UPDATE: This offer Is no longer available. Click here to see the latest deals!

Who’s never had the small business version of the Amex Platinum Card? *raises hand*

This card doesn’t count against your Chase 5/24 status. But I didn’t include it on my list of 6 best cards if you’re over 5/24 because:

- It will only appeal to a small segment of people

- The minimum spending requirement to earn the welcome offer is $15,000 (!) in the first 3 months of account opening

But there are several huge reasons to get this card, namely 85,000 Amex Membership Rewards points as a welcome bonus. Plus it comes with a long list of benefits – like $200 in airline credits, 5x points on flights, and 35% points rebate on an airline of your coach (for coach flights, and any airline for Business or First Class).

You can learn more about the card here.

The annual fee is NOT waived the 1st year. But man, if you make good use of the lounge access and annual statement credits… it’s a total GOAT.

Amex Platinum business card offer

- Link: Amex Platinum small business card – learn more here

| The Business Platinum® Card from American Express | Earn 100,000 Amex Membership Rewards points |

|---|---|

| • Get 35% of your redeemed points back from an airline of your choosing, and any First of Business Class flights you redeem points for • $200 annual airline incidental credit • 5X points on flights and prepaid hotels booked through AmexTravel.com • Access to the fantastic Centurion Lounges, Delta SkyClubs, and Priority Pass network • Enroll to get up to $179 back per year as a statement credit toward CLEAR membership • Terms Apply |

| • $595 annual fee (See Rates & Fees) | • Spend $15,000 on purchases within your first 3 months of Card Membership |

| • Learn more here. |

Elephant in the room comes first. You get so much with this card. But to unlock the full welcome bonus, you need to spend $15,000 on purchases within the first 3 months of account opening.

I like having a lil stash of Amex points

While the spending requirement sounds huge, it breaks down to ~$5,000 per month. Plus, you’ll end up with at least 100,000 points when you factor in the spending (and more if you spend in bonus categories).

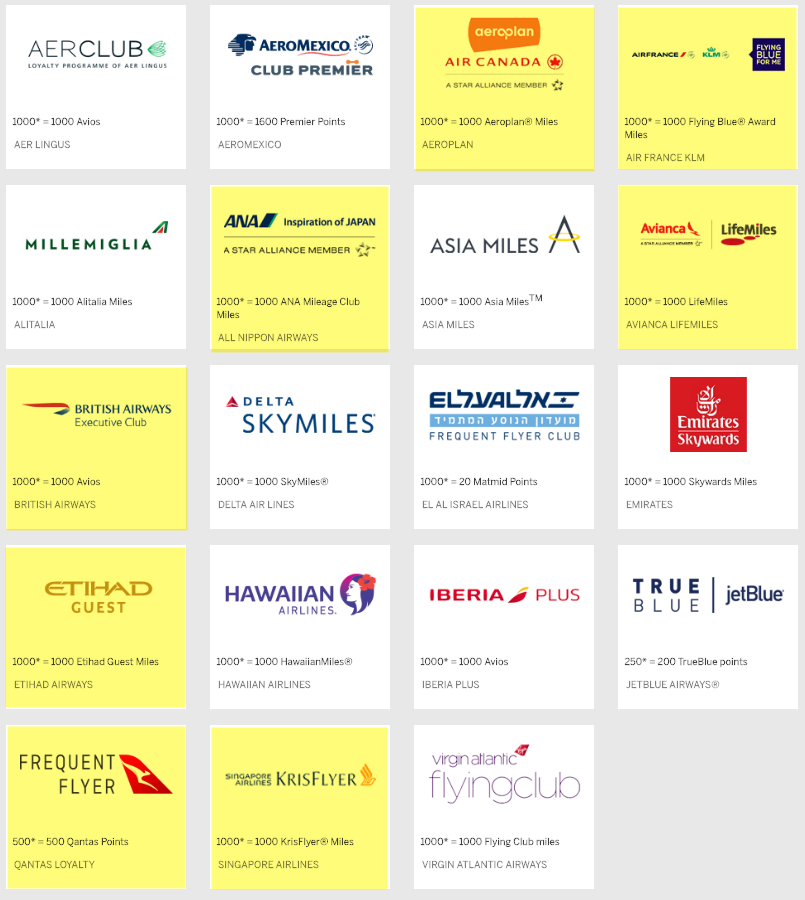

Amex has some valuable airline transfer partners (I’ve highlighted my faves)

When you transfer your points to partners, you can get with the current bonus:

- Business Class flights to Europe, Asia, South Africa, or New Zealand (depends on how far and where)

- Dozens of short-haul flights around the world – 15, to be exact @ 6,000 British Airways Avios points for flights under 651 miles outside the US

- 2 round-trip coach flights to Hawaii on United via Singapore Airlines (at 35,000 Singapore miles each)

- Round-the-world in Business Class via ANA

I love using points to fly for free in metal tubes <3

Any of them could be worth $1,000s of dollars on their own, which already makes it worth paying the annual fee the 1st year.

So. Many. Bennies.

You also get:

- Gold elite status with Hilton and Marriott

- Access to Fine Hotels & Resorts

Plus, you can access Amex Centurion Lounges. I go to the one at DFW all the time (the best one!). For me, this alone is easily worth the price of admission. Not only that, but you can use the card to enter Delta SkyClubs and Priority Pass lounges.

I knowwww… every premium card comes with a Priority Pass these days. But the Centurion Lounges are really a special treat – and you can only access them with an Amex Platinum (or Black 🤪) card.

Read more about the other benefits of this card here.

Earning and redeeming

This card earns 5X Amex Membership Rewards points on flights booked directly, and travel booked through Amex. And 1.5X points for purchases over $5,000.

When you select an airline and redeem your points for flights, you get 35% of your points back for coach flights on the airline you select. And 35% of points back for all Business and First Class flights, regardless of airline.

It’s NOT a good card for everyday spending as it only earns 1X point per $1 everywhere else. But when you’re meeting the minimum spending requirement, it’s worth it to earn a nice 95K haul of points. 🧐

By the numbers

Quick n dirty math time.

Assuming you keep this card for a year and meet the full spending requirements, you’d get:

- 100,000 Amex Membership Rewards points – I’m valuing this for $2,000 – and that’s a lowball estimate

- $200 in airline fee credits in 2018 and $200 in 2019 – $400 total

- $50 a month for lounge access – 50 X 12 = $600 total

This comes to $3,120 in value for paying a $595 annual fee. I have NOT tossed in the value of elite hotel status, Fine Hotels & Resorts credits, AMEX OFFERS, or booking flights at 5X per $1. And of course, these are my personal valuations. Yours will differ based on when and how you’ll use your points, how often you’ll use the lounges, if you use Gogo passes, and many other factors.

You also get $200 in Dell credits per year ($100 for January through June, and another $100 for July through December).

It’s a card with lots of broad benefits. But the point is: most small businesses can do well with this card. Especially if you’re spending $6,000+ a month and can earn the full welcome bonus to get at least 95,000 Amex Membership Rewards points.

Are there drawbacks?

Not really. The biggest one is this is a charge card (NOT a credit card), meaning you have to pay it in full at the end of each month (which you should already be doing anyway).

Other quirks to note:

- It takes like 2 months for your points to post because Amex delays points on a 2-cycle period, which sucks

- Some peeps don’t find the transfer partners to be “the best” (that honor would go to Chase), though they certainly have their uses and are quickly improving

- You have to activate many of the bennies, like selecting an airline or adding Gogo passes or Amex Offers to your account – they are NOT automatic

- You can NOT use your Priority Pass at restaurants, only at proper lounges

That’s really about it – nothing major or unusual. All-in-all, this is a solid card to keep long-term, especially if you value the lounge access like I do.

Bottom line

- Link: Amex Platinum small business card – learn more here

When I saw the minimum spending requirement for this card, I was like… oof. But when I broke it down, it’s ~$5,000 per month. That’s certainly still high. But many small businesses easily spend that to keep business flowing.

Plus, when you consider the value of the 95,000 Amex Membership Rewards points you’ll earn, lounge access, over $700 in annual credits, Hilton and Marriott Gold elite status, and all the other numerous benefits, it looks better and better as you parse it out, even with the annual fee considered.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

You don’t get Uber credit and saks with business platinum.

You are absolutely right. I updated the post. Thank you for the corrections!

Few things if you can clarify about this post. First are these 700 plus credits usd every year with the card or first year only.

Second 35% back or mr is interesting . Will that be for only mr earned with this card or any mrs in the account and having this card?

All the credits are by calendar year. So you can use them once in 2018 and they’ll reset in 2019. All your points combine into one place, so you’ll be the 35% back even if you earned them with another card. Pretty sweet.

Plastiq now lhas limited the options, but you can use AMEX cards to pay all kinds of (property, business, personal) taxes. And, don’t forget you get 1.5 MR per dollar on charges greater than $5K

Absolutely. It’s great for those big expenses – and for knocking out this big spending requirement. Thanks for the reminder, Doc!

https://outandout.boardingarea.com/plastiq

I haven’t been able to figure out a way to get the $200 airline credit any more, now that they don’t give it for getting 4 $50 Delta gift cards (one at a time) — I don’t upgrade seats, and I don’t buy food on the plane — any good suggestions for this? (I don’t live where Southwest flies, so if that still works, I wouldn’t want it to be my designated airline for the 35% back etc.)