Hi lil lovies. The holidays were wild, eh? I’m writing this in a medicated haze with flu-like symptoms. But I wanted to write. And I’ve been meaning to talk about is how I’m using balance transfer cards to:

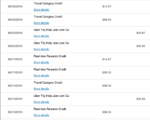

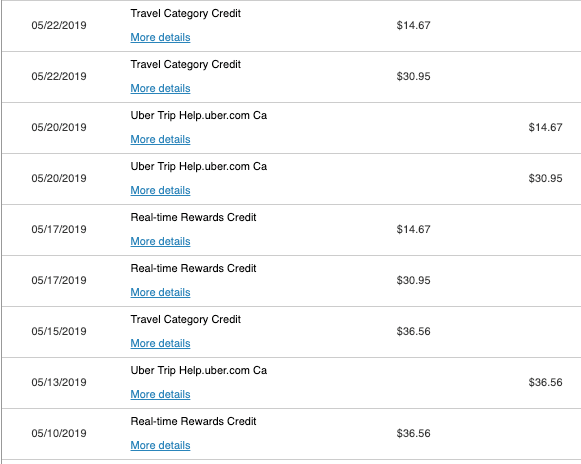

- Meet my current financial goals (which I need to update)

- Smooth out large, unexpected expenses (like when my AC quit in July and I had to get a new HVAC system)

- Give myself a jump-start to purchase big items when I want them (I bought myself a rowing machine because I really really wanted one and I’ve been using it regularly)

This is because I didn’t have enough in a savings account, which will change this year. So hopefully I won’t have to rely on them in the future.

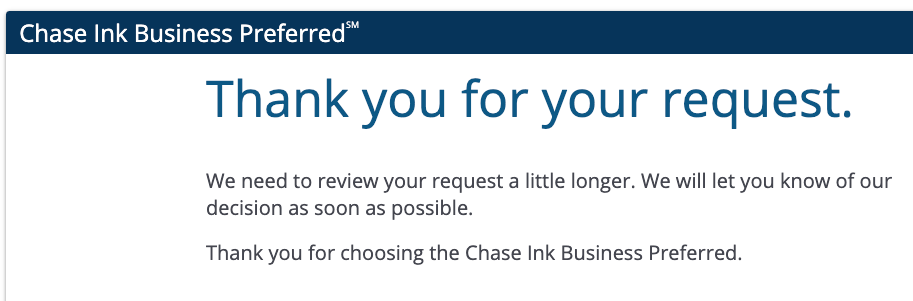

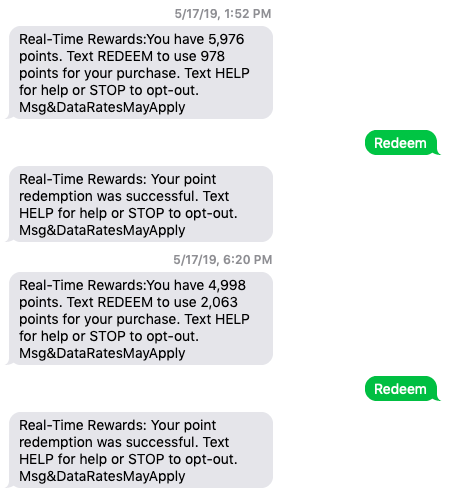

But for now, they’ve helped me consolidate a lot of balances spread over several cards with big interest rates. I paid a one-time balance transfer fee, and have a 0% APR rate through April 2020. So I haven’t paid a dime of interest since. And honestly? It’s been the one thing that’s given me time to get caught up.

Balance transfer cards aren’t a perfect solution. But they’ve bought me time and helped me avoid a ton of interest while I got my plans together

The test, of course, is paying them back before the 0% promotional rate expires. If you don’t, you’re right back to where you started. 🌀

The good thing is these rates are a year or more (usually more). A lot can happen in a year.

While I’m glad balance transfer cards have been available to me as a financial tool (which is absolutely how I think of them), moving forward I want to depend on savings rather than having to buy myself time.