Also see:

- Taking Another Look at Hilton, Hyatt, and Diamond Elite Status

- 7 Hilton Hotels Where 120,000 Hilton Points Are Worth $700+

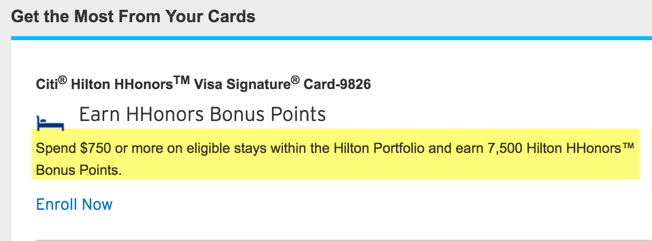

I noticed an offer in my Citi account – it can totally be a good one if you were targeted, and have paid Hilton stays coming up.

When you enroll and spend $750 at Hilton hotels through July 31st, 2016, you’ll get 7,500 bonus Hilton points AKA 10 extra points per dollar.

That’s a good deal if you A) have this card and B) have paid Hilton stays coming up.

You can also stack the heck out of this!

Combine promos to get a boatload of Hilton points

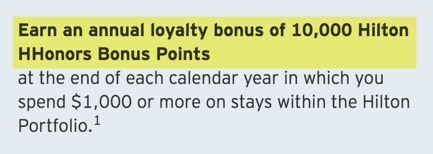

The Citi Hilton Visa also has a great sweet built-in perk:

You get 10,000 Hilton points if you spend $1,000 at Hilton hotels in a year.

And, you’ll earn 6X Hilton points per $1 spent with the Citi Hilton Visa.

Plus, you get 10X Hilton points per $1 you spend on your room rate (AKA not taxes and fees) as a basic HHonors member benefit.

Say you spend $1,000 at Hilton hotels before the end of July.

You’d earn ~34,000 Hilton points, or 34 Hilton points per dollar. (6X * 1,000 = 6,000 from Citi Hilton Visa + 10,000 from Citi Hilton Visa loyalty bonus + 7,500 from targeted promo + 10,000 for being an HHonors member.)

That’s pretty good! Already a quadruple dip.

Push it farther with status and Summer Promo

You’ll also earn more points if you have Hilton status:

- 15% bonus with Silver elite

- 25% bonus with Gold elite

- 50% bonus with Diamond elite

You’d automatically have Silver elite status with the Citi Hilton Visa. But I didn’t include the bonus in the example above to accommodate for taxes (which are probably around 15%, depending on where you stay).

Be sure to sign-up in advance for Hilton’s summer promo. Based on the $1,000 example above, you’d earn an extra 10,000 Hilton points, for a total of 44 Hilton points per $1 spent.

You’d earn even more with Hilton elite status (noted above).

That could turn this into a sextuple dip:

- Targeted Citi Hilton Visa promo

- Citi Hilton Visa annual loyalty bonus

- 6X points with Citi Hilton Visa

- 10X base points for being an HHonors member

- More bonus points for having Hilton elite status (comes with Hilton cards)

- More bonus points for signing-up for summer promo

In short, you can do well with the Citi Hilton Visa card’s targeted promo and annual loyalty bonus if you stack it right for stays through July 31st, 2016.

And even if you weren’t targeted, you can strategically earn the 10,000 bonus points per year for spending $1,000 on the Citi Hilton Visa alongside the summer promo to earn a nice chunk of Hilton points, too.

Depending on how you play it, you could get 20% to 100%+ back when you redeem the 40K+ Hilton points you’d earn in total:

- 40,000 Hilton points is enough for a 5-night award stay at a Hilton Category 2 hotel

- It’s also enough for a night at several pricey hotels around the world – here are my faves

Really, not bad for a card with no annual fee. Here’s my link if you decide to apply for a new card offer:

View Additional Hotel Credit Card offers here!

Bottom line

I’m always looking for ways to stack – and thought I’d share this one. Because it’s particularly good if you got the 7,500 Hilton points targeted offer with the Citi Hilton Visa.

Even if you don’t have that particular card, or weren’t targeted, you can still stack your card’s points-earning with the other dips to do nicely on Hilton stays this summer. It’s also a nice reminder to be on the lookout for opportunities – and to sign-up for promotions just in case.

I will definitely be using this stack for any upcoming paid Hilton stays – especially with my newly minted Hilton fanboy status.

If you have a Citi Hilton card, were you targeted for this offer?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I had this offer on TWO cards. But it required a 10 digit invitation code to activate. I called and contacted CITI by private message. I guess they solved the problem: when I checked both cards today under “See All Offers” the offer had been removed.

Oh wow, they took it away? Weird! I’d ask them to put it back if it’s so easy for them to remove it.

Oh, I called them alright. The response was that I got the offer by mistake. Huh? .No problem, CITI. I earn more Hilton points with my Hilton AMEX anyway. Back in the sock drawer ya go.

🙁 Sounds un-Citi like. They’re usually so proactive about their customer service. Sorry you had trouble.

FWIW, I didn’t have a registration code – just clicked and it was done.

Yes, I saw the picture near the top of today’s blog. That’s not how my offer looked at all! Mine had a big long space to enter an invitation code. One problem: I wasn’t invited!

Otherwise, great job today explaining the stacking. I love it when a purchase results in multiple benefits.

Yes, I received the offer and registered. My next stay just happens to be at a Hampton Inn and there was another offer for 10% cash back/statement credit – which I accepted as well. This is fun! Thanks!

Wow, that’s a NICE one to add to the stack. It’s fun to save money when you have paid stays anyway. Congrats! 🙂