Also see:

Interesting offer from Barclaycard.

They’ve had a so-so year with their cards, with a limited-time increase to 50,000 miles on the Miles & More card, the release of 2 decent JetBlue cards, and now this.

The typical sign-up bonus on the Barclaycard Arrival Plus is 40,000 Arrival miles, so this offer adds an extra $100+ of incentive.

Perhaps Barclaycard is rethinking their strategy with this card, as they should. It used to have a lot more features and benefits – but those have been cut, leaving behind a product that’s unremarkably ordinary.

The new limited-time 50,000 mile offer on the Barclaycard Arrival Plus

With a ~$500+ sign-up bonus, it might be worth a look.

The short

A typically lackluster card worth getting when you’re full up with the other banks and want to get an easy injection of travel credit. This is the highest offer there’s ever been for this card.

The long

- Link: Barclaycard Arrival Plus

- Link: Apply for Card Offers

- Link: Honest Reviews

With the Barclaycard Arrival Plus, you’ll earn 50,000 bonus miles after you spend $3,000 on purchases in the first 90 days of account opening.

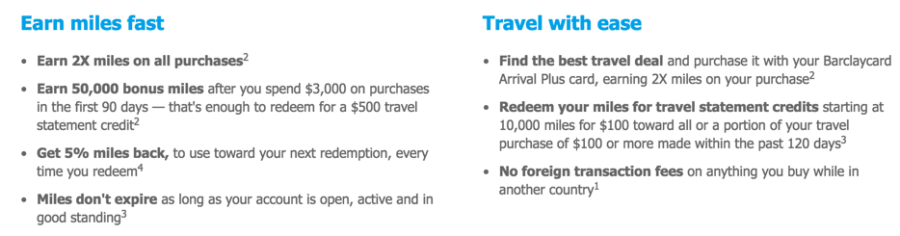

The lineup of bennies (Click to enlarge.)

50,000 Arrival miles are worth a cent each when you redeem for a $100+ travel credit. So, the bonus is worth $500 smackaroos.

And, you’ll get 5% of your redeemed miles back each time. This is how Barclaycard keeps you on the “earn and redeem” cycle. When you redeem those 50,000 Arrival miles, you’ll get 2,500 more right back – effectively making the bonus worth $525.

But, because the minimum spending requirement is $3,000, you’ll wind up with at least 56,000 Arrival miles in total – worth $560.

If you redeem them all in one go, you’ll get 2,800 Arrival miles back. But you’ll have to spend more on the card to earn that next $100 travel credit (in this case, an additional $3,600!).

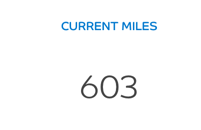

My orphaned Arrival miles… that will never be redeemed

Earn the bonus, redeem the points, and figure out how to orphan your points most effectively. Because it’s not worth it to earn 2X Arrival miles per dollar, unless:

- You’re NOT meeting another minimum requirement

- You’re not missing out on a category bonus on another card (travel or dining, for example)

- It’s easy for you to spend that much to unlock the next redemption level, then dump it

Is it a good deal?

Yeah. This card has its place.

If you’re beyond 5/24, full up on Citi, and done with the Amex suite for this lifetime, it’s worth throwing your hat into the Barclaycard Arrival Plus ring for a quick and easy $500+. Why the heck not?

But keep in mind Barclaycard will typically only approve you for 1 or 2 cards per year. They are a picky and conservative bank at their core.

Luckily (?), their cards aren’t that great or industry-leading. The only other good ones are the Miles & More and maybe the JetBlue cards if you fly JetBlue often, and mayyybe the Wyndham card if you can put the points to good use.

If you have another card in mind, consider which one you’d rather have more – in case you won’t get approved for both.

All this to say, yes, this is the highest the offer on this card has ever been and will likely ever be. If you’re applying for a new round of cards anyway, I recommend adding this one to the mix if you’re fine with the minimum spending requirements.

Grade: C

Yeah, just “Cool.” Because the $89 annual fee is waived the first year.

Beyond that, it’s not worth it to pay for what’s essentially a 2% cashback card with a restrictive $100+ redemption threshold ONLY for travel purchases. It’s certainly not the first card I’d recommend to add to the ol’ arsenal.

Furthermore, you can do better with most 2% cashback cards, like the Citi Double Cash or Fidelity Visa. But those lack something this card has: a decent sign-up bonus.

The only other reason I can see wanting to get this card is if you have a lot of foreign travel coming up.

Because this card is a true chip-and-PIN card (not a chip-and-signature as most are) – which can be a lifesaver at automated ticket kiosks, unattended gas pumps, and other places abroad (especially Europe) that make use of the chip-and-PIN feature. It saved my butt in Budapest to buy tickets for the trolley more than once, for example.

There are also no foreign transaction fees like most cashback cards have. But as it stands now, the card is not worth paying for long-term.

Keep or DTMFA: DTMFA.

- Link: Barclaycard Arrival Plus

- Link: Apply for Card Offers

Absolutely.

BUT – Barclaycard will often waive the annual fee if you call and speak with a supervisor. So that’s something to keep in mind once the second year begins, should you decide to try. (They waived it for me the second year.)

This is a great card to get for the sign-up bonus alone.

All cards have 3 main things to look for: sign-up bonus, regular spending bonus, and ongoing benefits.

This card has the first, but not the last two. So grab the sign-up bonus while this offer is around, especially if you’re locked out of Chase, Citi, and Amex. Evaluate it for around ~10 months and decide if you want to ask for a fee waiver the 2nd year.

If you can’t get it, DTMFA.

OR, downgrade it to its no annual fee counterpart to keep the credit line intact to help boost your credit score, like I did. And let’s hope Barclaycard rethinks this card and adjusts the perks and fee accordingly in the near future.

Do you agree with my assessment of this card’s offer? Will you add this one to your wallet?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Leave a Reply