Oh, Citi Prestige. How prestigious you once made me feel. You’re probably still my favorite card overall, but your shine has tarnished since I fell for you in November 2015.

Since then, you’ve returned well over $2,000 in value for me. And you’re still giving.

My lagan love, Citi Prestige

But, cruel winter awaits. As of July 23rd, 2017, you can’t have my heart any more. I’ll have to take it back. You’re going to change.

Like a trojan horse, Chase unleashed the Chase Sapphire Reserve which now blows you out of the water.

Citi, you were competing so well. What happened? (My guess is they were losing too much dinero.)

The short

A once-great card that’s now only worth it if you have a lot of paid hotel stays of 4+ nights.

The long

- Link: Apply for Card Offers

- Link: Honest Reviews

You will earn 40,000 bonus ThankYou points after you spend $4,000 in purchases within 3 months of account opening. That’s easily worth $532, as Citi ThankYou points points are worth 1.33 cents each toward travel booked through Citi. And $640 toward American Airlines flights booked through Citi at the rate of 1.6 cents each. So, a decent sign-up bonus.

But beginning July 23rd, 2017, Citi will take away:

- The 1.6 rate toward redeeming points on American Airlines flights AND the 1.33 rate on other airlines (down to 1.25 like Citi ThankYou Premier – oops!)

- The 3 free rounds of golf

- American Airlines Admirals Club lounge access (this is already gone for new cardmembers)

- Taxes and fees from the 4th night free, and move to a 25% discount (an average of all the nightly room rates)

So basically… it’s the Citi ThankYou Premier card with a hotel perk.

Citi’s favorite tool lately. Little snip here, little snip there… OMG we butchered it!

Note that if apply for the card now, you will NOT get Admirals Club access. But you’ll still get the Priority Pass Select card, which could be worth it for some peeps.

This card will still have 3X on airfare and hotel stays, and 2X on dining and entertainment.

But! Citi ThankYou Premier has a broader 3X category for ALL travel purchases including gas. And a much lower $95 annual fee.

And now Chase has said hoo-hah by adding a 3X category for travel (not for gas) and dining to the new Sapphire Reserve. So the piddly categories on Citi Prestige seem… not so great.

However, if you have a lot of paid hotel stays, you can easily recoup the card’s $450 annual fee with two or three bookings – that’s worth something.

But if you like racking up Citi ThankYou points, there are better cards (Citi ThankYou Premier and Citi AT&T Access More).

Nasty move, Citi

Also remember, Citi now limits the sign-up bonus per family of cards. So if you’ve opened OR closed another ThankYou points-earning card in the past 24 months, you can’t earn the sign-up bonus.

Grade: C

Yep, just “Cool.”

The bonus categories no longer feel “bonus-y” and that they’re going to cut their flagship perks is a huge blow to the value of this card.

Again, if you pay for a lot of hotel stays, it IS worth it to keep this card for the 25% perk.

And if you don’t have the Chase Sapphire Reserve *cough*, it’s nice to earn 3X on airfare and your hotel stays. So basically just book hotels with this card. I’d say that’s cool, wouldn’t you?

Keep or DTMFA: Keep.

- Link: Apply for Card Offers

Quite simply, if it’s giving you value, then there ya go.

If you want to earn 3X Citi ThankYou points for travel, get the Citi ThankYou Premier. Because you can also book travel at a value of 1.25 cents per point (note that Prestige is still superior until July 23, 2017 with 1.6 for American Airlines and 1.33 for other airlines).

Or if you’ve found ways to maximize Citi ThankYou points, well hey: that’s awesome. I certainly have my preferred uses for them.

Also keep if it’s easy for you to rack up Citi ThankYou points across multiple cards, because that DOES add up and adds value to each card (the idea of synergy).

The best reason to keep it though

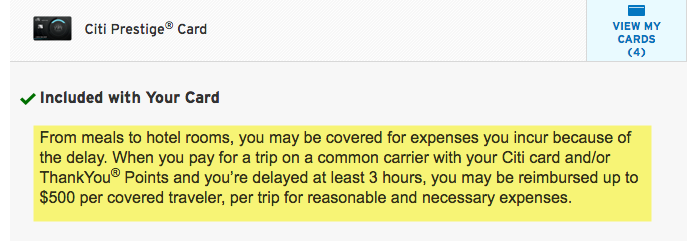

I have to sing the Citi Prestige card’s unsung song: they have the BEST trip and baggage delay coverage of ANY card – only 3 hours!

Citi Prestige: After 3 hours, you can spend $500

A 3-hour delay and I can start feeding myself? Well hell, I’ve been delayed 3 hours a time or two.

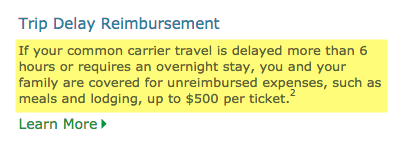

Chase Sapphire Reserve: After 6 hours, you can spend $500

Other premium cards, including the precious Chase Sapphire Reserve make you wait 6 hours. And oddly enough, the Chase Sapphire Preferred AND Citi ThankYou Premier have it as 12 hours (!).

For that reason alone, I consciously book my airfare on this card exclusively.

But when and if I ever get the Chase Sapphire Reserve (Update: I got it!), I’ll still charge airfare to Citi Prestige because of this benefit and 3X Citi ThankYou points. Plus, I can easily get award flights with Citi ThankYou points – they still have value.

Citi Prestige leads for trip and baggage delay. If you live in a hub where weather is prone to cause delays (Atlanta, Chicago, Dallas, even New York), I’d give a second thought to this card. Especially if you have a lot of paid hotel stays (did I just type that for the like fifth time? Geez!). There, I sang my song.

I will personally keep this card for as long as I can recoup the annual fee easily. After that, sayonara, I’ll pay for my own food if I’m delayed.

So what do you make of this assessment of Citi Prestige? Still a good card… or nah?

Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

nice review, I won’t sign up for this card, Citi took way too many benefits away for it to be worth it. I’m waiting to get under the 5/24 Rule to apply for the CSR or CSP.

Agree with you. Def do CSR!

Isn’t the Premier worth only 1.25 cents toward airfare? I think Prestige was worth 1.6 for American and 1.33 for other airlines, but will be 1.25 in the future.

Haven’t rechecked this so I could be wrong…

You’re 100% right! I updated the post and added a couple more tidbits. Thank you!

Are people still getting the 350 af after signing up at bank any idea if it will still remain after November change in Citi gold account

I haven’t heard about that in a while. Never hurts to ask.

Hey Harlan,

I realize this post is a bit old, but just came across it and have to both strongly agree and respectfully disagree with ya 🙂

Definitely agree heartily with your enthusiasm re the 3-hour-time kick-in for travel insurance benefits (though admittedly I’ve not had a chance to use this benefit; hopefully it’s as useful as it sounds!)

But disagree with your assessment that someone would need “a lot of” 4-night hotel stays to at least break even with this card. If we assume an average cost of a hotel stay per night would hover around $200+tax, then just one 4-night stay would do the trick.

$450 annual fee

– $200 on that one 4-night hotel stay

– $250 travel credit (earned from that same 4-night stay)

= effective net annual cost of $0 for the card.

Actually, even less; if we very conservatively give the Thank You Points a value of 1.25 cents each, then you’d earn 1000 points (200 * 4 nights hotel * 1.25) = $10. So you’d come out ahead at least $10 :-).

Even if you book a hotel that’s just $100/night+tax, then it’d take 2 two four-night stays a year to break even.

Hey Adam!

I love a little healthy conversation about these cards! 🙂

That’s an excellent point. My phrasing there could’ve used some refining.

I think what I was trying to say is… you HAVE to have that one (or two) 4-night stay each year to make it worthwhile. Some peeps don’t stay in places for 4 nights at a stretch. But you’d have to if you want to break even with the Citi Prestige, as you expertly explained. That’s easy for me (and it sounds like for you, too). But something to consider if you like short stays but are interested in this particular card.

That said, you’re absolutely right, one good booking would do the trick. Especially combined with the $250 annual airfare credit.

Thanks for helping me and others see a different angle here. I truly appreciate it!

A pleasure, and happy to have discovered your blog :). All the best!