The Chase Ink Business Preferred offer in this post is NO LONGER AVAILABLE. Click here to see the latest travel card deals!

On September 1, I applied for the Chase Ink Business Preferred 80,000 points offer. And lord, it was a long time coming. I’m now under 5/24 for the time in eons, and haven’t opened a new Chase card in literally years.

I was nervous to apply after so long. But the chance to snag 80,000 valuable Chase Ultimate Rewards points was too much to pass up. And applying for new credit cards is seriously better than any drug for me. So I was getting that sweet adrenaline fix after submitting my application and watching this screen:

Serotonin and dopamine ACTIVATED

Then was disheartened at this message:

YOU’RE WELCOME FOR MY REQUEST

Dang it. I knew this screen was common and the best bet was to sit tight and wait it out. I figured I’d give it a couple of weeks, and check back.

NOT. (Did you really give me credit for being that chill? 😹)

You know I logged into my Chase online account 4,000 times a day hoping the card would appear. After a week, I started to get down on my luck. After all, I already had seven other Chase cards. Would they really give me an eighth?

But then!

A white unmarked envelope from Westerville, Ohio, appeared in my mailbox. The joy and horror when I saw it!

Was it a thin rejection letter or a fat welcome packet? My fingers reached at warp speed. It was a fatty! There was a card inside! Perhaps it was a cruel marketing scam? Could it be?

I ripped through the paper and just starting laughing right there at the mailbox. I couldn’t believe it.

Just like that, I was back in the game. I had a new Chase Ink Business Preferred in my hot little hand.

Chase Ink Business Preferred 80,000 points offer

- Link: Chase Ink Business Preferred 80,000 Ultimate Rewards points

I didn’t really try to fall below 5/24. It happened as a natural function of not being able to get new cards for so long. Once I realized I just had to wait a few extra months, it was easy.

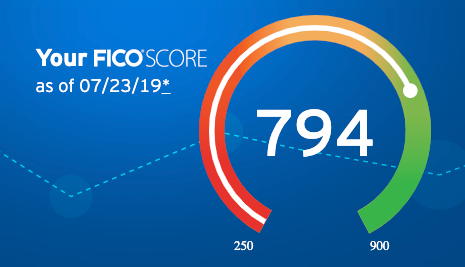

I already have six Chase personal cards and a Chase Ink Plus business card, so getting another one seemed out of reach. But before I applied, I paid all my Chase card balances down to zero, and checked my credit score, which was right under 800.

Nice score for new card apps!

Plus, I figured I could offer to shift some credit around if needed.

In the end, all I had to do was wait. No reconsideration call or extra screening required.

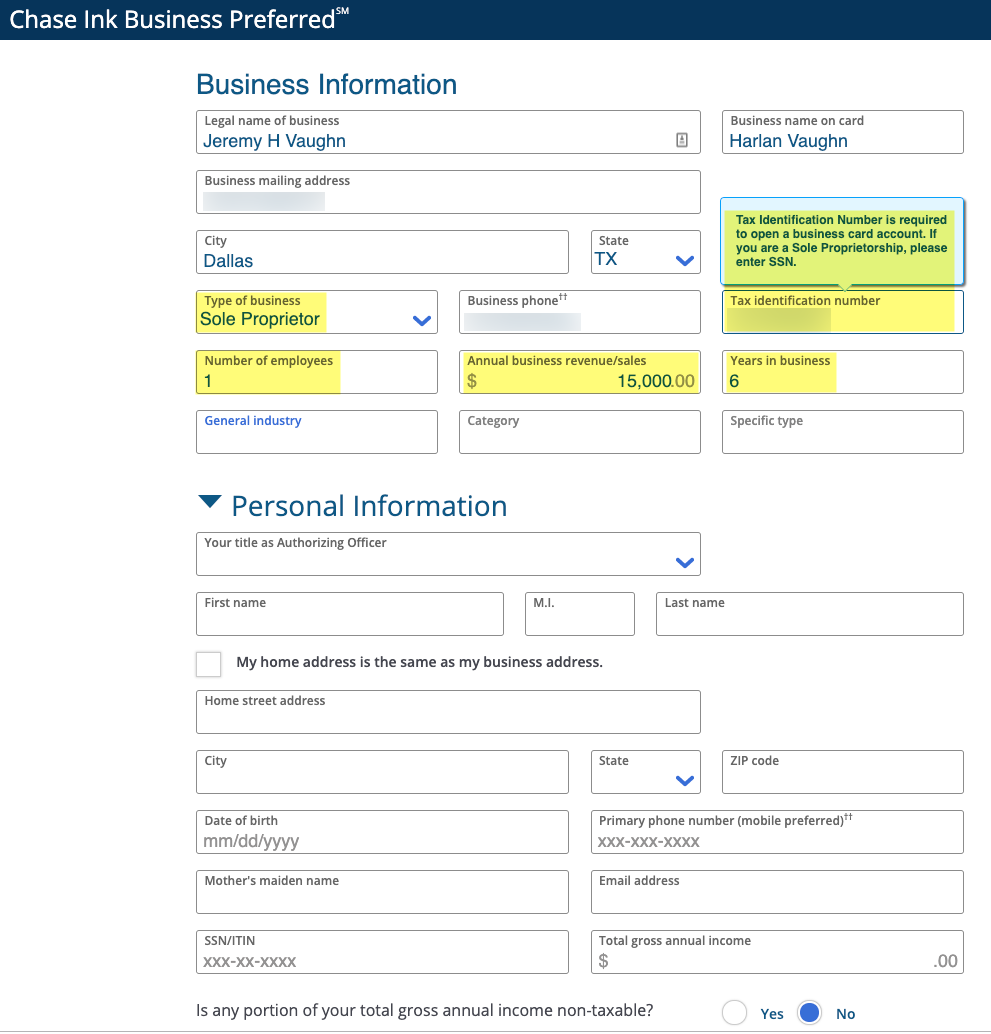

Filling out the application

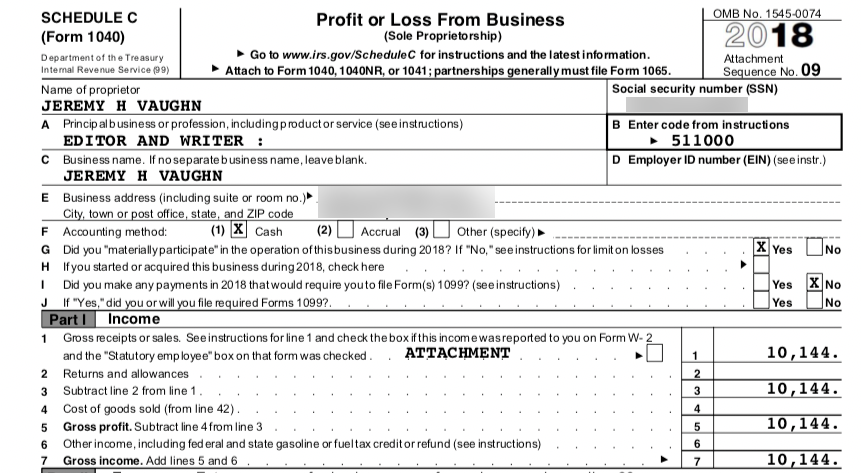

I was honest. I used my income from writing for Out and Out and other sites. So I checked my 2018 tax return to get a good guesstimate of my current revenue. Because I figured if they needed proof, I could easily show them.

A total of my 1099s for blogging in 2018

Last year, I earned a little over $10,000 with writing. And 2019 has been stronger, so I put $15,000 in annual revenue on the application and applied as a Sole Proprietor using my Social Security Number. The application looks like this:

Chase business card application

For Out and Out, I put one employee (me). And I started the blog in March 2013, so I put myself down as being in business for six years. After so long without a new Chase card, I figured I’d rather get denied based on the truth instead of stretching it without a way to back up my claims if they decided to review my application.

As you can see, they don’t require tons of revenue, multiple employees, or business incorporation.

For $15,000 in annual revenue, I estimate I make $1,250 from writing each month. So while you don’t need to prove much income, you do need to have some sort of business. Mine is writing and blogging. And yours might be:

- Coaching

- Tutoring

- Reselling on eBay or Craigslist

- Coding websites

- Photography

- Driving for Uber or Lyft

- Shopping for Favor or Instacart

- Recharging Bird or Lime scooters

- Selling houses

- Hosting on Airbnb or VRBO

As long as you’re honest on your application, and aiming to make a profit, you can actually apply for – and open – many of the best small business credit cards, including the Chase Ink Business Preferred card.

Why I wanted the Ink Business Preferred

- Link: Honest Review: Chase Ink Preferred 80,000 Point Offer

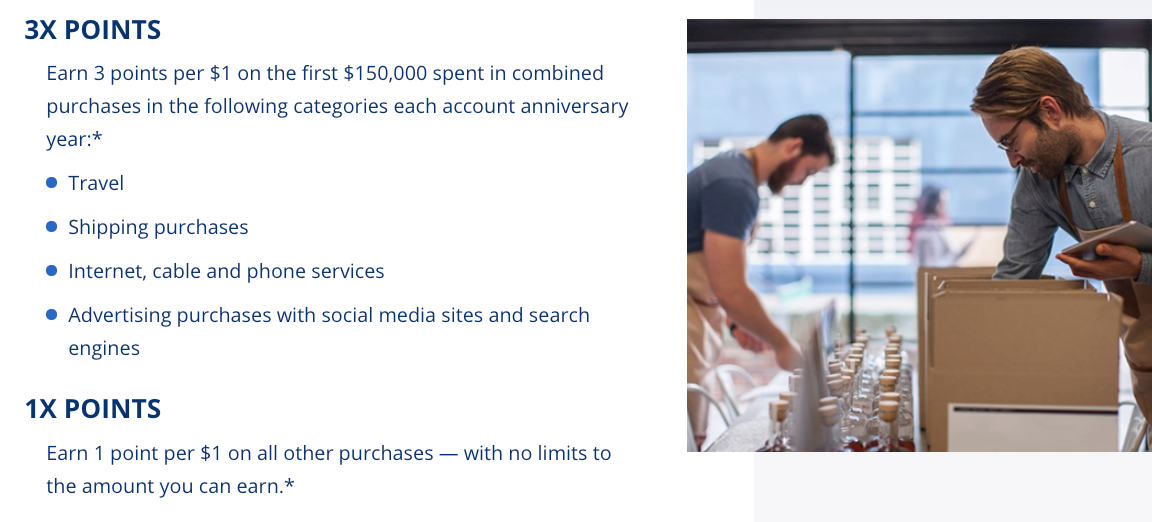

With the Chase Ink Business Preferred, you’ll earn 80,000 Chase Ultimate Rewards points after you spend $5,000 on purchases in the first 3 months after account opening. And you’ll get 3 points per $1 in these categories:

- Travel

- Shipping purchases

- Internet, cable, and phone services

- Advertising purchases made with social media sites and search engines

On the first $150,000 spent in combined purchases each account anniversary year.

LOVE having 3X on all travel back again

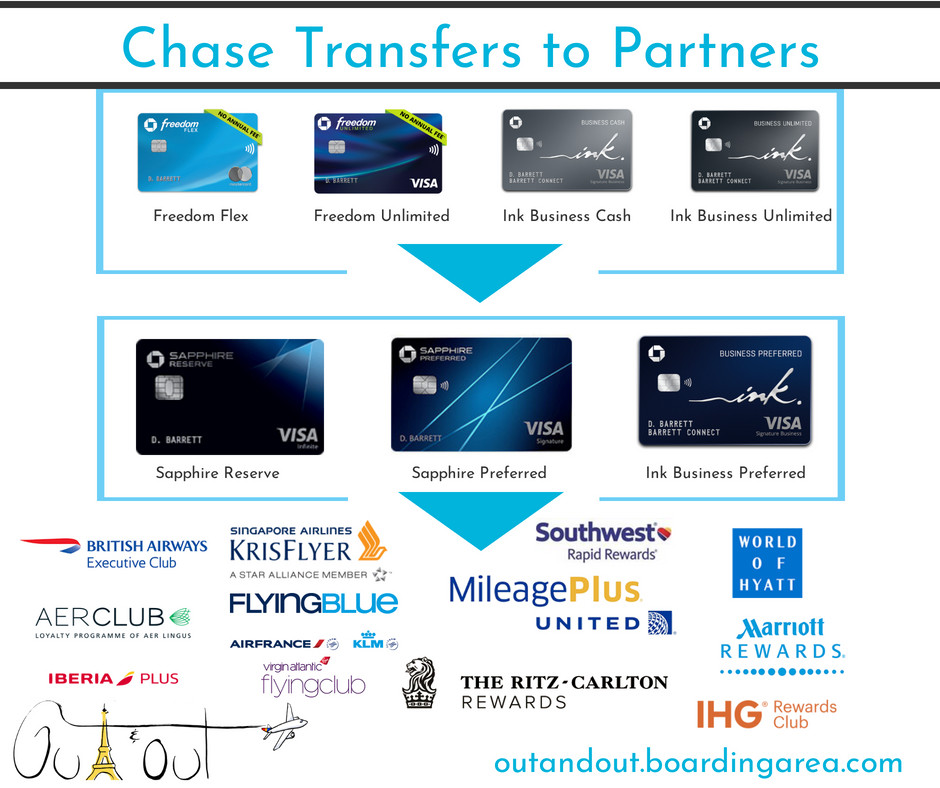

The points you earn are worth 1.25 cents each toward travel booked through Chase. So 80,000 points is enough for $1,000 in travel (80,000 X 1.25).

And you can transfer them 1:1 to travel partners including United, Southwest, and Hyatt (which is also the best).

Pair Chase cards to earn even more points

80,000 Chase Ultimate Rewards points is the highest bonus of any Ultimate Rewards card right now. And getting $1,000 in travel from a single card bonus is an incredible deal.

Even though I’m focusing on Citi ThankYou points right now, I’ll never say no to deals this valuable. Plus, the points never expire, so I can keep them until I find a great way to use them.

Given my long history earning and redeeming Chase Ultimate Rewards points, I have zero doubt I’ll find a way to get a few thousand bucks in free award travel out of this card offer.

So happy to be back in the game with a new Chase card!

To peep more tips on using Chase Ultimate Rewards points, check out:

- 8 Easy Tricks to Earn & Redeem Chase Ultimate Rewards Points

- 7 Easy Tricks to Use 50,000 Chase Ultimate Rewards Points for Cheap Travel

Bottom line

- Link: Chase Ink Business Preferred 80,000 Ultimate Rewards points

I’m the proud new owner of a Chase Ink Business Preferred card. Still can’t believe I’m back in Chase’s good graces!

Though the card is subject to 5/24, it doesn’t count against it… meaning I’m still under 5/24. And that’s another reason I wanted this card in particular.

Now I have every other Chase card open to me, and am getting close to resets with other banks, too. I feel brand new again, like when I started this wonderful hobby all those years ago. I’m going to wait for the best and highest offers and line them up one by one.

If you qualify for the Chase Ink Business Preferred card thanks to small business income, it’s worth $1,000 toward travel at a minimum. There isn’t a better offer on the market right now. If you qualify, I recommend going for it. The bonus points categories are extra, but if you spend a lot in them, make the card worth keeping long-term. Check out my full card review for info about the perks.

Are you waiting to fall below 5/24 to get the Ink Business Preferred? What cards are next on your list?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Congratulations on your new card.

Thank you, Rick! More than anything, I’m happy to know I still qualify for the best available offers to keep getting more award travel!

Congrats on the successful CIP! 80K UR points is no joke. Can’t wait for Nov when I can put in an app.

The BEST! It’s so good to feel “back in the game.” You’ll be there before you know it!

Congrats on the card and back to under 5/24! Let us know when the next meet up is!

Hey Edward! I am working on it right now – next month sometime! Can’t wait!