November was the first month I got down and dirty with my new financial goals. Having them in mind gave the month shape and purpose – I felt for the first time in a while that I was working toward something urgent and real and palpable that I could measure.

If naming things is empowering, creating a plan is getting superpowers. I watched as each dollar flowed into and out of my accounts.

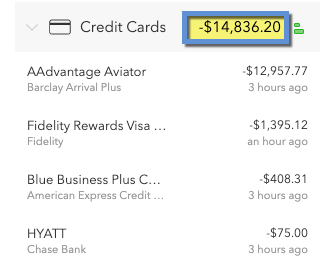

Slow and steady wins the race, but I have an out-of-control, flaming emergency! I have GOT to pay off my credit cards by April 2020 before the 0% APR rate expires. And I’ve got over $14,000 left to go.

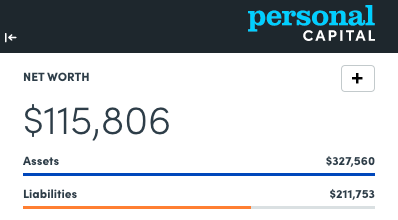

Last month, a combination of strong market and aggressive payments boosted my overall net worth to $115,806 – a full $20,000+ increase.

And while it’s nowhere near the $500,000 goal I want to hit, it’s an awesome start. And to that end, this is my first Freedom update (Freedom is what I call money). I hope I look back on these posts and marvel at my progress. One day…

Getting started on my FIRE in a big way – getting rid of credit card debt is my #1 prerogative right now

I know “never say never” buuuut… I will NEVER have credit card debit ever again as long as I live. In the future, I’ll dip into my healthy savings account. Because this hurdle really freaking sucks.

December 2019 Freedom update

Like most peeps, I’m hard on myself. While I can clearly track and see my progress, the little voice always says, “You could’ve done better.”

That’s not something I would say to a friend. Instead I’d say, “Your progress was amazing! Keep it up and you’ll reach your goal faster than you ever dreamed!”

I’m already at 23% of my $500,000 goal

So I’m not going to admonish myself because I did a fantastic job. I’m replacing negative self-talk with:

- My progress was amazing

- Keep it up

- I’ll reach my goals faster than I think

Because really, fear about money is what got me here in the first place. Thoughts like:

- All it takes is a bad market, and you’re back to square one

- Your assets might not appreciate as much as you think they will

- You can’t always save – some expense will pop up eventually and then what?

- Owning a home is too expensive

- Your goals are too high. You might save a little, but $500,000? *laugh track*

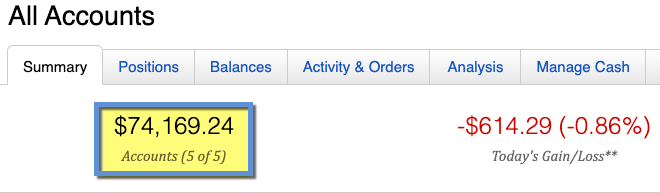

All my investments gained value in November 2019 (though today they took a loss). It will always be up and down like this

And all these things might happen. I’ve never experienced a recession with investments, so I don’t know how my temperament would be. And my home could lose value, or end up costing me. But that’s fear talking. And I had a great month.

Let’s dig in.

A $20,000+ net worth increase in 30 days!

Holy wow, how’d that happen?

- I got three paychecks in November (usually only get two)

- Therefore, had more 401k deposits with company match

- And the stock market did really well.

- Reducing debt make my net worth go up

- Zillow says my home gained value

I was hoping to crack $100K net work, so this result surpassed all my expectations.

| Current | Last month | Change | Goal | ||

|---|---|---|---|---|---|

| Credit cards | $14,836 | $21,945 | -$7,109 | $0 | |

| Mortgage | $143,941 | $144,952 | -$1,011 | $0 | |

| Car | $6,511 | $6,688 | -$177 | $0 | |

| Roth IRA 2019 | $0 | $0 | xx | $6,000 | |

| Roth IRA 2020 | $0 | $0 | xx | $6,000 | |

| 401k | $3,331 | $2,333 | +$998 | As much as possible | |

| Overall investments | $74,169 | $70,962 | +$3,207 | As much as possible | |

| Savings | $530 | $529 | +$1 | $20,000 | |

| Net worth in Personal Capital | $115,806 | $95,246 | +$20,560 | $500,000 | Track your net worth with Personal Capital |

A few thoughts.

The stock market is a fickle thing. A 1% change can add or deduct $1,000s from my balances. Luckily, it was mostly additive as I begin this trek.

And I usually only get two paychecks in a month, so while this is great, I don’t expect my progress to be this great in December 2019.

Holy crap, I am slaughtering my credit card debt! It kills me that I can’t max out my 401k this year until I knock this out.

But I descended to this point over a long time. Each month, there was a little more. I barely noticed it until one day, I couldn’t believe how far I’d spiraled out. But I’m climbing out faster than I got in. I am so grateful to really clobber this thing.

Once I hit single digit $1,000s, it’s full speed ahead

I don’t fully trust Zillow’s “Zestimate“ of home worth. I’d expect it to be off by ~$20,000 give or take. But I’ve found it to be pretty close, so I’m comfortable using it for my net worth projections.

I can’t wait to build out my savings account, increase my 401k deduction to 25% (it’s currently set at 10%), and max out my Roth IRA.

I’m impressed that my mortgage dips so much each month – I honestly thought it was much less than that.

And man, I really do fear the next recession. If it happens while I’m in my tracking phase, it’s going to make me feel really behind and get to me. I need to develop mental resources to withstand that for a couple years or more. Because it could happen.

Having a big savings account is going to be my saving grace throughout this journey, so I can let myself breathe. I’m also afraid I won’t let myself ever use it. Because of that “back to square one” way of thinking.

Heard

As soon as I can settle these things in mind, I think I’ll feel more confident. So this is me baby-stepping into owning the goals I set for myself. I still keep turning around to see where I came from – not far enough down the path for the beginning to look distant. Yet.

Bottom line

I’m pleased with how last month went, and how I’m starting December. My progress won’t always be this strong, and any little fluctuation could erase a lot of my progress.

It’s amazing how money (freedom) has this energy, don’t you think? How we let it into our thoughts, injecting itself into our fearscapes. And the concept of “net worth” as if a number can ever really define that?

Starting this plan and turning my thoughts to freedom are bringing up mixed emotions of enthusiasm, lack of control, security, motivation, and honestly, primal freaking fear about losing the stuff.

It’s also an exercise in moderating my energy, doing my best, and letting the chips fall where they may. And also this sensation of… wow, I gained so much this month. Now I have that much more to think about losing. Isn’t that effed up?

What is this thing, this entity – and all these conflicting emotions somehow miscible when discussing a single topic?

Another thought that unsettles me: I don’t have a solid WHY yet about this plan other than – I just want to. I want to be able to take care of myself for a long, long time. (Is that my why?)

But for now, “I exist as I am, and that is enough.” – Walt Whitman

And that’ll have to do. So I’ve started the journey – but it’ll be a while until I feel like I’m cruisin’ along.

Does thinking about money stir up these things in you, too? I can’t be only one both amazed and petrified at the same time? Thank you for following me through this!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Kudos to you for you efforts! You are making good progress! Anyway, an observation just to consider from someone much older. Having money in a tax deferred account is a HUGE advantage. Once you don’t max out your 401 k for 2019, that opportunity is gone forever. I wish very much I had more of my assets earning interest/dividends without having to pay taxes EVERY single year on the earnings. It really slows your accumulation when part of your earnings disappears yearly into taxes. So as painful as the credit card debt is, I’d urge you to consider whether it’s feasible to contribute a bit more in the tax deferred accounts. Obviously, I don’t know the details of your situation, so it may or may not be. You’ll get there, I have no doubt.

I just wanted to come back here and say thank you for posting this. I took it to heart and reprioritized Roth IRA contributions over paying down my credit card for a bit. It took some reflecting, but I realized you’re right. And I’m learning so many money lessons as I begin down this path.

Thanks again for your advice and support, Kate. I appreciate it.

Don’t use your house “value” as part of your monthly goal tracking because: 1. You have absolutely no control over housing prices.

2. Zillow estimates are always wrong so what’s the point of using data that is unreliable?

3. You should only look at your potential house valuation once a year.

4. You should only look at your house value/equity as an emergency fund of last resort and not something you are banking your future on.

Great advice! I feel like Dallas home prices are generally on the up and up – and with my condo, I’ve found Zestimates are a lot closer because there are many identical units so finding comps are super easy when they sell.

I also think it would be easy to sell my place if I wanted, so it’s fairly “liquid” in that way. If I had a home in a slow market that needed lots of repairs or would sit unsold for a very long time, I wouldn’t track it. But I feel like my current setup is a fairly solid bet – about as solid as the stock market right now.

Thank you for sharing your very valid points! I will definitely ponder them.

Looking good! Personally I wouldn’t muddy the water with monthly tracking of changes in car and home value, or at least keep that tracked, but separate.

You may want to have a second measure which leaves out the items beyond your control. Then you’ll know your still making progress of sorts even if the market (stock or real estate) is going down.

WHEN the market gets shaky and drops avoid the knee-jerk reaction to totally bail out. People lose lots of money when they get out and then miss the eventual upswing. Then they look for another drop to buy in (which may not come for a long time), Lots of people that were hit in 2008 bailed, and were thereafter panicked and missed a lot of the bull market. Pretty much all the lost 2008 market value was back within a couple of years. At your age the we pretty much know the market will be a gain long term, or at least it always has. One person sees a stock market loss and another person sees a buying opportunity (dollar averaging preferably).

This is so great. I totally agree. I just want to track paying off all my debts and get my mortgage and car paid off more quickly than my loan schedule. Tracking them together is helpful right now for some reason. Perhaps I can break them off in the future. But I feel like things are changing already. Will consider this, though. Thank you for reading and commenting, Carl!

Congrats! One thing about personal finance is sometimes learning the hard way is the best way.

Stocks are always a risk and the bigger the risk, the bigger the reward (or loss.) Similar to you, I hope we won’t have another recession (back in 2008 I lost my job and lost confidence in the stock market and just like what Carl WV said, missed out on buying stocks when the prices were extremely low.) Rooting for you to succeed, buddy!

Yes, Joey! I’m already learning so much. It’s been a ride and only been three months of tracking so far. I think I’m seeing that slow and steady wins the race. And also every tiny thing adds up to have huge impact. It’s extremely humbling, and very easy to get lost in the details. Trying to figure out my “money mindset” as I move forward. And really enjoying the journey so far.

Thank you for the encouragement – I appreciate you!

SO I signed up for Personal Capital and trying to add both mine and my husbands amex accounts. All is well, however, our Rose Gold accounts, two different accounts same last 5 numbers, one is cancelling out the other when I pull them in. Any advice?

Hmmm… maybe try to delete the accounts and add them again. If that doesn’t help, you could make separate Amex logins for each card and then plug both of them in. One of those ways should hopefully clear it up!

You’ve got this! I’m totally not ready for the next recession either 🙁 My goal is to save like crazy this next year and cashflow a lot of our home repairs.

YES YES YES! I’m in the same boat as you! I hope we can cheer each other on. Always love reading your posts.

And I’ll be at FinCon this year! Just booked the trip!