Also see:

Without a doubt, one of the best ways to earn points is to take advantage of category bonuses. Another way is to shop online through a shopping portal. But at first, you have to train yourself to always be maximizing.

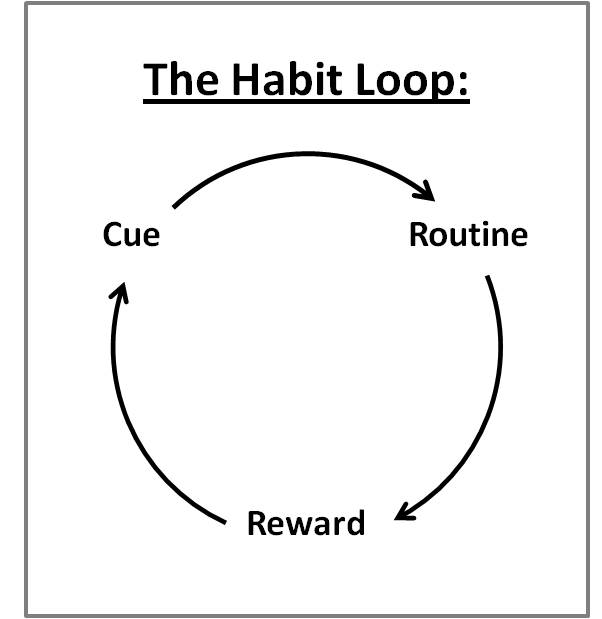

My habit loop

For Cue–>Routine–>Reward, I have:

Point of purchase–>Card selection–>Extra points at the end of the month.

It’s insanely simple to learn, easy to apply, and effortless to keep up after you practice it for a while. But the hardest part, like making any new thing a habit, is starting up.

It takes about 2 weeks of focused effort to make something a habit.

Another way to think of “point of purchase” is “any time I grab my wallet/purse/credit card”.

For card selection, I think:

Where am I?

What category is this?

OK, use ______ card.

For example:

- Grocery store / Groceries / Chase Freedom (this quarter) or Amex EveryDay Preferred

- Staples / Office supplies / Chase Ink Plus

- A Hyatt hotel / Travel / Chase Hyatt Visa

- A gas station / Tas / Chase Ink Plus or Amex EveryDay Preferred

- Restaurant / Dining / Chase Sapphire Preferred (will be Chase Freedom though April-May)

- Local boutique / General shopping / Right now, the US Bank Club Carlson Visa or the Barclays US Airways MasterCard because they’ve both given me spend bonuses

- Anywhere, when I’m meeting minimum spend / Doesn’t matter / The card I’m meeting the spend on – this one overrides everything else, as meeting minimum spend is the exception to all rules

For any online shopping, I do the same thing, except I check a couple of portals for the highest payout. Before I pull my card out, my habit loop is to both find the portal with the highest payout and to use the best card for the purchase (the Shop Through Chase and Barclays RewardsBoost portals have always been very good to me).

It all adds up.

I find myself thinking, often, “Oh, it’s only a couple hundred points.” But for all the times I think that, those few hundred points start to add up to thousands. And with 5,000 Ultimate Rewards points, for example, I can really start to use those in a significant way.

Other habit loops

You can apply the same simple formula to literally anything.

- Working out more

- Waking up earlier

- Eating healthier

- Establishing a routine/time management

- And even to earning more points

It’s amazing how much humans are creatures of habit. Something like 90% of our typical day is all things we’ve learned as habits. That’s why habits are so ingrained. But old habits can be replaced, and it’s really not that hard.

Identify the cue, alter the routine, enjoy the reward.

With regard to our hobby, the reward is more points. More points equal more trips. More trips mean more memories. More memories lead to rich lives.

Bottom line

It took me a solid month when I was first starting out and filling up my wallet to set the intention to focus on which card I used.

My go-to was the Chase Sapphire Preferred for a long time. Then it was the US Bank Club Carlson Visa. Then the Amex EveryDay Preferred. I had to make a system for myself to avoid confusion, and within that system, I realized I had the tools to work smarter instead of harder – and to increase my points balances at the same time.

I enjoy healthy points balances while I am earning, then I burn them. It’s part of having a goal in mind.

For the master of habit loops, check out Charles Duhigg’s website and also his book, “The Power of Habit“.

What other habit loops are useful for travel? I would also love to hear about other internal systems and mental tools regarding our hobby.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

[…] and to earn some rewards for doing so. Building a reward for yourself is one of the best ways to establish a habit loop – and if maxing our your IRA is your goal, the savings account can be the reward. Or rather, […]