giving up the sign-on bonus, it could be a way to earn a LOT of Citi TY points!

I don’t have AT&T, nor do I want them, but if the AF isn’t waived the first year it’s not worth it to me.

You’ll earn 10K TYP after spending $10K in a year. So if you shop online a lot, those points more than cover the AF. But as always, do what’s best for you.

Hi Harlan,

Are you still receiving 3x for your student loan payments?

Hey there! I haven’t checked in a while. I’m going to make a payment today. My statement closes on March 9th. So I will report back. But my hunch is no, they’re not counting any more…

Hey again! Just confirmed I only earned 1X with this card. Looks like they closed this loophole.

Only way I could think of is to make a manual payment and change the code to something other than Education… but of course you risk being caught. Could always try – it should code as 3X that way.

Thanks for checking. I just product changed to this card and trying to determine if it’s worth it to keep it.

Absolutely. The 3X category is quite broad. I’d say it’s the card I put the MOST spending on, actually. Def hang on to it for a while before you cancel!