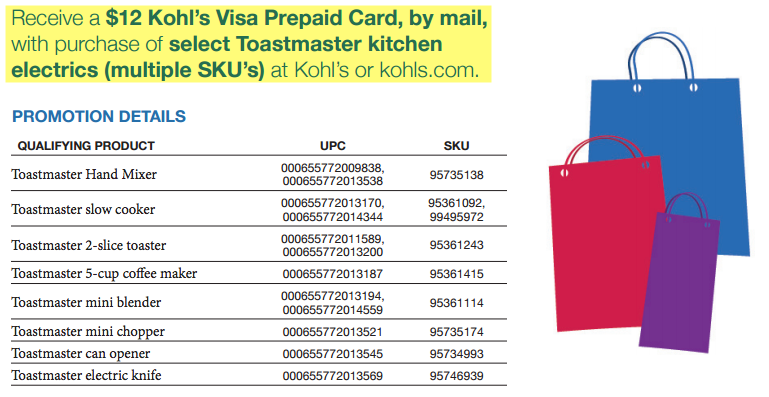

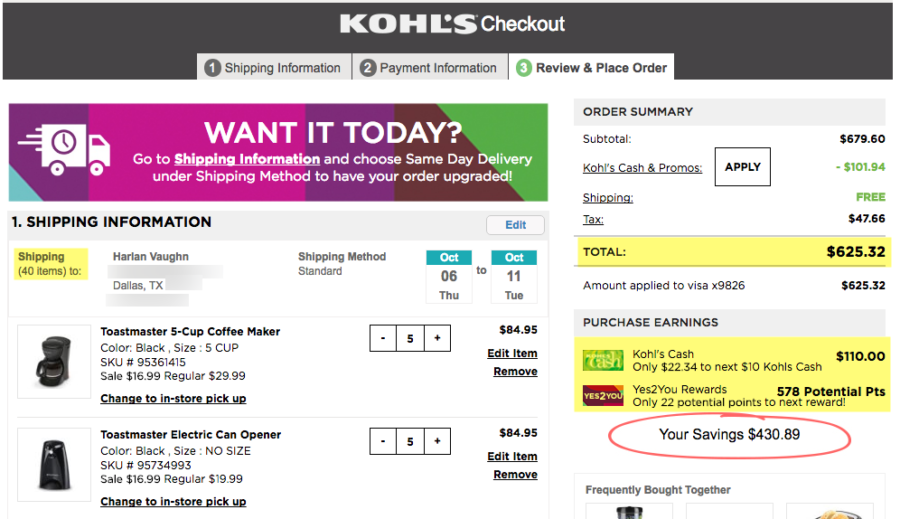

Y’all know I love a good opportunity to stack!

Well shiver me timbers and ’tis the season, but I’ve been putting most of my spending these days on… Amex cards?! Yup, even though I recently product changed to the precious Chase Sapphire Reserve.

For regular spending, I’m meeting the minimum requirement on the Hilton Amex (no fee version). And for everything else, I’ve been using my Starwood Amex business card to run payments through Plastiq. It’s just too good of a deal right now.

Here’s why.