In a couple more months, I’ll be mercifully under 5/24, which means I’m looking at the best Chase credit cards and wondering what I’ll open, as if ordering off a menu. Chase hasn’t been a possibility for so long, it feels a bit like starting over.

It kinda is. I’ll get to retool my card arsenal – and that got me thinking about what’s worth getting – and what to skip (or cancel if it comes to that).

Upon reflection, I realized there are 3 ways to approach Chase cards:

- Focus on personal cards (especially Ultimate Rewards cards)

- Focus on small business cards

- Go for the Southwest Companion Pass

Not to say any of these paths is absolute. I find that generally, peeps have certain travel goals in mind before they start applying, myself included.

And of course, you can mix and match. Here are the ones to start with.

I’ve got the Chase Freedom Flex℠ – and soon I can expand my entire Chase card strategy

8 best Chase credit cards

Chase currently issues ~27 credit cards. And a solid 2/3 of them are caca. 💩

But the gems are truly worthwhile. ✨

4 personal cards (Path One)

Pick one: Chase Sapphire Reserve® or Chase Sapphire Preferred® Card

It comes down to this: heavy travelers should get the Chase Sapphire Reserve®, and everyone else (or newbies) should get the Chase Sapphire Preferred® Card.

To differentiate, here’s my full review of the Reserve and Preferred. And here’s the break even point between the two.

The Chase Sapphire Reserve® has a $550 annual fee, and an annual travel credit up to $300. The net annual fee becomes $250 effectively.

The Chase Sapphire Preferred® Card has a $95 annual fee. The difference between the two is basically $55, which is an extra ~$5 a month.

The major difference is in the earning:

Sapphire Reserve earns 3X Chase Ultimate Rewards points on travel and dining, while the Sapphire Preferred earns 3X Chase Ultimate Rewards points on dining and 2X on all other travel purchases.

What’s the difference? Quite a lot!

You should spring for the Sapphire Reserve and get 3X on travel and dining

Most peeps will do better with the Chase Sapphire Reserve®. But if the big annual fee scares you off, the Chase Sapphire Preferred® Card is still a great place to begin. Plus, you can product change after a year. So there’s really nothing to lose.

Note you can’t earn the bonus on both – it’s one or the other every 4 years. Right now, the current offers on each card are:

I haven’t earned a bonus on these cards in 6+ years, so the Chase Sapphire Preferred® Card might have my name on it… literally. 😛

Pick one (or both!): Chase Freedom Flex℠ and/or Chase Freedom Unlimited®

- Chase Freedom Flex℠

- Chase Freedom Unlimited®

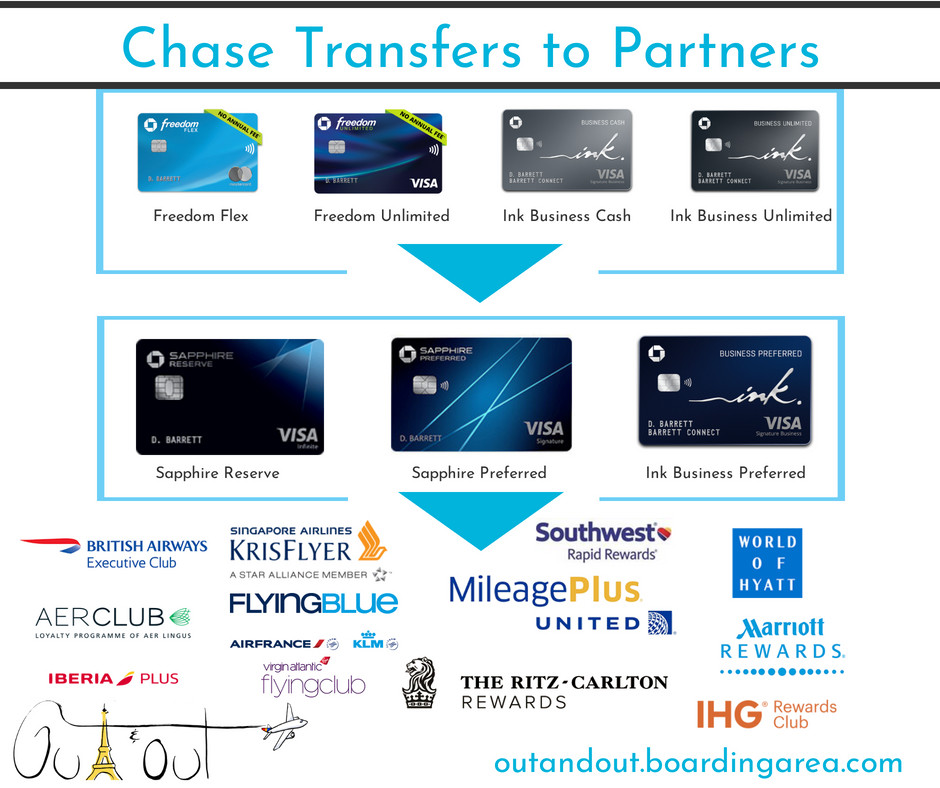

These no-annual-fee cards are perfect complements to Ultimate Rewards cards with annual fees, because you can combine your points across all accounts – then send them to travel partners, where their value soars.

Pair Chase cards to earn even more points

While both have the “Freedom” name, there are distinct differences in the earning rates:

- Chase Freedom Flex℠ has 5X categories that rotate quarterly – earn 5% cashback (5X Chase Ultimate Rewards points) on up to $1,500 in combined spending when you activate the bonus, then 1% (1X) everywhere else

- Chase Freedom Unlimited® earns a flat 1.5% cashback (1.5X Chase Ultimate Rewards points) on all purchases. Boom.

Chase Freedom Flex℠ 5X categories have included restaurants, gas stations, grocery stores, Amazon, and tons more in the past. Suffice it to say I always put it to good use

For that reason alone, this card is a definite frontrunner. I hope that bonus offer sticks around. 🤞 If you’re eligible, def get it while you can.

If you’re torn between the two, go for the Chase Freedom Flex℠ if you like the 5X bonus categories, and the Chase Freedom Unlimited® if you prefer a flat earning rate.

Also see:

Pick one: A co-branded card

Chase issues many airline and hotel cards, including:

- British Airways Visa Signature® Card

- United℠ Explorer Card

- IHG® Rewards Premier Credit Card

- Marriott Bonvoy Boundless® Credit Card

- The World Of Hyatt Credit Card

I have 4 of the 5 cards above. Not to say you should get that many. But Chase really does have strong co-brand cards.

If you like Hyatt hotels, The World Of Hyatt Credit Card stands out as particularly strong:

I rarely fly United, but find the United℠ Explorer Card worth keeping because of:

- 2 free lounge passes per year

- Expanded award availability for cardmembers

- 25% bonus United miles in the MileagePlus X app

- Primary car rental insurance (always good to have at least one card with this perk)

Point being, if you like any of these brands, snap up their Chase card before you find yourself over 5/24. Cuz when you do – *poof!* no Chase cards for you!

Even if you’re mildly curious about a Chase card, I’d recommend snapping it up while you can

2 small business cards cards (Path Two)

The magical thing about Chase small business cards is, while you can’t get them if you’re over 5/24, they won’t count against your 5/24 status.

Translation: GET THESE CARDS FIRST! (That is, if you have a small business or earn profits with side hustles.)

There are 3 excellent small business cards. Snag two if you can.

In particular, the Ink Business Preferred® Credit Card has a stunningly high sign-up bonus.

And the other two? It’s the same logic as Chase Freedom Flex℠ vs Chase Freedom Unlimited® above.

Get the Ink Business Cash® credit card if you like the 5X categories, and the Ink Business Unlimited® credit card if you’d rather earn a flat 1.5X Chase Ultimate Rewards points on all your small business purchases.

But it really becomes Chase Freedom Unlimited® vs Ink Business Unlimited® credit card because they have the same earning rate – the former is personal, the latter is small business.

So which sign-up offer do you prefer? It’s honestly a toughie. But I’d go with the Ink Business Unlimited® credit card to get a bigger sign-up bonus and stay under 5/24. But your situation might be different.

2 Southwest cards (Path Three)

Finally, there’s the Southwest route. This is for peeps who want the Southwest Companion Pass. And why wouldn’t you? It’s by far the best deal for domestic (and near-international) travel.

I personally find earning Southwest points too restricting (that is, you can only redeem them on more Southwest flights). But if you’re into their route network and they service your home airport, by all means go for it!

Even better – the points you’ll earn from the sign-up bonuses DO count toward your Companion Pass (including the minimum spending!).

So if you open one or two or these cards, you could be well on your way – or outright earn – the Companion Pass, which is valid for the remainder of the current year and ALL of the following year. You need to earn 110,000 qualifying points in a calendar year to earn the Companion Pass. These points will post in 2019. And if you earn a Companion Pass in 2019, it’s valid for the rest of 2019 and all of 2020.

Incredible deal if you like flying Southwest.

Putting it all together – mix n match

To come up with the 8 best cards, I recommend:

- 4 personal cards – either Chase Sapphire Reserve® or Chase Sapphire Preferred® Card, Chase Freedom Flex℠ and Chase Freedom Unlimited®, and 1 co-brand card

- 2 small business card – the Ink Business Preferred® Credit Card and either the Ink Business Cash® credit card or Ink Business Unlimited® credit card

- 2 Southwest cards – if you want the Companion Pass

And here’s the fun part. You can put them together in any order you want.

Because Chase issues 3 personal and 1 small business Southwest card. Or you could get 2 co-branded bards instead of one. Or skip certain cards completely.

I didn’t open any of my cards with a master plan in mind. Rather, it’s a patchwork I cobbled together over the years.

But when I drop below 5/24, I’ll have the chance to make a deliberate plan for which cards I want – and their combination. With all of these cards, the power is in the pairing.

Ahhh, it’s all in front of me now. What a feelin’

I’m definitely a combination of Path One and Path Two – maybe a couple of personal cards and a couple of small business cards.

Travel – and designing travel goals – is extremely personal. I think of credit cards as tools in a toolbox that help me achieve my goals. What works for me won’t work for you. But Chase really does offer some of the strongest travel rewards cards in the industry. I’m fortunate I get to “wind back the clock” and refine my strategy.

And please please please pay off all your cards in full every month. If you don’t, the interest you’ll pay negates any value you’ll get from these spectacular sign-up offers.

Bottom line

Of Chase’s 27 credit card products, only 8 of them deserve a spot in your wallet. And of that curated list, it requires some mixing and matching to get the levels *just right* for your travel goals.

I see 3 distinct paths with Chase cards:

- Ultimate Rewards and co-brand personal cards for nearly everyone (Path One)

- Ultimate Rewards small business cards for those that qualify (Path Two)

- Southwest cards for those gunning for the coveted Companion Pass (Path Three)

I’m a blend of one and two, whereas you might be on a singular journey – or all three.

Because of 5/24, remember to get all the Chase cards you want if you’re just starting out. If you’ve opened more than 5 cards from ANY bank (excluding certain small business cards, including Chase’s own small business products), you won’t be approved for Chase cards.

And if you like any of the small business cards, get those first – because they won’t count toward your 5/24 status (although they are still subject to the rule).

I’ll keep this page updated with the latest offers. As it stands now, these card picks represent potentially $1,000s in award travel. I can’t wait to dive in and go crazy.

Do you agree with my list? Which cards are you picking up?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Leave a Reply