This one’s for my friends who say, “I never earn enough points to get a travel reward,” or, “Points are useless once you have them.”

The truth is you don’t have to invest a ton of time into learning how to use your points. You can do well by using 1 or 2 tricks to earn and redeem for travel.

And if you do that, you will still come out way ahead of most people.

These “tricks” require very little finesse – just that you pay attention. Perhaps now is a good time to form a habit loop?

Even if these methods are ALL you ever learn, they’re an incredible place to begin. And once you’re comfortable, you can build from there – baby steps.

4 ways to EARN Chase points

1. Sign-up offers

First up, sign-bonuses are a super easy way to earn Chase points.

It’s important to know you will NOT be approved for these cards if you’ve opened 5+ cards from ANY bank in the last 2 years. But if you’re starting out, that shouldn’t be an issue.

And the Chase Sapphire Preferred is still the best card for beginners.

To earn the biggest bonuses, you need to spend $3,000 to $5,000 dollars in the first 3 months you have the card. If that sounds like a lot, it’s not.

Once you divide it out, it’s $1,000 to ~$1,667 per month. When you can use services like Plastiq to pay bills like rent, car payments, insurance, and utilities, it’s pretty simple to meet the requirements to earn the bonus.

2. Bonus categories

Every Chase card has a spending purpose. For example, the Chase Sapphire Preferred earns 2X Chase Ultimate Rewards points on travel and dining.

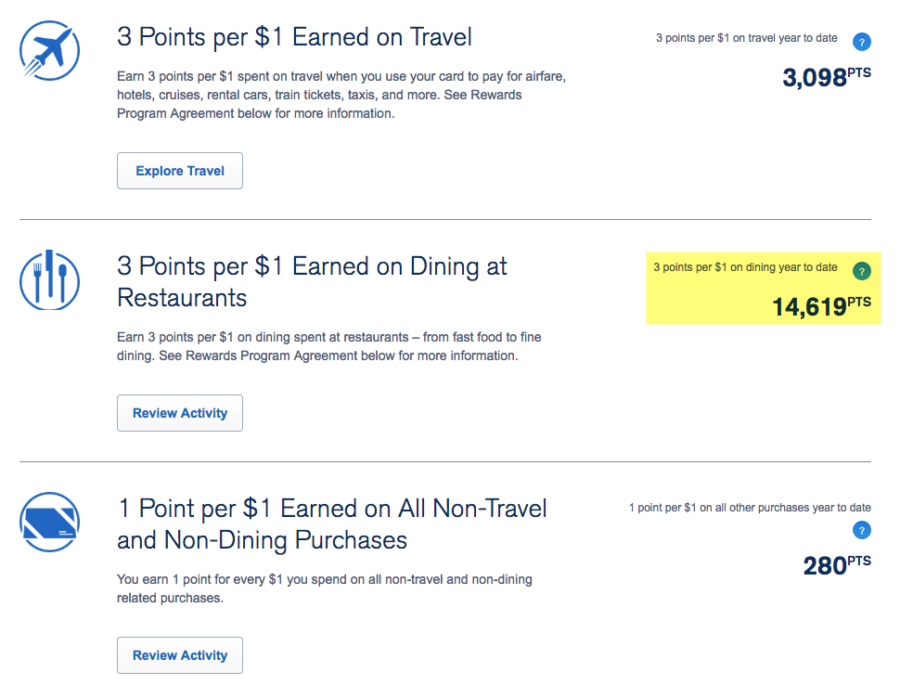

I earn a crap ton of Chase points for dining. Notice I don’t use the card much for non-travel and non-dining!

And the Chase Sapphire Reserve (compare it here) earns 3X on travel and dining. I pretty much ONLY use the card for the bonus categories! If it’s not travel or dining, that card doesn’t get to come out and play.

Luckily, the bonus categories are broad – so I still use the card nearly every day. Travel includes things like parking, tolls, car rentals, Airbnb, and Lyft rides. And dining includes coffee shops, bars, and fast food.

Bonus categories are so important. Know and use them to earn extra points, like shopping for groceries

The Chase Freedom has rotating quarterly bonus categories to earn 5X Chase points. This quarter, through September 30th, 2018, you can earn 5X Chase points for gas station purchases, Lyft rides, and at Walgreens (on up to $1,500 in spending for the combined categories).

Past quarters have been for grocery stores, Amazon, warehouse stores like Costco, and mobile phone payments. If you go to the limit, that’s 7,500 Chase points per quarter (1,500 X 5).

And over a year, that’s 30,000 extra Chase points!

3. Combine points from multiple cards

Jumping off the last point.

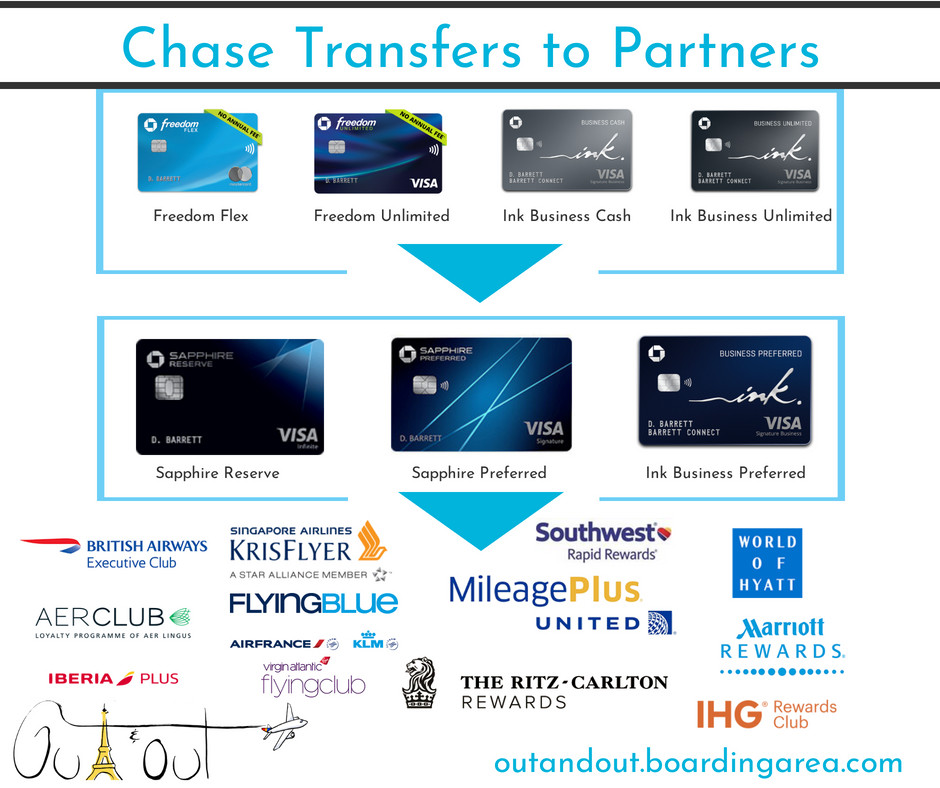

Once you have a couple of Chase cards that cover most of your bonus spending, you can then combine all your Chase points into one account – the one that lets you transfer points to travel partners.

Pair Chase cards to earn even more points

I combine all of my Chase points to my Sapphire Reserve account. And from there, to travel partners for free or really cheap travel.

Combining your points to get the maximum value per point is the simplest and easiest trick in the book. If you have a Freedom or Freedom Unlimited, you can unleash the power of transfer partners by picking up a Sapphire Preferred, Sapphire Reserve, or Ink Business Preferred.

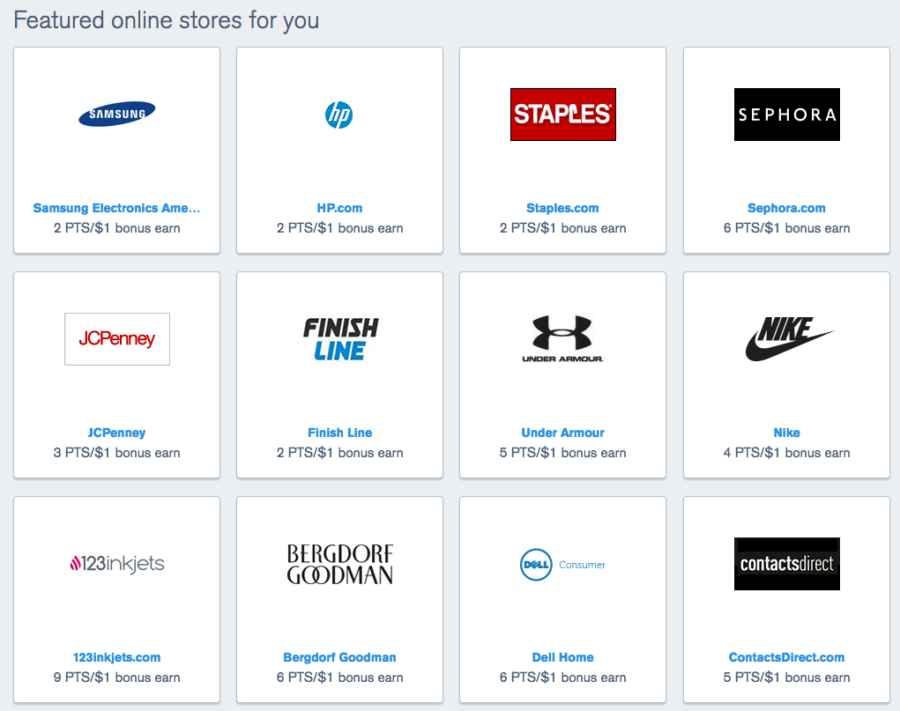

4. Shop through the Ultimate Rewards shopping portal

Did you know Chase has its own shopping portal, only available to peeps with Chase Ultimate Rewards cards?

As of now, the portal lets you earn bonus Chase points at 365 of the most popular online merchants – all for clicking a link before you start shopping.

Even better, the bonuses can stack.

For example, when department stores are a Freedom 5X category, you’ll earn 5X Chase Ultimate Rewards points at department store sites like Kohl’s, Macy’s, or JC Penney.

And you’ll also earn a bonus from clicking through the portal! If the portal offers 5X points (again, just an example), you’ll end up with 10X points per $1 spent.

In any case, it never hurts to rack up more Chase points. They’re arguably the most valuable points around. Just be sure to check Cashback Monitor so you always get the most points or cashback for your online shopping.

4 ways to REDEEM Chase points

Once your pile of points grows, you’ll inevitably start to wonder what you can do with them.

There are many ways, but here are 4 of the absolute easiest. Again, if these 4 tricks are all you ever learn, you will still come out ahead of the vast majority.

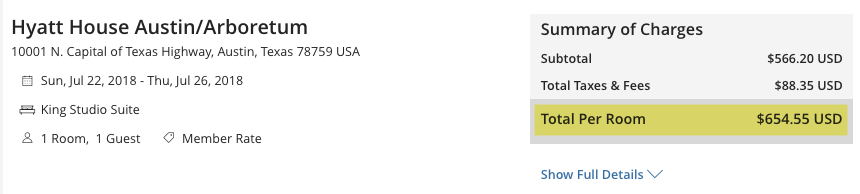

1. Transfer to Hyatt for free hotel stays

I jam on this one all the time. For those who say nothing is ever available with points, the good news here is Hyatt doesn’t have blackout dates for award nights. As long as a standard room is available for cash, you can book it with points.

You won’t pay taxes & fees when you book with points.

Last week I was in Austin for 4 nights at the Hyatt House Austin Arboretum. I used 32,000 Hyatt points (transferred from Chase) to pay for the stay.

I ended up paying $0 – and got a rate of 2 cents each for my points.

2. Transfer to Southwest for flights

Another easy one. Southwest doesn’t have blackout dates, either. And the number of points you’ll need is tied to the cost of the flight.

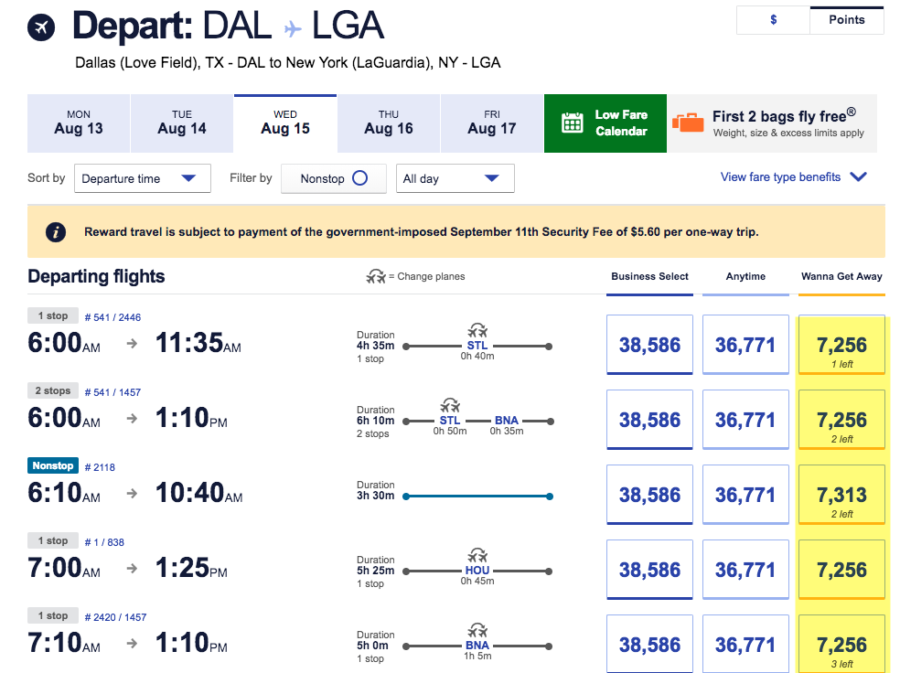

That means if you can find a cheap ticket, you can either pay cash, or use a low number of points. I could use ~7,200 Southwest points to fly to New York next month. These fares are around $120, and each point is worth ~1.6 cents.

Keep in mind if you have the Chase Sapphire Reserve (compare it here), you can book flights through Chase for 1.5 cents each. You’ll earn points when you fly – and the flights count toward elite status.

Note: You have to call Chase to book Southwest flights with Ultimate Rewards points.

Depending which card you have, you can do well if you like to fly Southwest. And often, you can pay fewer points for an award flight than the standard 12,500 miles each way most other airlines charge.

3. British Airways for short flights on American

I cannot overstate this enough. My friends think it sounds crazy to use British Airways points to book American Airlines flights. But that’s really how it works, because they are airline partners.

Within the US, “short flights” are those under 651 miles.

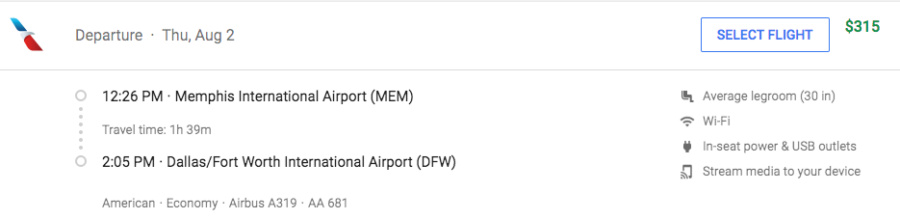

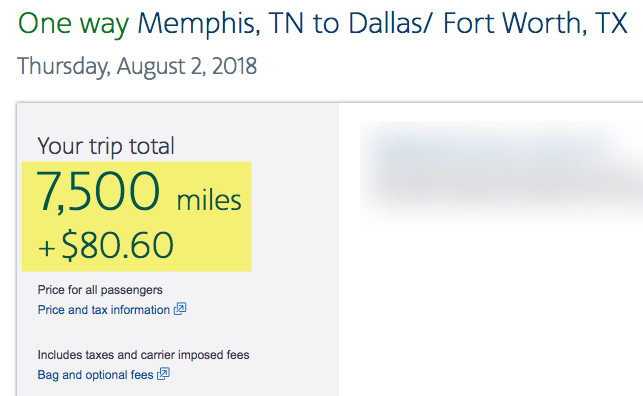

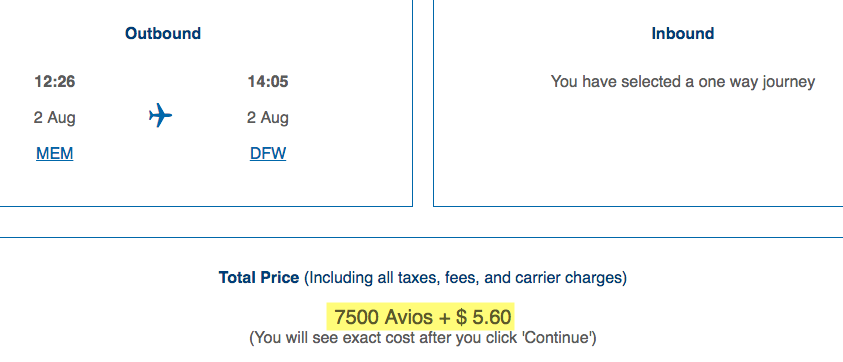

Take, for example, Memphis to Dallas – a short flight with (sometimes) high ticket prices.

I found a flight for this weekend – say, if my mom wanted to spontaneously come see me (she’s in Memphis and I’m in Dallas).

At $315 just for the flight out, it looks like mom won’t be coming out this weekend, eh?

If you used American Airlines miles, you’d pay 7,500 miles plus an extra $75 for a close-in booking fee for that same flight. Plus you’d need to have American Airlines miles.

But, you can still access this flight with Chase points – and only $5.60 in fees – by booking it through British Airways instead. You can search directly on the British Airways website.

That’s because British Airways doesn’t charge close-in booking fees. So you can book the same $315 flight for 7,500 British Airways Avios points and ~$6. Of course, double the prices for a round-trip – but it’s still much cheaper than other airlines would charge for similar award seats.

I’ve used this trick to book flights between Dallas and Austin, too. Basically any short but expensive flight on American Airlines – this is a powerful and handy trick to have in your arsenal.

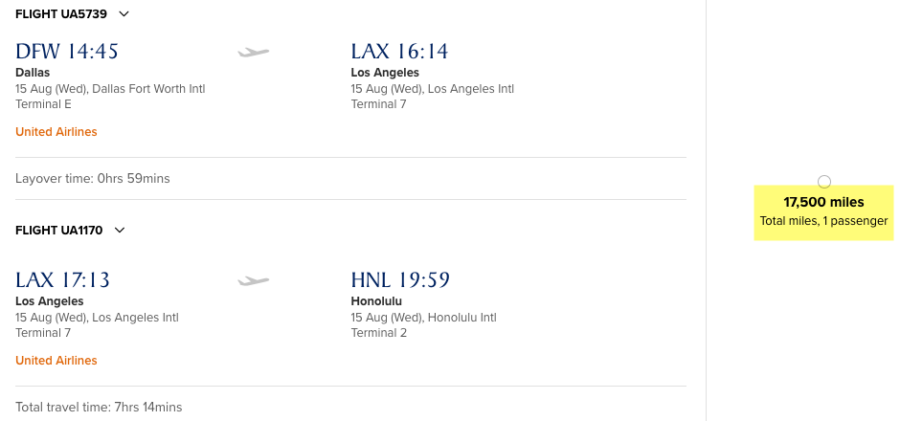

4. United flights to Hawaii via Singapore

You can transfer your Chase points to Singapore to save on flights to Hawaii. You’ll pay:

- 35,000 Singapore miles round-trip in coach

- 60,000 Singapore miles round-trip in Business

- 80,000 Singapore miles round-trip in First

Split the cost in half for one-way prices.

30,000 miles to one-way fly to Hawaii in Business Class is pretty good! And much cheaper than United charges on their own flights (50,000 miles for a one-way!).

I’m considering another Hawaii trip this fall or winter… and I’ll personally check this particular award for my trip. You can search on Singapore’s site.

I mention Singapore miles specifically because they’re a transfer partner of all 4 main transferrable points programs (Chase, Amex, Citi, and SPG). So chances are you can cobble together an award with Singapore miles.

Check out their award chart – there are other sweet spots like 7,500 miles to fly around the west coast on Alaska, 27,500 miles to Europe in coach, or of course flights on Singapore Airlines, voted the best airline in the world again this year!

Bottom line

Chase’s Ultimate Rewards program has been a solid points program for years by now – and its value remains to this day. I understand the frustration of feeling like you can’t earn enough points to do anything meaningful, only to find they’re hard to redeem once you earn enough.

But 2 of Chase’s partners don’t have blackout dates (Hyatt and Southwest) and others require the smallest bit of searching around. Your patience will be rewarded in spades of free travel. And these tricks are easy ways to cut right to real value.

Any questions? I’m happy to point you in the right direction!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

When I search fro Memphis to Dallas etc. I get “BA does not have traffic rights to operate directly between these two cities” What am I doing wrong? Thanks for all the tips

Search for award flights instead of paid flights.

Click “Executive Club,” then “Spending Avios.” Choose reward flights and do your search there – you will see the award flights. 🙂 Hope that helps you!

Thank you. Do you know of any way to search flexible dates or see calendar of points per date?

The best way is to search on AA.com and filter for nonstop. You can see a calendar of what’s available. Then replicate the search on BA.com. Saves a ton of time!